Prices always go up.

This is the belief that most have. Actually, with many things, this is the case. However, there is one field which tends to go unnoticed when it comes to a discussion like this. What is important is the fact that it is growing as a percentage of the overall economy.

What this means is the calls for hyperinflation are nonsensical. There is no way for that to happen when a growing percentage of your economy falls under the laws of information technology.

Before getting to the specifics, lets dive into what this is.

Laws of IT and Deflation

Historically, we can sum up the laws of IT by their different components.

We have:

- semiconductors

- storage/memory

- software

When it comes to the individual aspects, we see a doubling with regards to cost/performance of 2 years, 3 years, and 6 years. This means we have an annual deflation rate of 50%, 33%, and 16%. The key is the last one, software, is moving at a faster pace.

In fact, we might be able to assign the same to semiconductors, at least looking at GPUs.

The point here is we have a massive amount of downward pressure as the tentacles of this expand.

There is another component to consider. Technology tends to push the price of things to either the zero or near-zero level. Here is where we see things that use to carry a cost suddenly become available at no charge.

An example of this is long distance phone service. Today, we can interact with people all over the world at zero marginal cost. Another is the idea of paying commission on stock trades. Since people were eliminated from the process, companies could offer the service for free.

One of the keys to this is we are seeing this expand. The Internet was a boom in that it really advanced the digital world. Online activity has operated under this premise for the last couple decades. However, we are seeing this move forward.

The Impact

Let us take a look at some examples of who this spreads.

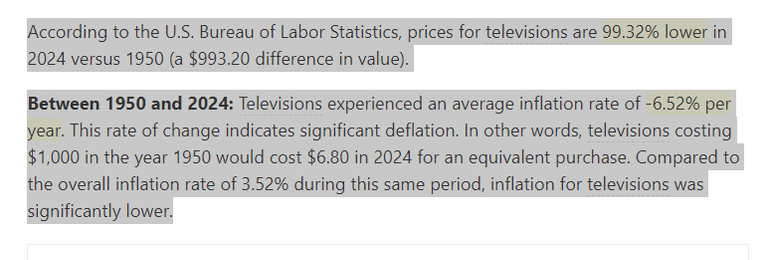

It is one thing to think about software, but what about something unrelated. Let us look at televisions.

Here is what happened in that industry:

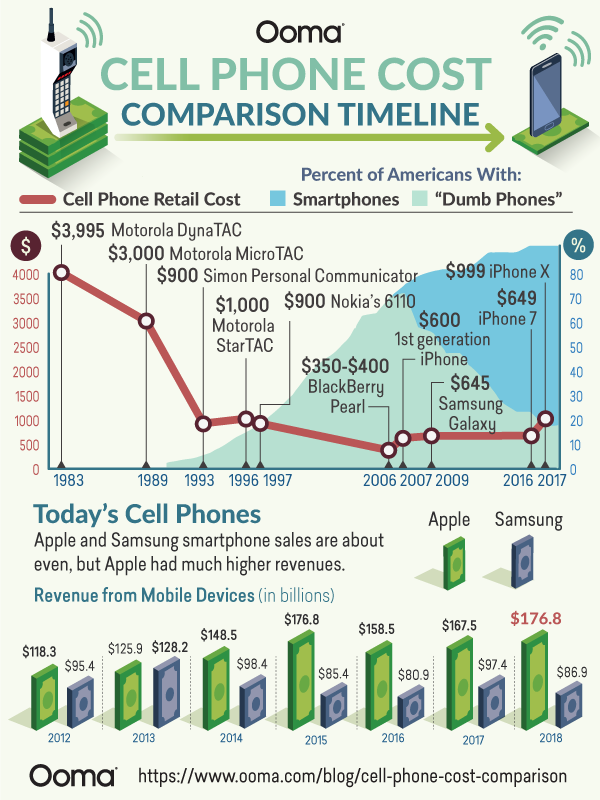

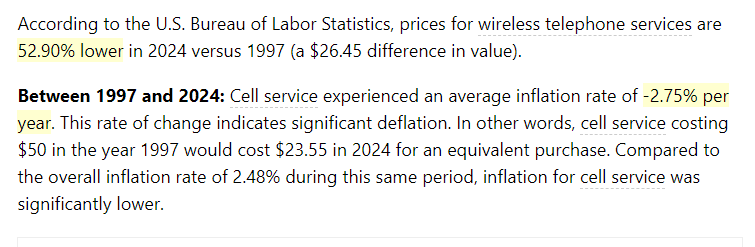

Then we have mobile phone service:

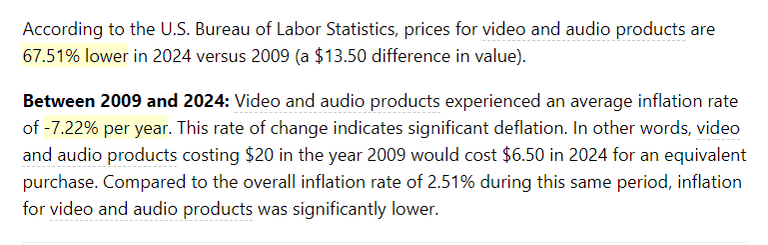

Audio/Video equipment:

Photography equipment:

None of these are online digital products. When you look at the list above, these are not things that immediately come to mind. Instead, they are real world products and services yet they still managed to see deflation over long periods of time.

This provides us with some insight into the future.

The Tentacles Are Spreading

Most do not factor in free.

For example, how many people, when discussing this topic, step back to think about what photos use to cost? Do think consider what it could take to get a set developed and to distribute to the family members?

The answer is no. Instead, they just snap photos on their phone and upload them to Instagram or whatever the preferred application is.

It is getting to the point where we do not even need to take the photo. We can have software generate it for us.

How is this a factor?

Let us consider the idea of music in films. There was a time, not long ago, when there were postings for jobs to create the music for a film. This could be everything from background music to jingles.

Those are all gone. Instead, those making films are simply having software spit out the music. This is something in the background that is not rivaling the quality of a chart topping song. Instead, we are dealing with a few chords that enhance the emotion being conveyed within a scene.

AI music seems to be good enough for this.

What does that do for the cost of the production? It has a way of decreasing it.

Obviously, this is not something major. But what happens when this spreads into healthcare, education, and construction? These are a few areas where we see massive price increases.

Much like overpopulation, the inflation equation has people looking in the wrong direction. Those who believe in a future of hyperinflation do not understand technology. When you have 7%-10% of the US economy under the laws of IT and another 10%-20% being affected by it, how is that even possible?

The answer is that, long term, it is not.

Posted Using InLeo Alpha