The markets are assuming that the Federal Reserve Bank, European Central Bank, Bank of England and others will cut interest rates. In their very worst case scenario, they think interest rates might be held where they are. But what if they go up?

We have a canary in the coal mine: New Zealand.

The Reserve Bank of New Zealand (RBNZ) has a history of leading other central banks. They were the first to hike and the first to pause.

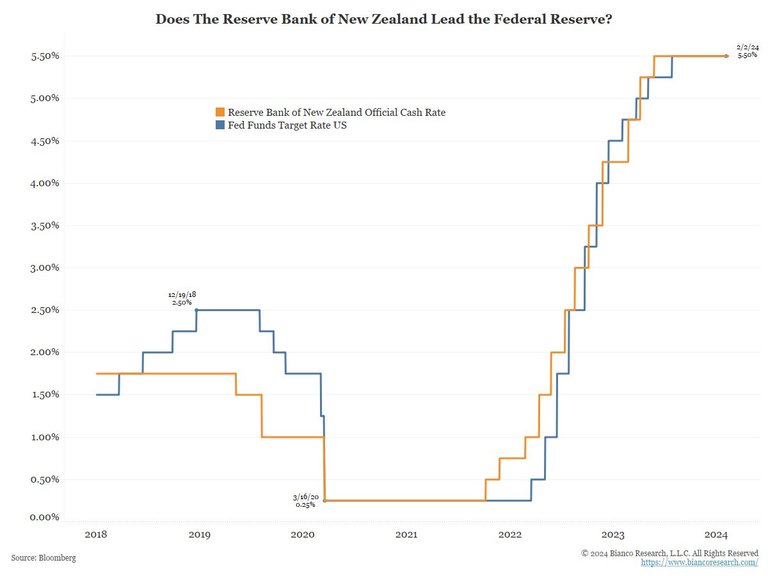

You can see from this chart how the Reserve Bank of New Zealand has led the Federal Reserve of the USA:

Economists in New Zealand are fretting that inflation is NOT under control and the RBNZ might have to hike interest rates at their next meeting in April. They held rates at their meeting on 28th Feb. But New Zealand's CPI was 4.7% in December.

One reason for a rate hike might be to strengthen the New Zealand dollar, to make oil and other imports cheaper. And where New Zealand leads, other central banks follow.