I'm sure you have heard Netflix and chill but never had the opportunity to partake. That's ok, you can still Voo and chill without ever finding the one.

Voo?

VOO is a ETF that represents the top 500 companies in the US, basically the S&P 500. What is great about VOO is it has a very low expense ratio, this is administration fee to maintain the ETF. Compared to SPY (0.0945%), VOO (0.03%) is very attractive for long term investing.

Why am I telling you this? Less than 10% of investors over-perform the S&P 500. So buying an ETF like VOO to park your money and will better than 90% of investors. As someone who aggressively plays the stock market, if anyone asks me for advice, this is always what I tell them.

I am not one to give financial advice, I hate making recommendations to friends and family and will always suggest for them to VOO and chill. VOO however only diversifies the US market, adding 20-30% of your portfolio with VXUS will give you a lot of international exposure which will over-perform S&P 500 in some years and help hedge when the US market is in a downturn. I generally still stick with a VOO only strategy.

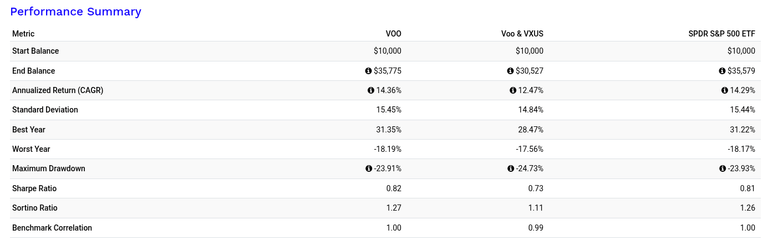

This is a portfolio back test of a VOO, VOO & VXUS, and SPY (S&P 500 ETF) over the last 9 and a half years. As you can see VOO performs very similar to SPY but has a slight advantage due to the lower expense ratio. Even 1/3rd expense ratio has very little impact on your portfolio over 10 years with only a $200 difference with a $10,000 investment or 0.0055%.

Over the course of almost 10 years, you would have seen a 350% return. There are other options, some like VT, VTI, FXAIX, and SPY. If you back-test all these options, VOO will always be in the lead.

I prefer a more aggressive and actively managed strategy, but I still recommend VOO and chill. VOO and chill is boring, but good investing is boring.

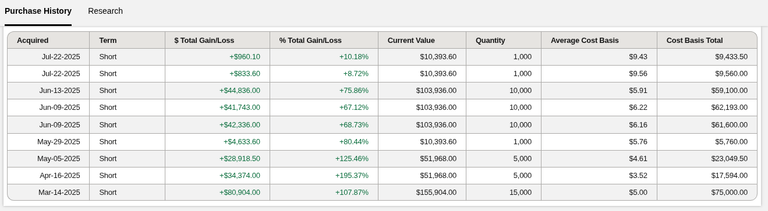

Gains like this are very exhilarating, but they are very difficult to pull off and there are always losses. In most cases, these loses will cause people to blow their account. Unless you want to live/breath the market, VOO and chill will win almost every time.

A lot of people hire wealth management agencies to manage their capital and in most cases these agencies will under perform VOO and chill and charge you 1% a year to do so.

Are you paying someone to under perform the market?

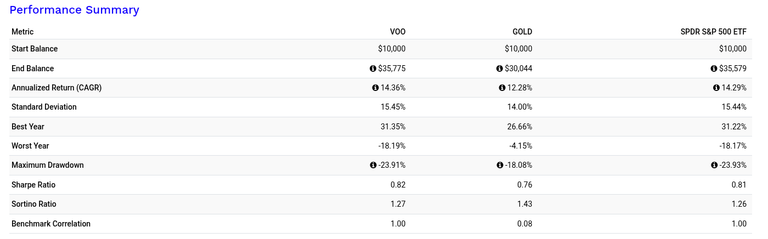

I got my son started in the stock market and he is currently 100% invested in VOO and is up 8.62% this year. The only other asset that consistently out performs is Bitcoin, even Gold can't compete with the S&P 500.

Even if you plan to be more aggressively investing, parking your cash in VOO until then is a smart move. Even if you can only dollar cost average $10 bucks a month, you will be better off for it.

This is not financial advice and just my personal opinion. As always, ask your mom before losing money.

Posted Using INLEO