One of the theories some pundits put forward for the huge tariffs, is that the Trump administration was trying to push bond yields lower.

The reasoning went as follows: Scare the stock market with tariffs. Investors pull money from stocks and park the money in bonds. The more buying of bonds there is, the lower the yield on bonds. Then when the Treasury has to roll over it's debt, it does so at a lower interest rate. This theory has some plausibility as Treasury Secretary Scott Bessent said earlier this year that his main goal was to get the 10-year yield down.

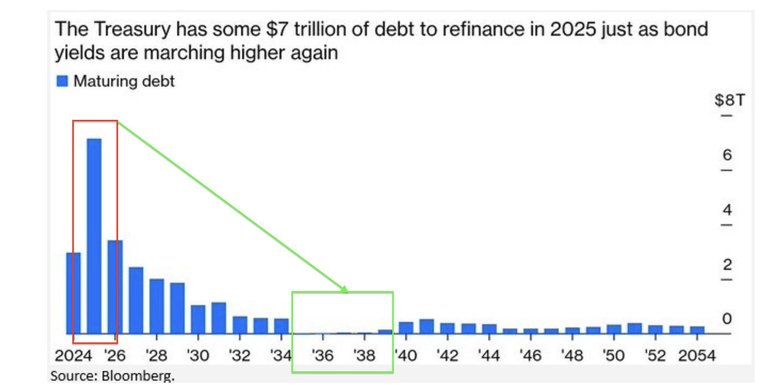

The Treasury has $7 trillion of debt it needs to refinance this year. Here's the chart:

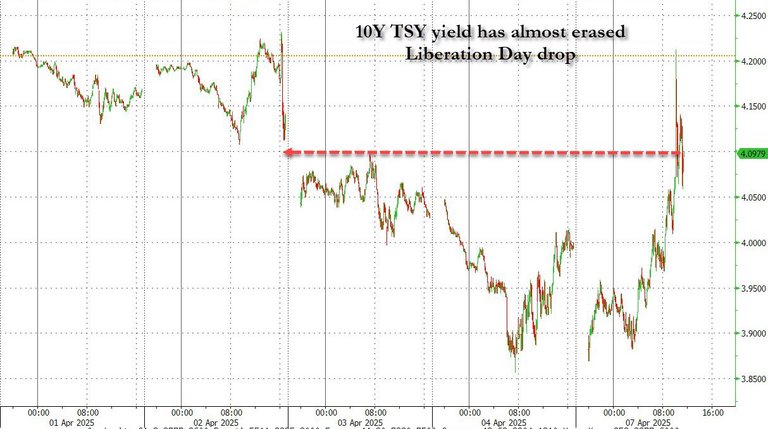

So how is the strategy going? On Thursday, bond yields did trend lower and money rotated into bonds, plus investors anticipated a recession and rate cuts from the Fed. But at the close on Friday, bond yields started edging up, and on Monday did a scary surge up. Here's the chart:

Why is this happening?!

There are two theories:

The first is that hedge funds facing painful margin calls and are selling all their assets. On Friday there were stories going round that some hedge funds paid their margin in gold. If they're selling gold, they're selling Treasuries and crypto too.

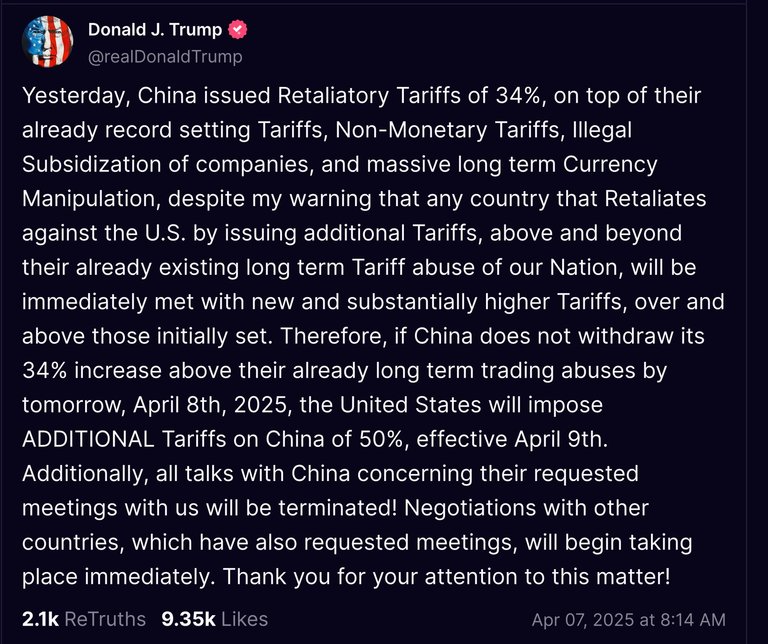

The second theory is that China is selling Treasuries. Trump posted an intemperate tweet, threatening China with further retaliation in response to their retaliation which was in response to his tariffs. Here is the post:

Within an hour, bond yields spiked. Was it the market responding to Trump's words, or China retaliating by dumping Treasury bonds?

China officially holds $759 billion in Treasury bonds, plus an undisclosed amount wrapped in legal entities based in Belgium.

If they have concluded that the US might seek a pretext to freeze their holdings, or outright default on the debt (as hinted by Elon Musk), then they have very little to lose by dumping the bonds now. With the bonus of hurting the Americans.

The US Treasury will be holding a bond auction on Wednesday. Watch the yields. If they spike, or the auction fails altogether, the crisis will dramatically worsen.

In that situation, the Fed can intervene by printing money and using it to buy bonds to force yields down. But that is inflationary.