What's your plan for an emergency fund?

If I had come across such a question some years back, I would have flunked in my answer because I didn't believe that I needed an emergency fund. I had whatever finances I needed given to me upon request byy family especially my dad who would not want me to worry about anything.

Then came an unplanned tragedy that occurred in my family and that rocked my world...to the core. It began with my mum being diagnosed with acute kidney failure and then running helter skelter from one hospital to another. We sold some of our properties to take care of the her medical bills and finally when she passed on, we were almost left with nothing. That's when my eyes popped open.

Trying to start something foreign that you never grew up with can be quite difficult. I strggled to save monthly but before the next month pay roll comes in, I would have dipped my hands into the savings and used it to meet needs. I agree with @kingsleyy when he said that it was not easy for low income earners to save especially those workers with mean bosses who would deliberately delay the monthly income by up to fifteen days into a new month.

It was hectic trying to save for any emergency but I did it and I am glad that it is now a habit of mine. My plans for an emergency funds are quite simple and easy to do without hassles and I'll share them below;

#1. Cancel all debit and credit cards.

That was my first point of call to enable me keep aside money for emergency funds in my bank account. I had to stop my banks from issuing credit and debit cards to me. I only spent what has been stipulated in the budget I draw up every month, doing my best to stick to it.

#2. Discipline and budgeting.

The importance of this cannot be over-emphasized. I make sure to budget a certain amount out of my monthly income and come what may, I stick to the budget except of course the need arises, which would of course, be an emergency.

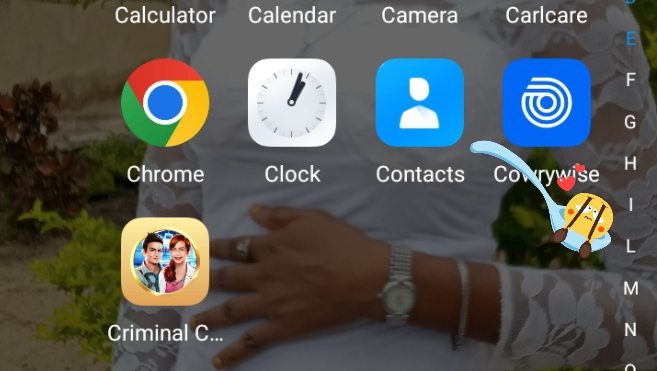

#3. Savings apps

To avoid going back to dip my hands into my bank account to withdraw money when I am short of cash, I madr sure not to keep my emergency funds in the same bank account rather I deposit the money for my emergency funds in a savings app. There's a plus side to doing this too. When I save money in the savings app, I get daily interests on the money and this continues for as long as I leave the money there. Also when it is time for withdrawal, there are certain conditions that are attached which is a kind of discouragement to abnormal withdrawals as these savings app don't follow the conventional banking methods.

The savings app I have come to love over time is the cowry wise app. There's a 15% p.a interest on monry saved and there's a withdrawal token free as well as a 24 hour waiting rule before theoney actually drops for withdrawal. The app also locks the money being saved until the maturity period stipulated by the user with the minimum duration being 6 months.

All these are my plans actively used to plan for my emergency funds. I hope you found something useful.

Thank you all for reading..shalom

This is my entry to the #indiaunitedprompt #16. Feel free to participate here

Images used are mine.