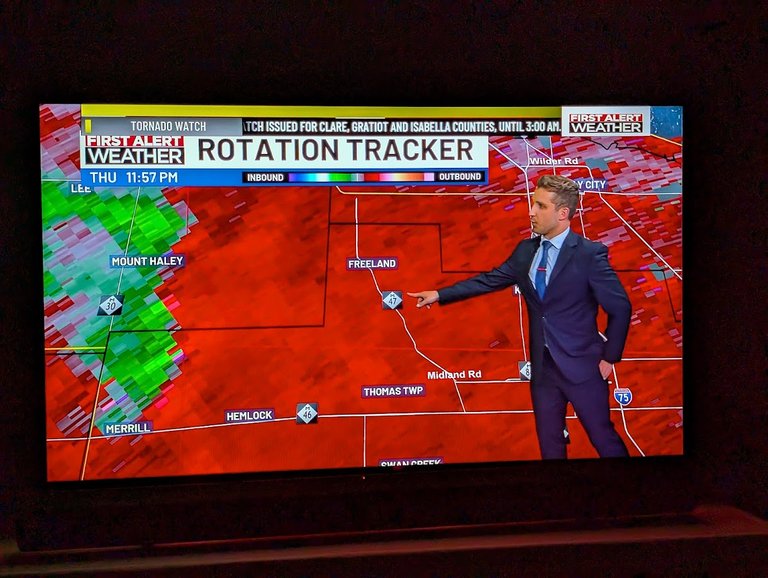

I'm pretty tired right now, I got jolted awake at around 11:45 last night when the tornado sirens started going of in the township where I live. I knew there was a strong line of thunderstorms coming when I went to bed, but I didn't expect I would be sitting up at 12:30 at night watching the local news station waiting for the warning to expire.

We got lucky, I don't think any major weather events were logged besides some heavy rain and strong winds. Plus lots of lightning and thunder of course. It was pretty much non-stop for a while there. I think a lot of the damage won't be fully realized until they get out this morning and start looking at things. The map from the power company shows that about 10,000 people in our area are being impacted by power outages right now. Far less than I expected.

That's a lot of read right there... Kind of makes you think of the cryptomarkets right? It was interesting to see the price of BTC take a dive from $104K to $101K the other day. I can only guess it was due in part to the reported security breach by Coinbase. That's a tough one because Coinbase didn't really do anything wrong besides hire the wrong people. Either that or they didn't pay them enough that they could be so easily swayed by the promise of money for data.

I'm sure you have heard already, but Coinbase seems to have flipped the script and instead of paying the $20 million dollar ransom for the data, the have made it a $20 million bounty for anyone to catch the thieves.

How very Mel Gibson of them

I tried to find a GIF of the scene, but the movie must be too old or nobody cares about Mel Gibson since he kind of went a little nuts. It was a quick recovery though and just like the beautiful sunrise that came with the new morning, the price of BTC is back up near $104,000.

It is time again for another Finance Friday/Friday Finance. This is a series I started where I talk about random bits of financial stuff that I have seen, gathered, or experienced during the week. I hope as a reader you find it informational, entertaining, or both. I also hope it can generate some good discussion and edify the community.

—-----------------

GENIUS Act

Oddly enough, along with the weather alerts that were blowing up my phone last night, I also got an alert that voting should be taking place today in the US Congress for the GENIUS Act. This act is stablecoin act that I honestly didn't know the full scope of. I jumped on GROK and used the prompt: "summarize the GENIUS act for me with a few key bullet points."

I'll now summarize for you. Stablecoins need to be fully backed 1 to 1 by reserves, there will be federal oversight for issuers based on market size, consumer protections in the case of issuer bankruptcy. Finally, it also stipulates that International stablecoin issuers have to comply with US law, and it will hopefully update the US payment system.

From what I have heard, it has been a contentious subject in the House despite the fact that it passed the Senate. I expect if it does pass the house the president will sign it with little hesitation.

Is this a good or a bad thing? I honestly don't know, but it may be one of those cases where anything is better than nothing.

EOS is now "A"

I doubt there are very many of you, but if you still follow that token everybody loves to hate called EOS, they have now started a migration to a new token. The EOS token is being replaced by a token by the name Vaulta with "A" as the ticker symbol. I still hold some EOS, but I haven't begun the migration process yet.

I really don't know what this means for the token. I doubt it will breathe new life into the chain. Things have been pretty stagnant for a while and what seemed the next best thing since HIVE has turned into a basic dud. The underlying network is still pretty sound. WAX is a perfect example of how the EOS operating system works even if the token doesn't.

Silver Feed

I finally gave up on trying to get a silver spot price feed working. After getting some really good feedback from the #silvergoldstackers community, it appears there just isn't a very reliable way to get alerts for the movements in the spot price of silver. It sounds like I just have to regularly check it and then see if I can make it to my local store before the price goes back up too much.

Unfortunately, it seems I usually only make a purchase about once a year when it gets close to Christmas time and I would kind of like to change that. I think getting on some kind of regular buying schedule would be a good idea if I can figure out a way to offset the shipping costs. It would help if my local store had more reasonable hours, but I understand it is kind of a niche market, so they aren't going to have the regular retail hours like say a Wal-Mart.

HIVE

HIVE continues to be on a bit of a tear and I am kind of lamenting the fact that I didn't move more HBD into HIVE when it was lower than it is now. I still stand to make a bit of money, but not nearly as much as I had planned. With the XV token from @spinvest coming to a close soon, I will likely just hold those earnings liquid to move into HBD when the price of HIVE hits a favorable point.

Right now my focus is on anything over $.75, but I know we are a long way from there. Last I checked, the payout for XV was a 2.66 HIVE profit or something like that, so I think it was a pretty good investment. I kind of wish I had been able to buy more back when it launched. It's hard to believe it has been three or four years already!

Sports Talk Social - @bozz.sports