For the last sixteen years, the US stock market has outperformed the rest of the world. This was helped by steady governance which resulted in a strong economy, while the eurozone was mired in a currency crisis, the UK was grappling with brexit, Japan was struggling with deflation and a falling population and China was dealing with a property crash.

All that has now changed with frenetic activity of Trump's second term. Tariffs are on, tariffs are off, oh no they're on again, shake it all about!. It's had a chilling effect on businesses which can't plan ahead, and US stock markets have tumbled, anticipating a hit to earnings.

Of course after a 16 year bull market, stocks were due for a correction, but the chaos in the White House has made things worse.

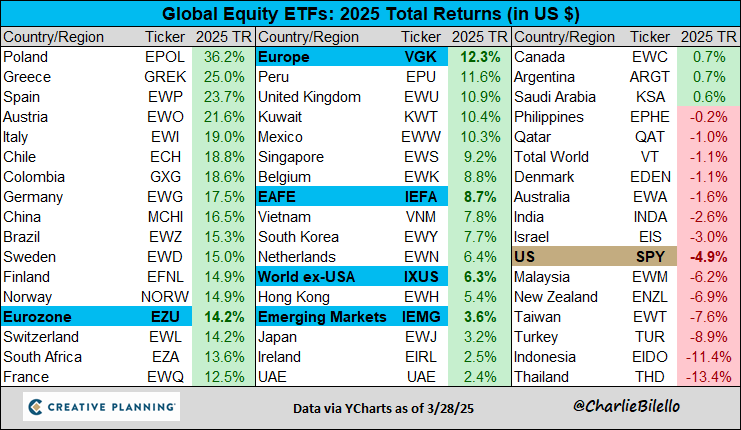

As a result, money is flowing out of US markets into other undervalued markets. Here is how global equity has performed in 2025 so far:

As you can see, European markets are doing extremely well, with Poland showing exceptional gains - 30% in just three months!

Meanwhile the United States and Asia are down. With new tariffs coming on April 2nd, the US is probably at the start of a bear market. Some retail investors might be tempted to "buy the dip", but it's too early. Despite the falls, stocks are still near their all time highs. When the bear market really gets going, the drawdown can be as much as 25%, possibly more.

The best advice is to sit on the sidelines holding cash while this plays out. Or put your money in European stocks as they are still undervalued despite recent gains.