Both the Nasdaq and the S&P500 are now in correction territory, as they're down by at least 10% from their highs. The questions are "How long will the bear market last?" and "Is the bear market fortelling a recession for the economy?"

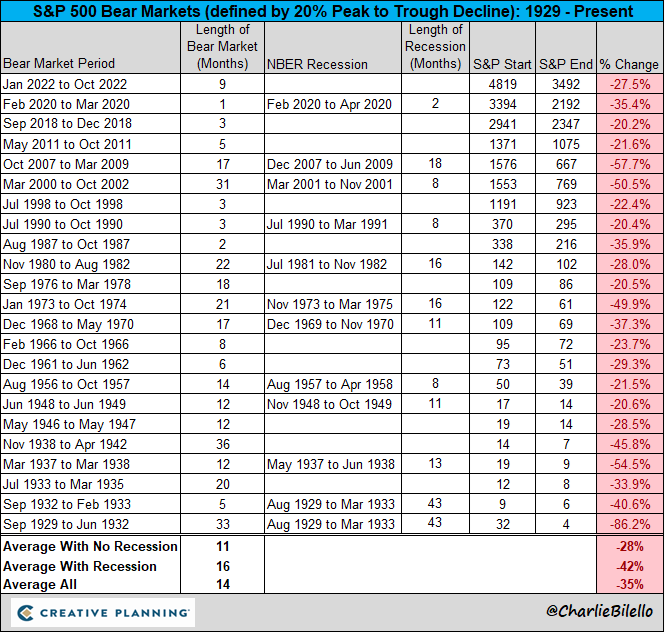

Here is a table looking at previous stock market crashes, and whether they were accompanied by a recession:

As you can see, shortish stock market crashes arn't correlated with recessions, they're just about investors taking profits. But longer duration crashes are caused by companies reporting lower earnings and even losses as the real world economy contracts.

(As an aside, the 1929 crash was so severe, that the S&P did not recover to it's August 1929 level till the 1950's - it took about 25 years).

This time round, the sell off started on March 4th, when tariffs on Canada and Mexico came into effect. The sell off was dramatic because the markets had previously thought Trump wouldn't go through with it, so they hadn't priced it in.

The steel and aluminium tariffs will increase input costs of all American businesses that use steel and aluminium - auto makers, manufacturers of beer cans etc. Those costs will be passed to the consumer. So the part of inflation that is about the price of manufactured goods will rise.

The general 25% tariff will hit imported food and drink. However, if the dollar rises, the effect of the tarifs will be cancelled out resulting in no price change. The US dollar has risen against the Canadian dollar and Mexican peso.

Canada has retaliated with tariffs of their own, and beyond that there is a widespread boycott going on. That will affect American exporters - for most US states, Canada is the chief destination of their exports. So the markets are anticipating reduced profits and some job losses.

Finally, 70% of Americans own stocks, and seeing their gains vanish might prompt them to tighten their belts to rebuild their savings. That too might result in lower economic activity.