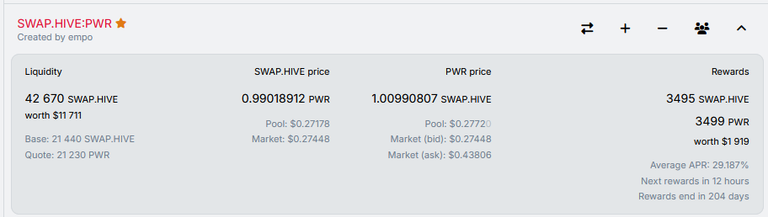

Some of the insane APR's in Deisel Pools.

Even if you heard the term "Deisel pool" the very first time, I can still bet that you know the functioning of the Diesel Pool very well. Diesel Pool in simple words is "Defi in Hive" and word Diesel is used to "mock" the high Ethereum fees for doing transactions versus "free transactions" available in Hive, provided you hold the required "Resource Credits" in your account which you by default own if you own staked Hive Power in the Hive ecosystem. When the diesel pools were launched initially, they did not even charge the "swap" and "transaction fees" also and it is almost free for user to swap their tokens.

It was thought that "Liquidity" incentives will be provided by the individual creating or owning the pool although any individual is also able to provide incentives to the the pool if individual creates a distribution contract to distribute rewards. After introduction of the fees in Diesel pool, liquidity provider now have 2 ways of getting profited for providing liquidity. It is not necessary that liquidity provider incentive exists for every pool in Diesel pools but today I will be talking about some of the pools that do have rewards and really have insane APR for providing liquidity.

You can already see in the above screenshot that APR in the some pool is insanely high as 130% and these are not the complete list of the pools.You can check on yourself for the pools in Beeswap pools to check it yourself for other interesting pools. You can use the official Tribaldex interface too but Beeswap interface is more feature rich.

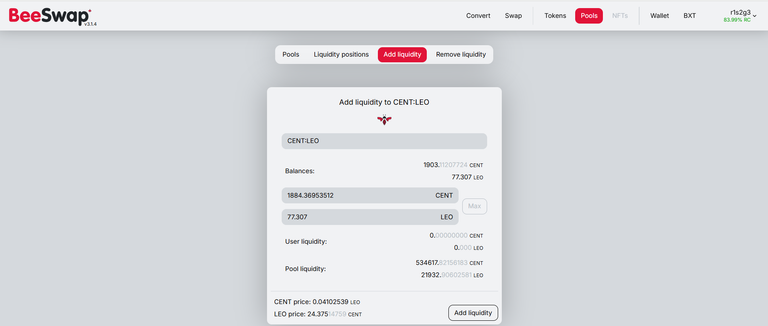

So I have liquid CENT and liquid LEO and I find CENT:LEO pool providing high APR and I jumped in it, providing the liquidity to the CENT:LEO pool.

Current Pools in which I am providing liquidity

With the addition of the liquidity in CENT:LEO pool, I am providing liquidity to other 4 pools in the Tribaldex/Beeswap. Rewards for DEC:SPS liquidity provider are awarded through the Splinterland's game interface and it shows 0 here. My most handsome payment of providing liquidity come from the ATX:SWAP.HIVE pool, where I am making more than .75 Hive per day(or in 24 hours.)

Beware of Impermanent loss and liquidity.

If you are just get motivated to jump into these pools providing the insane APR's , I guess I have also need to warn you about the potential risks about them. The first risk is impermanent loss, where your token balances changes with time and you discover that your token balances become less than the original balance even with liquidity provider fees earned. Secondly, "incentivized" APR is the function of total liquidity, if liquidity goes 10x, then APR will become 1/10x. Most of the tribaldex pool has very low liquidity and if you dreaming of this high APR with some serious money than better forget it.

Curation with minute token balance is not at all worth the time.

If you are still wondering that why I am in these liquidity pools? Reason is simplw that most of tokens in Hive-Engine are having super low price, powering up , and curating with them for 5-15% APR does not make any sense unless you are bagholder of it, so it is better to put them in Diesel pool, if they earn good APR, they are very much welcome, otherwise forget them.

These are my personal view and feel free to explore and create your opinion.

Posted Using INLEO