I thought I should write a separate post about the Bitcoin Halving because I noticed enough people are anxious for the market to go up already, and they chose this event as a sort of "before and after" scenario for price action.

What happened on the Bitcoin Halving was the slicing in half of the mining rewards for producing Bitcoin blocks. From 6.25 bitcoins per block, it went down to 3.125 bitcoins per block. We shouldn't be worried about the Bitcoin miners, besides the reward for producing blocks, they receive transaction fees, and those are on the rise, the more used Bitcoin is.

There will be, however, fewer new bitcoins hitting the market regularly from miner block rewards, and that, if the demand remains constant or grows, should eventually push the price higher, which is good for miners, as well as the general crypto market.

That doesn't happen overnight though. Traditionally, post-halving there is a short period of volatility that would bring Bitcoin to a lower price (TA says lower 50s is in the cards), or a slightly longer period of sideways movement.

Interesting interactive chart I ran into looking for an image that showed the chart of Bitcoin and its halvings.

We know the saying that "history doesn't repeat, but it often rhymes". To me, it seems 2023-2024 rhymes more with 2015-2016 than with 2019-2020 so far. Most people have relatively fresh in their minds the events of the last cycle and may be expecting something similar. That's why a different pattern may be applied by the actors with the power to influence macro factors in crypto this time. So we might see something relatively similar to 2016-2018. We are years after that, with a more mature market, so these kinds of multiples are unlikely, though.

The longer we advance into the new phase of the bull market, the more details we will have about what to expect. So far I wouldn't say we had major surprises on the price side, other than beating the ATH for Bitcoin before halving.

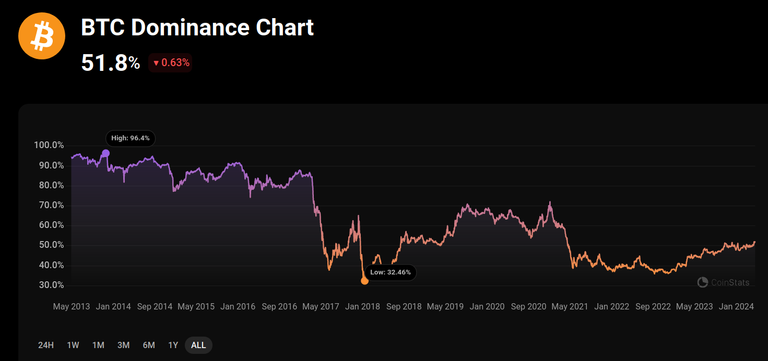

Actually, we do have another interesting matter to remark on. This cycle, alts seem to follow the movements of Bitcoin closely, only with higher volatility. It doesn't seem like we will have a distinct alt season. We haven't seen major alt selloffs to support Bitcoin's grind to a higher price level and dominance, although BTC.D is above 50%, way below close to 70% it was at its peak during the last cycle (at this time during the previous cycle BTC.D was around 65%):

Previously, alts were sold into Bitcoin while it increased its dominance (you could literally see days when Bitcoin was the only top coin in the green), and then, Bitcoin was sold into alts in the alt season (then, alts were in the green and pumping hard, and Bitcoin was either flat or slightly in the red). Now, it looks like Bitcoin increased its dominance, but it did it from fiat money that has been poured into the ETFs, and not extracting value from alts.

All signs and historic precedents indicate another serious bull market phase ahead. But before that, we might see another short period of pullback or a slightly longer period of sideways price action (if I were to bet, I'd bet on the pullback). How you want to handle the next period is up to you. But the important thing is to realize pumping probably comes a little later, and it may not be straight-up verticals from the beginning. Patience... is the key in crypto (and not only)!

Want to check out my collection of posts?

It's a good way to pick what interests you.

Posted Using InLeo Alpha