Last Sunday I missed posting my report. The brutal truth is, I was exhausted and had no brain for TA. In this industry, you need your head 100% in the game, otherwise any mistake can cost you a lot, but I'm here today, so let's see what $HIVE has been doing.

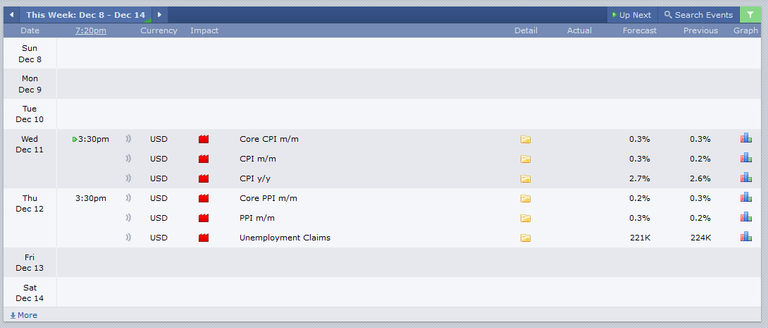

Finally, looking at the monthly chart, I'm seeing a price action I've been talking about for months.

Last month $HIVE was finally able to break out of the gap has been inside of for the past 6 months. The monthly candle closed above both gaps, inverting them and so far, even though the month has just started, the current candle is a nice bullish one. I'm not going to speculate on the monthly as TA is not about making speculations, so let's wait till the month ends.

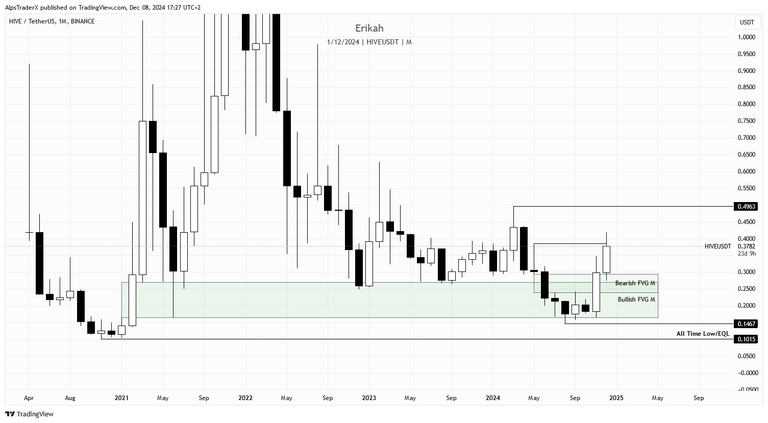

The weekly chart also looks good. At the time of writing, there are around 6 hours till the weekly candle close, so in theory a lot can happen, but should this candle close above the gap, would mean bullish continuation to the upside. Should the candle close below or inside the gap, that means rejection and possibly continuation to the downside.

However, I'd be cautious here. Even if the candle closes above the gap, I wouldn't exclude revisiting the $0.3 level. No need to panic, it would be a healthy correction and most likely needed too and better now than later, from a higher level.

In case of a successful weekly close, I'm looking for price to sweep the equal highs at $0.4987 and ultimately the levels above, market in the chart.

On the daily, price ran into resistance. The bearish gap market with yellow has rejected price twice and is capping the market for the time being. Today's candle rebalanced it, but for bullish continuation it needs to close above and invert it.

On a more granular scale, the h4 chart is showing a bit of weakness. Price lost momentum and possibly coming back to rebalance the gap, or interact with the h4 order block. Such a small pullback is healthy, no cause for concern and as I said earlier in this post, better now than later.

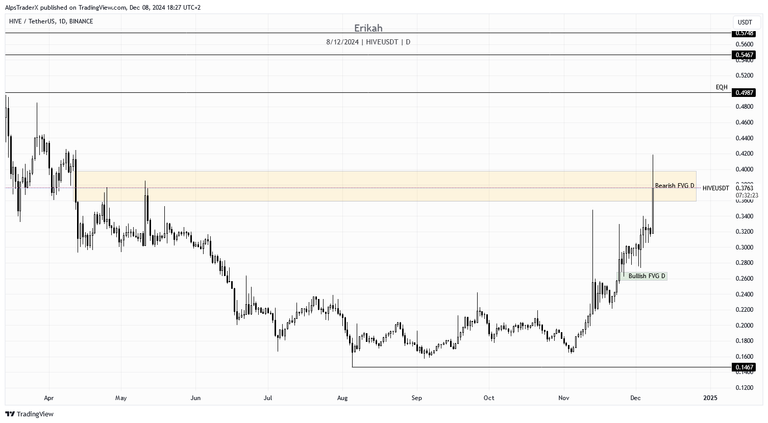

After 34 weeks of consolidation under previous ATH, $BTC finally made a significant move to the upside. We had news catalyst to help price get to this high, but at the end of the day, it doesn't matter, what matters is that $BTC has finally managed to break above $100k.

We have a bullish gap on the leg up, which may (or may not) get retested. Only time will tell.

The daily charts shows a bit of indecision, but it still looks good to me. Price is above the OB and even though today we may get a second doji, it's still not bad. At this point price can go either way. As long as it stays above the OB, I'm looking for price to sweep the current ATH. On the downside, the next liquidity pool is around $90530, but revisiting the $85k area is not excluded either.

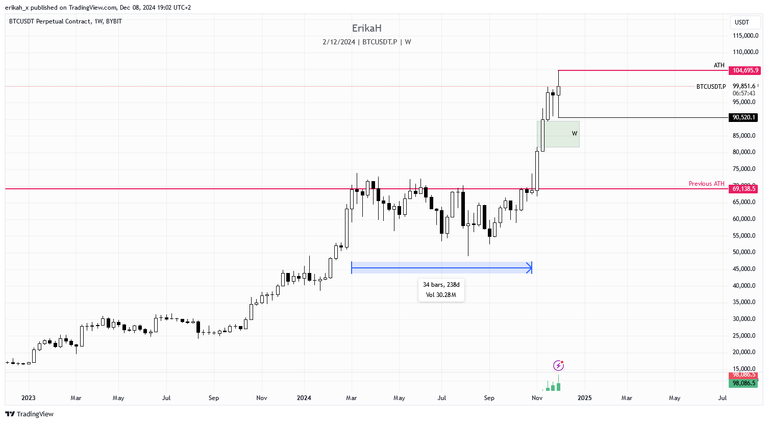

This week we had 5 red folder news day with nice volatility. Next week we only have 2 days, so most likely the other 3 days will be a bit boring, but with the current geo-political situation, you never know. Things can move quickly, so better be prepared for every scenario and apply strict risk management.

Now that $HIVE finally started to move, I'm really curios how things are going to evolve for us.

Stay safe people, be smart and protect your capital.

As always, this is a game of probabilities, not certainties. Also please note, this is not financial advice, it's my view and understanding of the market.

All charts posted here are screenshots from Tradinview.

If you're a newbie, you may want to check out these guides:

- Communities Explained - Newbie Guide

- Cross Posting And Reposting Explained, Using PeakD

- Hive Is Not For Me

- How To Pump Your Reputation Fast - Newbie Guide

- Tips And Tricks & Useful Hive Tools For Newbies

- More Useful Tools On Hive - Newbie Guide

- Community List And Why It Is Important To Post In The Right Community

- Witnesses And Proposals Explained - Newbie Guide

- To Stake, Or Not To Stake - Newbie Guide

- Tags And Tagging - Newbie Guide

- Newbie Expectations And Reality

- About Dust Vote And Hive Reward Pool, by libertycrypto27