... even though inflation hasn't yet reached it's target of 2%. It's currently 2.1% and is likely to rise this winter because of the rising cost of electricity and natural gas.

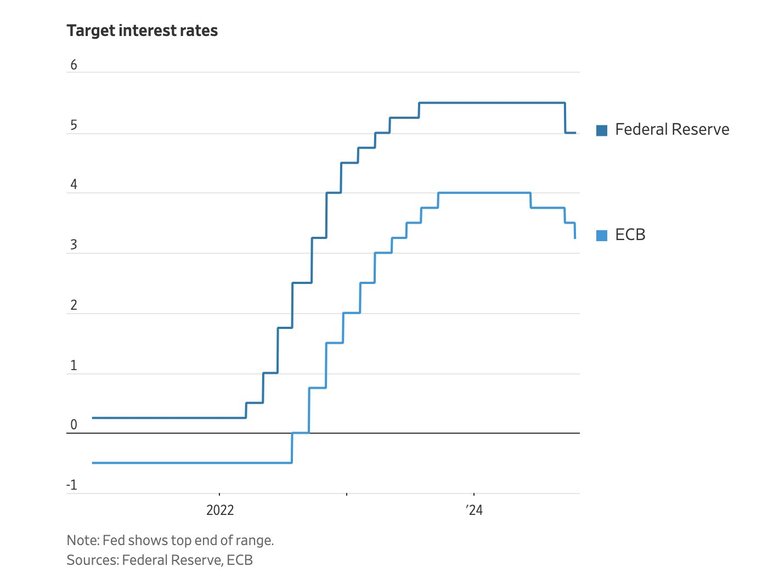

Eurozone interest rates are now 3.25% down from a peak of 4%.

So why have they cut for the third time instead of just holding and waiting till inflation is properly defeated?

The simple answer is they're worried about Germany which is recession and is rapidly deindustrialising. When Germany slows down all it's neighbours slow down too, as they supply parts to the big German manufacturers.

If the German manufacturers relocate to China - as VW is threatening to do - the whole of the EU is in trouble.

So the ECB has done it's bit by cutting interest rates.

What Germany really needs is reliable energy. That involves the German govt admitting they made a mistake shutting down their nuclear power stations, and issuing permission for the reactors to be restarted.

More broadly, the EU needs to dump it's draconian Net Zero regulations which are strangling manufacturers.

But in the absence of action from governments and the EU Commission, all the ECB can do is cut interest rates and hope for the best.