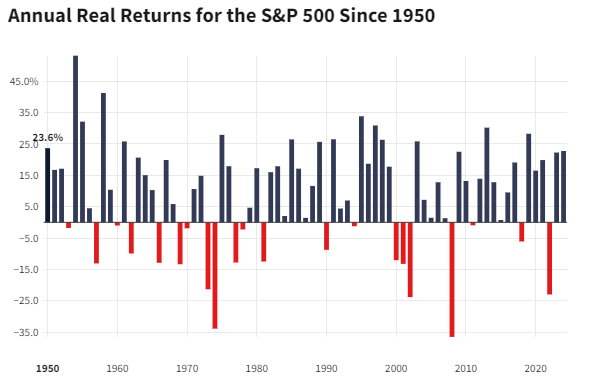

We’ve officially entered 2025, and looking back at last year, the S&P 500 delivered one of the most remarkable performances in its history. With gains of 23.3% in 2024, the index exceeded all expectations, setting new records and delivering extraordinary results ( In stock standards ).

To put it simply, the total market capitalization of the 500 largest U.S. companies grew by a staggering $10 trillion, surpassing $50 trillion!

And if that wasn’t enough, this growth followed an already strong 2023, when the market rose by more than +24%.

But what drove the markets to such heights?

2024 REVIEW

source

So, 2024 wrapped up with the S&P 500 at 5,881.63 points, marking a 23.3% rise! In fact, this is the first time since 1998 that the index has achieved back-to-back years of over 20% gains.

For the number enthusiasts like me, let’s look at some of the year’s highlights:

The index surpassed the 5,000 and 6,000 marks for the first time.

Its best streak? Two consecutive seven-day winning runs, while its longest losing streak was six days.

The lowest point was 4,682.11 on January 5th, while its peak hit 6,099.97 on December 6th.

And what about the best and worst months? Well, the best monthly performance was in November (+5.73%), while the worst drop occurred in April (-4.16%). As you can tell, 2024 was marked by plenty of volatility, but also incredible opportunities!

What Powered the 2024 Surge?

The S&P 500’s stellar 2024 performance was driven by three key factors:

(a) the Federal Reserve’s monetary policy,

(b) the tech sector’s explosion due to artificial intelligence (AI), and

(c) political developments in the U.S. Let’s dive deeper into each of these drivers.

- The Economy and FED Policy

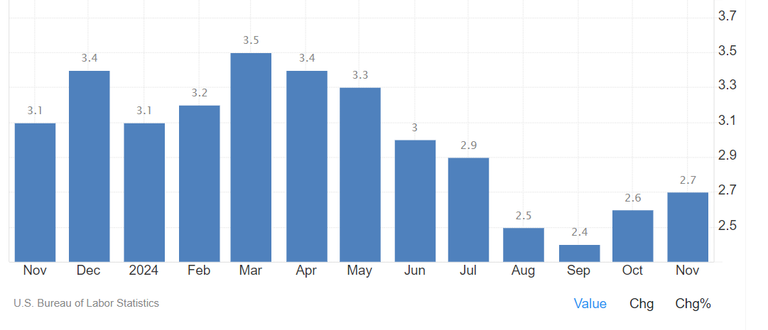

2024 marked the beginning of interest rate cuts by the Federal Reserve, providing a boost to markets. Inflation, which had been a concern in 2022 and 2023, fell significantly, nearing the 2% target by the first half of the year.

However, the second half of the year saw stagnation in the Personal Consumption Expenditures (PCE) price index, the FED’s preferred inflation measure. Meanwhile, the labor market showed signs of easing, with FED Chair Jerome Powell noting that conditions had become "looser" compared to pre-pandemic levels.

The result? Three rate cuts in total—September, November, and December—brought interest rates down by 100 basis points (1%).

- Tech and Artificial Intelligence (AI)

The tech sector was the big winner of 2024, with AI investments propelling the Magnificent 7 stocks. “Oh, Nvidia carried them all? Exactly! Nvidia , a leader in AI chip production, saw its stock soar by 178%!

This surge made Nvidia one of the world’s largest companies by market capitalization.

The rest of the Magnificent 7 also performed exceptionally well: Microsoft gained +13%, Apple +31%, Alphabet +37%, Amazon +46%, while Meta and Tesla each jumped +67%.

In short, the AI craze ushered in a new era for the tech sector, rewarding companies leading innovation. Despite high valuations raising some concerns, most analysts agreed that these firms were backed by strong profitability and genuine growth potential. So yes, folks, in case you’re wondering, this isn’t a bubble!

- Trump’s Reelection

Lastly, the most recent event that gave markets a significant push was Donald Trump’s reelection in the November presidential election, which sparked a 7% rally in the S&P 500 from election day to year’s end!

Why was Trump’s reelection so impactful? The policies supported by the Trump administration filled markets with optimism because:

(a) investors expect lower corporate taxes,

(b) deregulation is anticipated to boost business activity, and

(c) tariffs and trade policies might benefit certain sectors of the U.S. economy.

2025

2025 will be a tricky year. Everyone is expecting a correction because the S&P's numbers feel like a bubble. At the same time, U.S. companies are reporting exceptionally strong revenues and profits. In my view, we need to be cautious—speculators are lurking, ready to pounce on even the slightest bad report to pull the rug out.

Posted Using InLeo Alpha