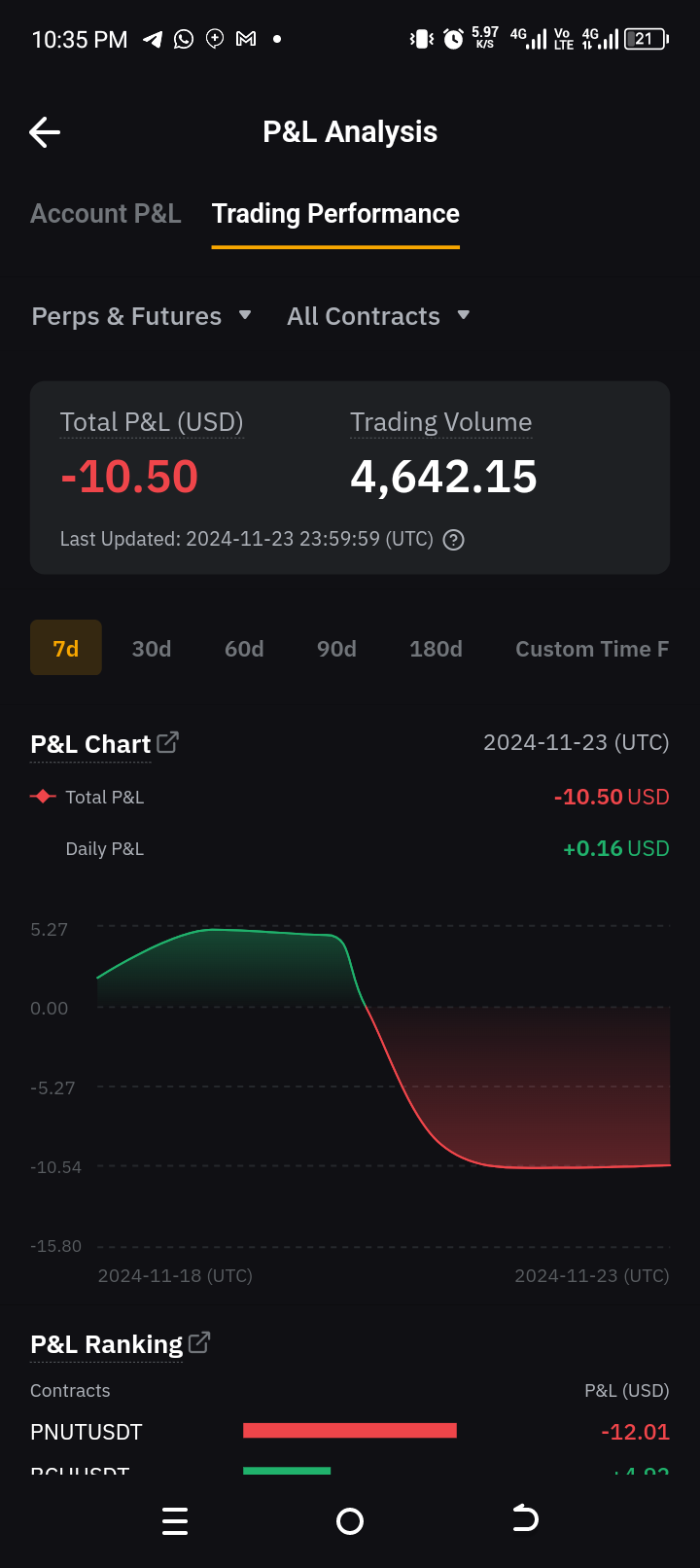

In futures trading, PnL (Profit and Loss) and profit are two related but distinct concepts which alot of persons gets confused with as they tend to used the inter changeable

PnL (Profit and Loss) PnL represents the current, unrealized gain or loss of an open future trading position. It's the difference between the current market price and the entry price of the position of an open trade

For instance

- open trade by Buy 1 futures contract at $100 base rate as the Current market price rises to : $120

- PnL: $20 (=$120 - $100)

Where as

Profit

Profit, on the other hand, represents the realized gain or loss from a closed futures position. It's the difference between the entry and exit prices of the position.

Example:

- Buy 1 futures contract at $100

- Sell 1 futures contract at $120

- Profit: $20 (=$120 - $100)

Key differences to note is : Realization: PnL is unrealized floating which the market Can still take back if the trade where to change direction , while profit is realized is already booked profit in one's account balance. Timing: PnL is calculated continuously, while profit is calculated at the time of position closure. Position status: PnL applies to open positions, while profit applies to closed positions.

Let's illustrate the difference, consider a trader who buys a futures contract at $100 and the market price rises to $120. The trader's PnL would be $20. If the trader sells the contract at $120, the profit would also be $20. However, if the market price drops to $90 before the trader sells, the PnL would be -$10, but the profit would still be $20 if the trader sells at $120.

Understanding the difference between PnL and profit is essential for effective futures trading and risk management.

So next time you see profit from the market don't forget to book some down by taking something off the market.