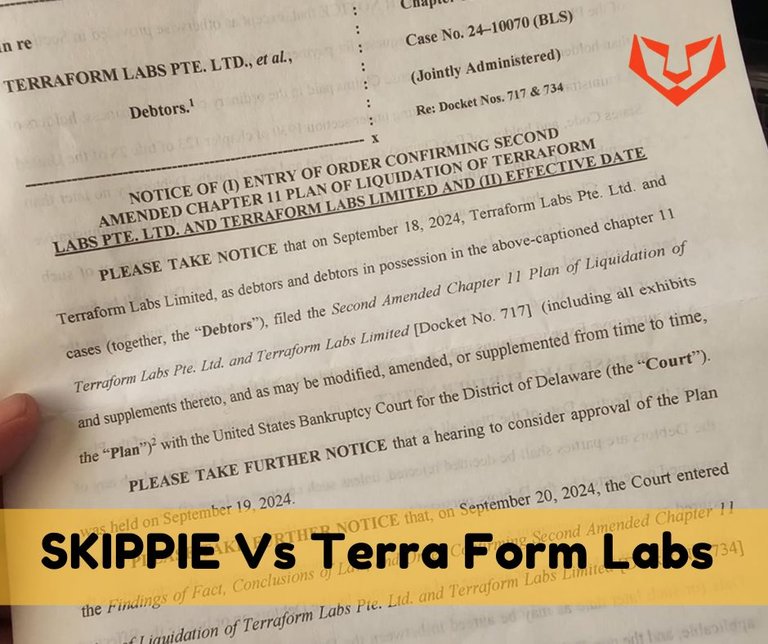

SKIPPIE Vs TerraForm Labs

Goooood day Lion's I trust you are safe and well and roaring into action! Some exciting news underway with TerraForm Labs being ordered to repay investors/purchasers and as many of you know SKIPPIE held funds in Luna. To answer many of the question's raised, yes we did apply to the bankruptcy, but being in Australia I wasn't sure if it would apply to us however it appears it does!

I'm not entirely sure how this will go down as it is quite clear the company is broke and the company has received a USD 4.4 Billion dollar fine with the U.S Securities and Exchange Commission (SEC) confirming it will not claim any funds until investors have had their money returned.

So let's all keep our fingers crossed for a fruitful settlement and we can go on with the project but as it has been so long we'll have a vote and I might just throw the cash at @raymondspeaks for a Bro boost for everyone.

But let's take a look at how things have gone so far.

The Collapse of TerraUSD and its Aftermath

Terraform Labs founded by Do Kwon saw its Terra ecosystem collapse in 2022 after its algorithmic stablecoin, TerraUSD (UST), failed to maintain its peg to the U.S. dollar. This catastrophic failure wiped out over 40 billion in market value and left countless investors grappling with losses. The event triggered a major downturn in the cryptocurrency market plunging it into a prolonged “crypto winter” that the industry is still recovering from.

The crash also exposed vulnerabilities in algorithmic stablecoins which rely on complex mechanisms rather than traditional assets to maintain their value. The collapse of UST highlighted the risks associated with this model and led to a regulatory crackdown with both U.S. and South Korean authorities targeting Terraform Labs and its CEO, Do Kwon, in multiple legal cases.

Settlement and Bankruptcy Proceedings

After nearly two years of legal turmoil Terraform Labs recently reached a settlement with the SEC. The agreement includes a massive USD 4.47 billion fine, although payment of this amount is suspended until eligible customers are reimbursed for their losses. This decision, approved by the bankruptcy court prioritizes compensation for victims over the SEC’s financial claim which is unlikely to be recouped.

The settlement coincides with Terraform Labs' Chapter 11 bankruptcy filing in a Delaware court in January 2024. The bankruptcy is intended to allow the company to wind down operations and focus on repaying creditors. Documents reveal that the company holds assets and liabilities ranging from USD 100 million to USD 500 million, with obligations to between 100 and 199 creditors (SKIPPIE being one of them). The bankruptcy court’s plan allows Terraform Labs to allocate between USD 200 million and USD 400 million to reimburse victims.

Significantly short of the USD 40 billion lost during the 2022 collapse. Nevertheless, this settlement marks a milestone in the company's attempt to resolve the financial and legal challenges stemming from the collapse.

According to Terraform Labs’ current CEO, Chris Amani the company intends to fulfill its obligations to creditors without requiring additional financing. Amani expressed optimism noting that despite the collapse, the Terra ecosystem has shown resilience and evolved in new directions since 2022. He hopes that completing the bankruptcy and settlement processes will help close this chapter of legal proceedings for Terraform Labs.

Do Kwon ongoing Legal Troubles

Do Kwon’s personal legal battles however, are far from over. The Terraform Labs founder has maintained his innocence despite being pursued by both U.S. and South Korean authorities. After fleeing South Korea following the collapse, Kwon was apprehended in Montenegro earlier this year while attempting to travel with forged documents.

This led to a complex series of extradition discussions, with both the U.S. and South Korea vying to bring Kwon back to face criminal charges.

In a twist, Montenegro’s High Court initially overturned a decision to extradite Kwon to the U.S. but later reinstated it, citing political motivations. According to Montenegro’s Minister of Justice, Andrija Milović, the decision is part of a broader diplomatic relationship with the United States with whom Montenegro is in discussions to establish a bilateral extradition agreement.

This arrangement could set a precedent for future extraditions between the two nations and strengthen Montenegro’s ties with the U.S. in matters of international law.

Kwon now faces extradition to the United States, where he will answer to charges that include fraud and securities violations, accusations he has consistently denied. The SEC and U.S. Department of Justice are expected to continue prosecuting Kwon and potentially bringing his high profile case to trial.

In another U.S. legal case, a judge ruled that Terraform Labs’ tokens, LUNA and MIA, were securities adding weight to the SEC’s allegations of securities fraud against Kwon and Terraform Labs.

The Terraform collapse had a global impact, sparking litigation and class action lawsuits beyond the United States. In Singapore, a class action suit brought by 376 victims seeks restitution for a combined loss of USD 57 million which shows the widespread devastation caused by the collapse.

These cases have brought Terraform Labs and Do Kwon into the crosshairs of regulators worldwide, raising questions about accountability in the largely unregulated crypto sector.

As countries grapple with establishing legal frameworks to prevent similar collapses, the Terraform Labs case serves as a cautionary tale. In response to cases like this regulatory agencies around the world have ramped up scrutiny of stablecoins. With a particular focus on algorithmic models like UST. Many jurisdictions are also working to clarify regulations around securities in crypto, potentially tightening oversight to prevent similar fraudulent practices.

Financial Damage but will we see our money back?

Terraform Labs’ bankruptcy and settlement with the SEC offer a measure of closure for some of the financial damages but still leave unresolved questions about regulation and accountability in the crypto industry. The Terra ecosystem’s collapse has heightened calls for stricter oversight and sparked discussions on investor protection in the largely decentralized, borderless crypto space.

While the Terra ecosystem has shown signs of resilience and adaptation the financial and reputational damage is undeniable. The court approved bankruptcy plan and Do Kwon’s potential extradition represent a legal reckoning for one of crypto’s most high profile failures that will be a core memory for so many for years to come.

image sources provided supplemented by Canva Pro Subscription. This is not financial advice and readers are advised to undertake their own research or seek professional financial services

Posted Using InLeo Alpha