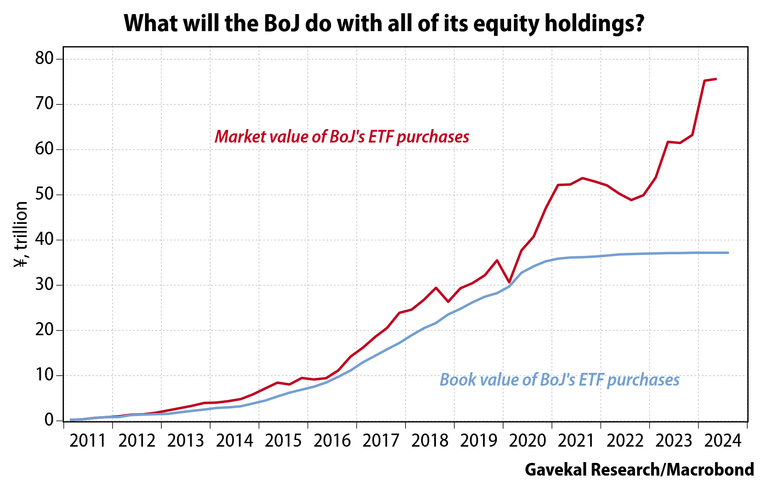

... the market value of which is ¥70 trillion. See the following graph:

As it exits the easy monetary policy of the last 15 years, it is likely to sell these ETF holdings first, rather than Japanese Government Bonds. The thinking is that the proceeds raised from the sales of the ETFs will be passed to the Japanese government which will use the money to repay debt (or reduce borrowing in the years they are running a deficit).

These ETFs are Japanese ETFs, not overseas ETFs. They bought them because it was a way of getting all the Covid era QE yen they had printed into the Japanese economy.

The problem is, they bought so much, they own the equivalent of 7% of listed Japanese companies.

That means it will be difficult to exit without crashing the Japanese stock market.

However, the Bank of Japan has some experience here. During the Great Financial Crash of 2008/9, they bought stocks to stabalise the Japanese stock market. Then from 2016, they slowly sold them without causing a ripple in the stock market. Of course this time they own so much more, that if they sell at the same snail's pace, it will take two and a half centuries before they get rid of it all.