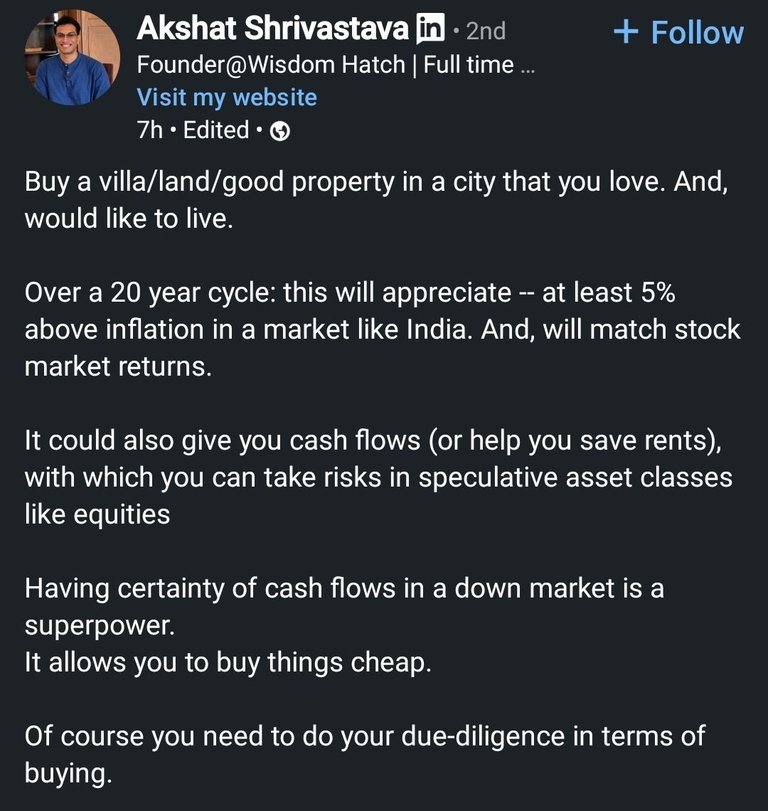

Recently Akshat Srivastava, who is a big finance influencer told to buy the villa, plot or property in the place where you love and most likely will live. But the problem is, it is not so easy. I love Jaipur which is in Rajasthan but I have to work in Bangalore. And I cannot buy the property in Bangalore because of high prices. And also I don't want to buy in Jaipur because I cannot maintain it.

PC: LinkedIn.com

So that's not feasible for most of the people. And the problem is Bangalore is getting super expensive. So if you want yo buy the house in Bangalore you have to get the debt and also high debt. That's a big problem for most of the people, I.e. having a debt. In the stock market you can buy literary with less money but that's not the case with the real estate. The problems with the real estate is too much, you need a big capital, you have to check the documents thoroughly to see if the documents are correct or not and then you have to maintain it well so that people shouldn't encroach it.

And that's why most of the people stay away from the real estate and even if the market is volatile they are OK in putting the money in the share market. I know having a property which generates cash is a great asset, you get regular cash flows. But it's not everyone's cup of tea but if you want to get your hand dirty, then getting the property from good builder should be your priority. People think that they can pay the EMI in place of rent but the EMIs are usually 3x to 4x their Remy and that's what make them vulnerable in the future. They cannot pursue what they want to do and that's the problem if you are buying the real estate in loan.

Posted Using INLEO