BUFFETT PASSES THE BATON

Let’s start with the biggest news, which came out of the annual meeting of Berkshire Hathaway .

In case you missed it, Buffett announced that he is passing the baton as CEO. He specifically said, “It’s time for Greg Abel to become CEO,” adding that the transition of power will happen at the end of the year. Well, this was something we’ve known for a while, since Abel was already Vice Chairman and had started playing a more active role in the presentations—we just didn’t know when he would officially become CEO.

But Buffett isn’t stepping away completely. So what will he do? He’s keeping his shares in Berkshire because, as he said, he BELIEVES the company will do even better with Abel at the helm. “I’m holding on to my shares because I want to remain a partner in what’s coming,” he stated.

As for the highlights from the meeting, here are a few key takeaways:

(a) Berkshire didn’t do any stock buybacks this year, due to the new 1% tax on repurchases.

(b) The investment in Japanese companies was described as “super long-term”—we’re talking 50 years or even forever.

(c) There were multiple references to artificial intelligence and how it could reshape the insurance markets in the future.

And of course, the humorous moments didn’t disappoint. From “I want to be remembered as elderly” to “it’s harder to be an operator than an investor,” Buffett once again stole the show.

STRONG LABOR MARKET

Naturally, the recent market rally was also fueled by the latest labor market news. Despite tariffs and ongoing trade tensions, the U.S. job market showed signs of RESILIENCE.

Specifically, 177,000 new jobs were added in April, compared to the 130,000 that markets had expected.

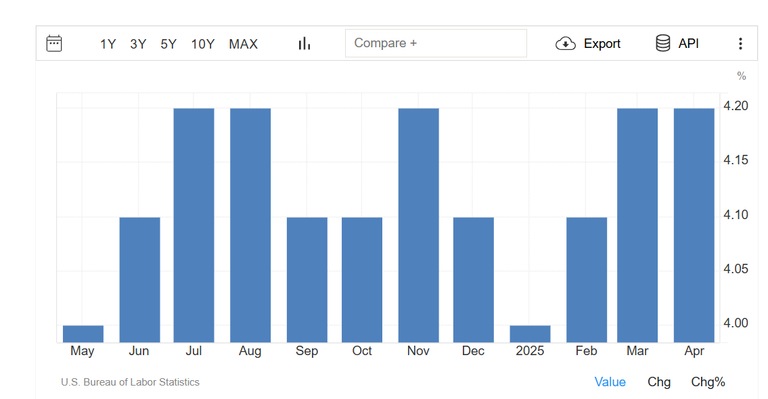

And what happened with unemployment? Unemployment remained steady at 4.2%.

Why does that matter? Because this stability in the labor market points to the resilience of the U.S. economy—even if the future remains uncertain. That means the Fed is unlikely to cut interest rates immediately, and will probably wait a bit longer.

RECORD-BREAKING STREAK ON WALL STREET

Back to the markets now.

The S&P 500, believe it or not, posted a 9-day winning streak—the longest since 2004!

Likewise, the Nasdaq and Dow Jones followed with equally impressive performances. And we’re not talking about a random uptick here: markets literally soared, shaking off even the heavy blows they had taken after Trump’s tariff announcements.

Posted Using INLEO