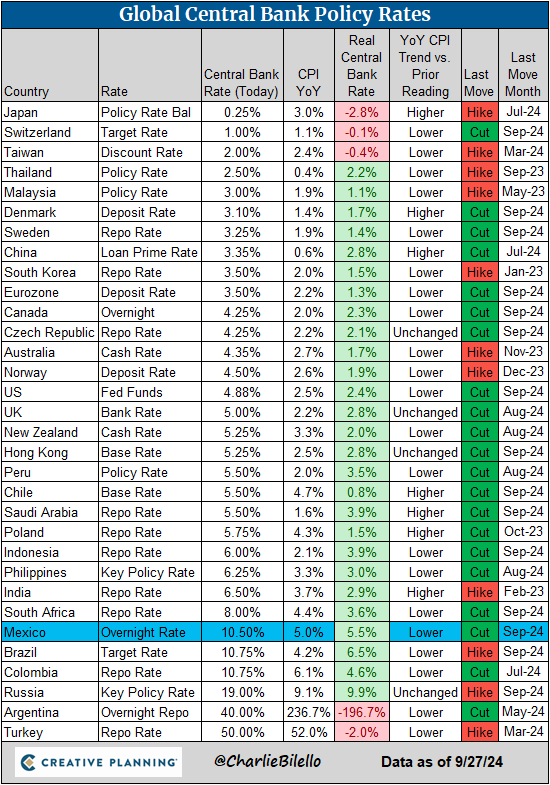

The latest country to cut rates is Mexico - they have cut by 25 basis points to 10.5%. This is their third cut this year.

Switzerland has cut by 25 basis points to 1% (also their third cut this year). Sweden also cut for the third time this year by 25 basis points to 3.25%. And Czechia cut for the seventh time this year by 25 basis points to 4.25%.

The Swiss rate cut has actually taken their real interest rates into negative territory.

Why are they all doing this? Quite simply the Federal Reserve's 50 basis points cut weakened the dollar. This is bad for countries that export to the USA. So all these countries are scrambling to cut rates to weaken their own currencies again.

It's rare to see global easing like this without a recession, and when inflation hasn't been completely vanquished.

Maybe the central bankers know something the rest of us don't. Or maybe they're miscalculating the way they did before the Great Financial Crash, in which case their herd like behaviour risks inflation coming roaring back. (In the mid 1970's they thought they had defeated inflation, and cut interest rates too early, and the easy money caused inflation to soar again).