Hello and welcome to this weeks LBI Holdings and Income report. LBI is a pooled investment token based on HIVE with a range of assets backing its token. Each LBI token represents a share of the assets, and the value of that share is published daily on inleo.io as a thread. All you have to do is check our profile page to find the most recent "Asset backed Value" for the token.

LBI came under new management last year, and we are working on raising its profile, converting it into a token that shares a portion of its income each week with token holders, while also selecting investments to maximize growth. LBI's roots are firmly planted in the @spinvest ethos of "get rich slowly". We don't chase amazing returns and massive gains, we look for solid investments, long term growth and the magic of compounding.

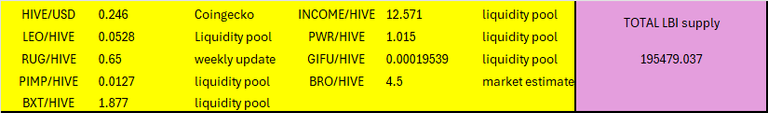

Another week in the books for LBI - and our minor restructure to establish the @lbi-leo wallet continues. Here are the asset prices at report cutoff time:

And here is the link to last weeks report for comparison:

https://inleo.io/@lbi-token/lbi-weekly-holdings-and-income-report-week-34-week-ending-23-march-2025-cbj

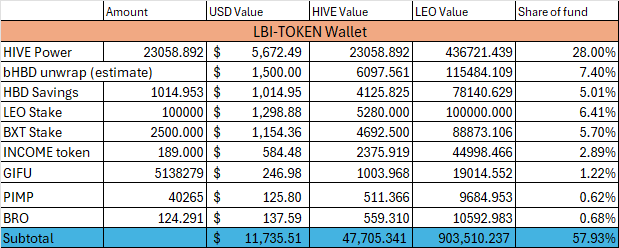

@lbi-token wallet

I've changed the report format a bit, and combined this into one section instead of separating it as two parts. 50 HIVE added for the week, which is pretty good with one less post than usual. HBD saving dropped as we continue to dip in to it to set up the new LEO wallet. The LEO stake is moving over to the new wallet, and there is two weeks left for that process to run its course. Overall, a steady week.

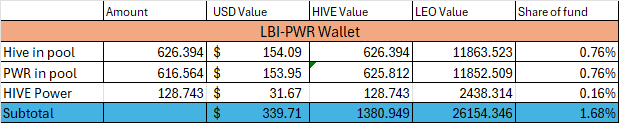

@lbi-pwr wallet

Fed a little extra back in to this wallet, to rebuild the position a bit after dipping in to it last week. 160 HIVE added to this wallet overall for the week from a combination of fresh funds and organic growth.

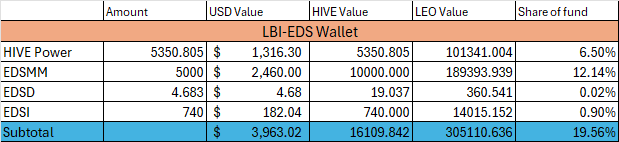

@lbi-eds wallet

3 HIVE (from inflation) 20 EDSI and 1.2 EDSD added for the week - very much a standard week. The yield we generate from this is likely to be lower in the future as the EDS project is having to adjust it's structure a bit to remain sustainable in the long run. However our overall income should keep growing thanks to the fact we grow by 20 EDSI each week, offsetting the likely APR decline coming.

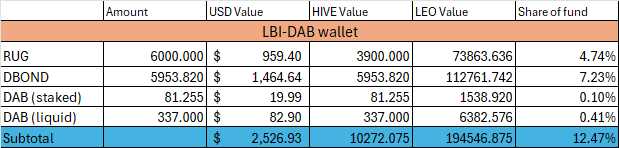

@lbi-dab wallet

419.9 total DAB at the end of this week, which is 13.26 up from last week, which is ok but down a touch from last week. The good news is RUG had a better week, and we received just over 40 DBONDS as our yield from RUG this week, which is better than it has been for a while.

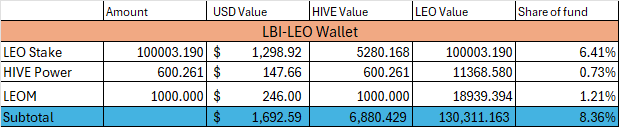

@lbi-leo wallet

The set up of this wallet continues, with a couple more weeks still to run. Income has started to flow now, with curation rewards kicking in. Our total LEO stake has started to grow, and the pace of this will accelerate once all the funds are in here and the wallet is fully established. Once it is done in a couple of weeks, this wallet should hold around 17% of LBI's assets, depending on the LEO token value at the time. 1/3 of this wallets income is being staked, 1/3 will go to income and 1/3 will be swapped to HIVE to build HP. I was hoping to be able to track mining rewards and curation rewards APR, but they both come as the one payout with no split indicating how much of each, making analysis impossible.

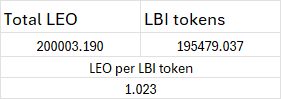

The LEO per LBI hasn't changed this week (well if I used a lot more decimal points it would show a difference as we burned a few LBI and added a few LEO - once this wallet is properly set up this ratio should grow over time.

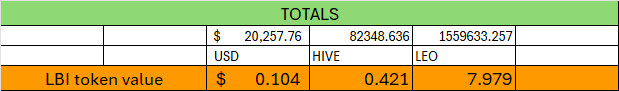

Totals

We finish the week just over $20,000 total value, up about $500 from last week. The price of LBI is up slightly compared to the USD ($0.101 up to $0.104) down a bit in HIVE terms, and up close to 8 LEO per LBI.

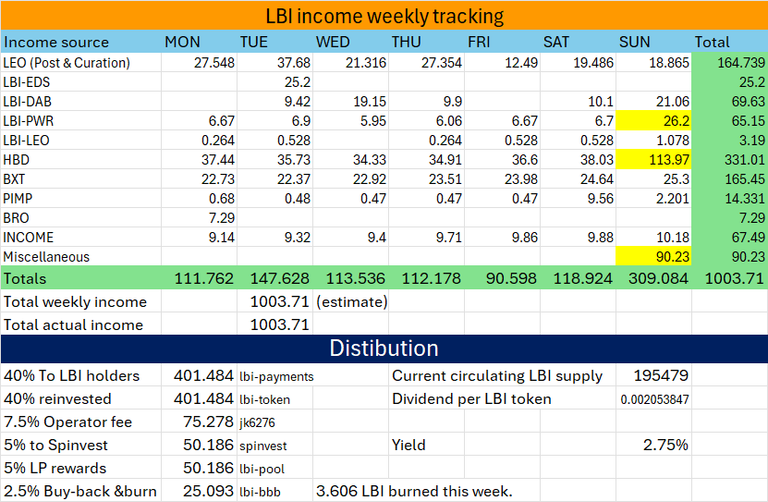

Income report

We hit the 1000 LEO mark this week, with a little cheating. I did use a touch of our growth to add to the income to get over 1000, which I have indicated in the report with the yellow highlighted squares. Once the LEO wallets transition is completed and our growth continues we shall get a more accurate picture of total income. At current LEO prices, 1000 per week is my goal for now.

400 LEO sent out to LBI holders as dividends, and 3.606 LBI burned for the week

Conclusion

Another steady week overall, with the main focus being setting up the LEO wallet. All our assets performed as expected this week, and while things may seem boring from week to week at times, the foundation is definitely in place for this fund to grow for years to come.

Thanks for taking the time to check on our progress,

Cheers,

JK.

Posted Using INLEO