So, today I am going to take a look at the latest developments in inflation and what they mean for the markets, the FED... and me, as an everyday investors!

Because while the numbers may seem boring... they actually hide a lot. And as I am seeing, those “small” changes in June could shape interest rates, markets, and the next steps in my investment journey.

INFLATION

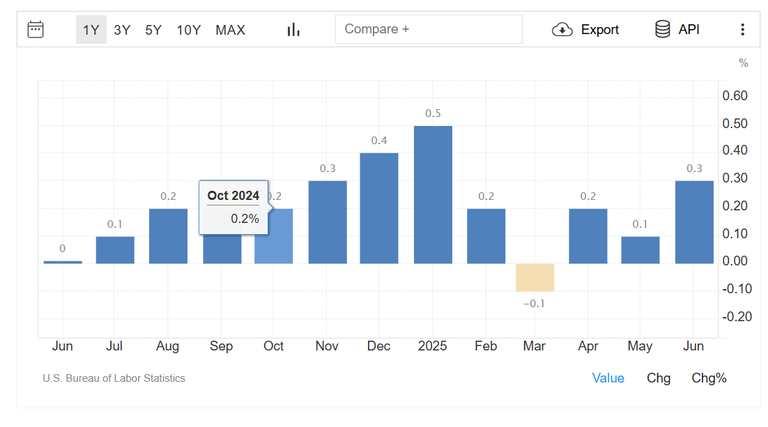

So, the Consumer Price Index (CPI) for June rose by 0.3% on a monthly basis, accelerating compared to May when it had only risen by 0.1%.

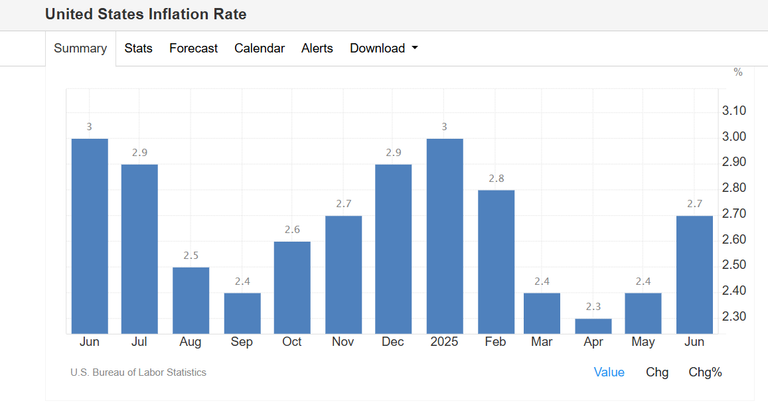

On an annual basis, it came in at 2.7%, slightly above the 2.6% forecast and also higher than May’s 2.4%. This marks the biggest yearly increase since February, showing that while inflation is trending downward compared to previous years, it hasn't been eliminated.

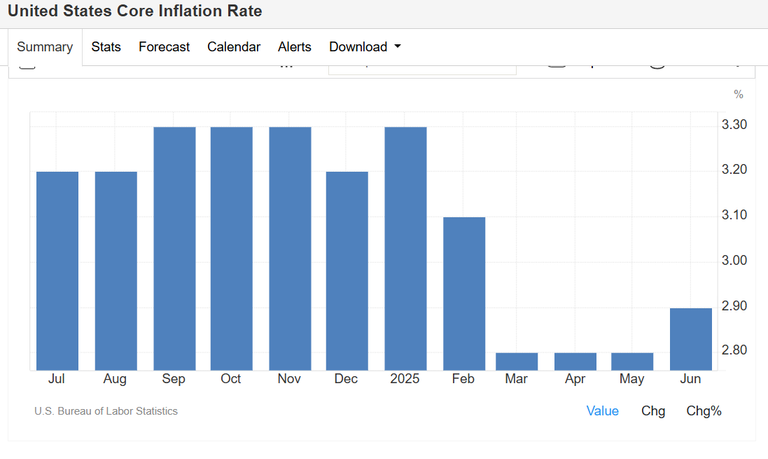

In the so-called "core" inflation (core CPI), which excludes food and energy, we saw a 0.2% monthly increase and a 2.7% annual rise. Here, the numbers were slightly below analysts' expectations of 0.3% and 2.9%, respectively, but they still remain above the FED’s 2% target. This shows that while the overall picture is improving, the battle with inflation is not yet won.

And what caused this increase? Mainly the housing category, which rose just 0.2% in June—slowing down from May’s 0.3%—but still remains the biggest contributor to overall inflation. A notable increase was also seen in household goods and furniture, where prices rose by 1%, something many attribute to the early effects of tariffs.

THE FED

And this is exactly where the FED comes in.

Because while many are hoping for interest rate cuts, the reality is that the FED... simply can’t do that yet. The central bank doesn’t look at just one indicator. It wants to see an overall picture that says, It’s safe to ease.

Right now, that picture isn’t here yet. Inflation is close to the target, but not stable enough to call it “under control.” Energy prices rose 0.9%, with gasoline specifically rising 1%. Food prices also went up 0.3%, with dining out being particularly expensive. And this is all before we’ve seen the full impact of the new tariffs.

So a rate cut in July... is pretty much off the table. The market is now turning its attention to September as the most likely “window” for the next move. And even that... comes with conditions.

What I am doing ? Nothing I keep building the position I want slowly and waiting to see what is going to happen because with Trump no one knows what will happen.

Please Vote for our

Please Vote for our