Gold has been used as a medium of exchange for thousands of years. Today, we have fiat money that is used for daily trades when we want to exchange the value of two assets. The new currency model is adopted for the primary role of precious metals as they are more scalable and easier to use daily.

Though paper money has replaced precious metals, especially Gold and Silver, these valuable natural assets have been left by people. Rather, we assigned another role, which is called store of value. With its new face, GOLD, and partially Silver, are purchased by people to store and secure their value.

What these precious assets do is that they hedge the investors against inflation and protect their purchasing power over time. Now, central banks, companies, and people store Gold and Silver as strategic funds in their portfolios.

Performance of Gold in Cease in Economies

One of the narratives behind Gold is the low - risk investment in fearful times. Wars, pandemics, high inflation, and political risks are the times when people lessen the allocation of risky assets and buy Gold and Silver to hedge themselves.

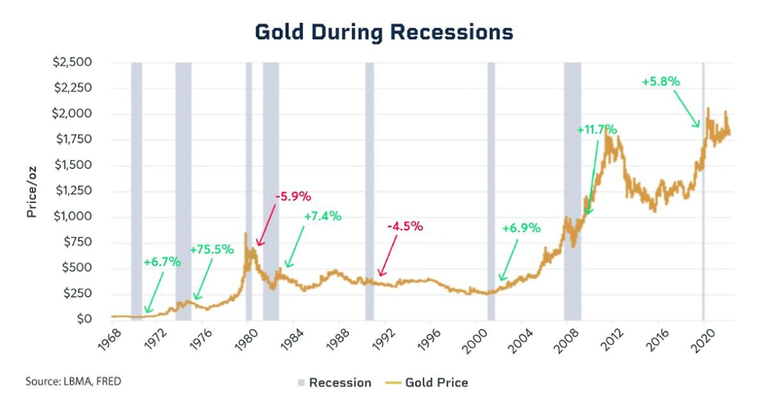

During recessions, people liquidate their stocks (and crypto) as they need cash when everything collapses. The approach that " be close to liquid in recession " first creates sell pressure on Gold, as well.

If you look at the charts, you will notice that investors sold their gold when they were in recession. However, none of the cases resulted in more than a 10% loss in the price of Gold. In many cases, Gold was the asset people started putting their money in.

Since they are seen as a safe harbor, the U.S. government bonds and Gold recovered fast besides the strong DXY against other fiat currencies. While the debt of the U.S. is going up, the second choice of people will definitely be Gold if we enter a recession again.

The main purpose is not earning more in such times, rather, you try to save your money while the companies and governments are bankrupt. We will follow the data coming from the U.S. to understand if the conditions are pointing a recession or the inflation is still too sticky to handle.

In both way, the markets are under the control of bears and the fearful atmosphere cannot attract bulls to stay for long. Having a short recession followed by quantitative easing and green markets might be the best possible scenario for crypto investors while the market is bloody red today.

What do you think about the performance and role of Gold in recessions?

Share your thoughts below 👇

Hive On ✌️

Posted Using InLeo Alpha