When did Khal talk about LEO's listing on Maya Protocol for the first time publicly? I don't even remember, but I surely haven't heard about it [added: until] this year. It's true, before talking about listing LEO to Maya, he wanted to do it on Thorchain, so we had some idea of the general intentions in this regard.

Anyway, well after the first discussions about LEO listing on Maya, the new LeoDex came into the picture.

What LeoDex needs, now that is mostly built, is Arbitrum LEO - CACAO in the liquidity pool on Maya, and SWAP.HIVE - LEO in the diesel pool on Hive-Engine.

Well, Khal mentioned in the AMA that after HIVE purchases are built and tested thoroughly, they will also integrate SPS, DEC, and HBD on LeoDex. That's good news for Splinterlands and LeoDex since they take a swap fee. As for Splinterlands, the community was looking for new listings... This one can go to BTC, DASH, ETH, ARB, RUNE, and soon other ecosystems from Thorchain.

So, where does the "clairvoyant" part come from? Well, at the beginning of the year, I decided to take it slow with my LEO staking goal. Looks like I shouldn't have any regrets. Ad revenue is gone until INLEO builds an internal ad system, which will probably take a while. Khal said Google Sense payments were very low compared to the traffic, and that their ad code was responsible for many errors on INLEO.

My first thought at the beginning of the year was to keep some LEO liquid, given that we are in a bull market and we should expect some pumps. I partly did that. And I partly sold some LEO at 15-16 cents, expecting it to go lower in the short term. Which it did.

But then, I also added over time small amounts of LEO with SWAP.HIVE in the diesel pool. There is no reward paid on this pool, but there are swap fees. I calculated them at some point to be around 3% per year. Nothing spectacular... at that time, but better than zero.

I'm curious about what we have now, given that SWAP.HIVE-LEO is used for swaps between Hive and Maya.

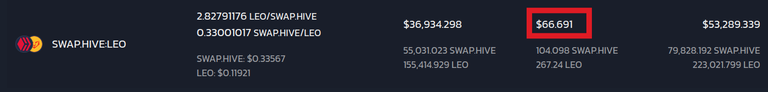

Let's see. These are the 7-day transaction fees on SWAP.HIVE-LEO (I chose the 7-day interval because it is probably the most relevant after the volume started to rise post-LeoDex launch):

So, $66.691 fees in 7 days, at a liquidity of $36,934.298 (currently), means 9.44% per year, currently, if I haven't messed up the calculations. That's about the same if not higher than curation APR on HIVE, but we have to consider this will fluctuate with the amount of liquidity added and the volume of transactions.

I have no doubt the volume will be on the rise. Proof for this is the difference in APR between the first time I calculated before LeoDex, around 3%, and now, over 9%. I doubt liquidity dropped in between, quite the opposite. We should expect the volume to rise too, first because it is needed for a lower slippage on the inter-chain swaps, and second, because of the nice swap fee rewards right now.

So, I am a clairvoyant, right? 🤣

Want to check out my collection of posts?

It's a good way to pick what interests you.

Posted Using InLeo Alpha

Posted Using InLeo Alpha