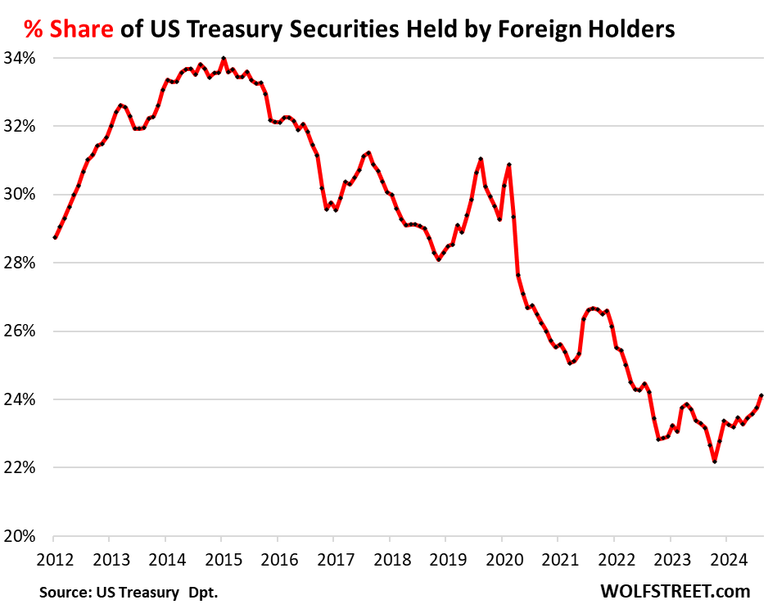

Here's the percentage share of US treasuries held by foreign investors:

So, what's going on?

First of all, who holds US debt?

The City of London holds about $744 billion on behalf of all it's global clients. Luxembourg holds about $400 billion, and the Cayman Islands holds about $400 billion. This money rarely moves.

But China and Hong Kong have reduced their holdings from $1.45 trillion in 2015 to $1.01 trillion in August.

Hwever, Canada, Taiwan have increased their holdings. But Saudi and the Emirates have kept their holding steady for a decade.

So who is financing the vast American debt? The answer is Americans seeking yield. Some are buying Treasuries direct from the US Debt of Treasury. Others are buying through indirect money-market and bond funds. Institutional buyers - the Fidelity's of this world - are also strong holders of US debt.

The media narrative is all about how foreigners have stopped buying US debt. But as long as Americans and American institutions continue to buy and support their own government, the day of reckoning is averted.

The American economy is unique in that it is self sustaining. It doesn't need the rest of the world to buy it's goods. Judging from recent developments, it doesn't need the rest of the world to buy it's debt either. Americans can do that.

All that is required for confidence to return is for Americans to have renewed faith in their system, including in their currency.. Whether this is possible under the two presidential candidates, is another question.