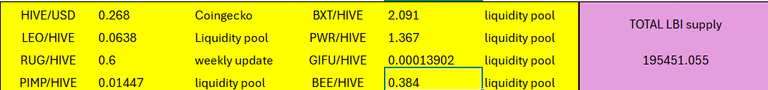

Hello and welcome to this weeks LBI Holdings and Income report. LBI is a pooled investment token based on HIVE with a range of assets backing its token. Each LBI token represents a share of the assets, and the value of that share is published daily on inleo.io as a thread. All you have to do is check our profile page to find the most recent "Asset backed Value" for the token.

LBI came under new management last year, and we are working on raising its profile, converting it into a token that shares a portion of its income each week with token holders, while also selecting investments to maximize growth. LBI's roots are firmly planted in the @spinvest ethos of "get rich slowly". We don't chase amazing returns and massive gains, we look for solid investments, long term growth and the magic of compounding.

Posting this weeks report from Peakd as images are not working currently for Inleo and I have limited time to wait. Anyway, lets see what has been happening for LBI this week.

Here is the link to last weeks update post for comparison.

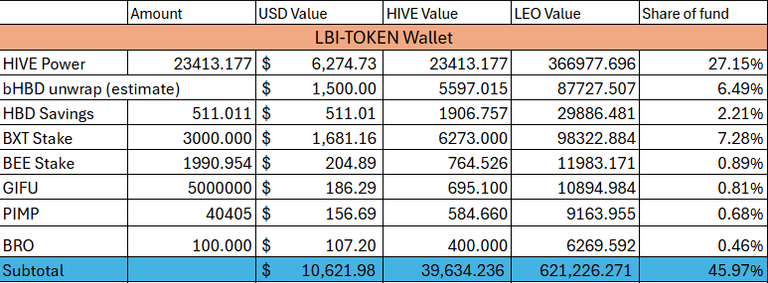

@lbi-token wallet.

A very stable week overall, we have added another 60 HP to the total this week, and a small amount of BEE. I'm hoping to start building up the HBD balance a bit now, as I have added new income streams so we are less reliant on using HBD to supplement the income distribution. The Bee stake delegation payment was missed this week - I have commented in the discord server for the project we are delegating to but not heard back yet. Our delegation lease's are adding nicely to the weekly income, which you will see below in the income report.

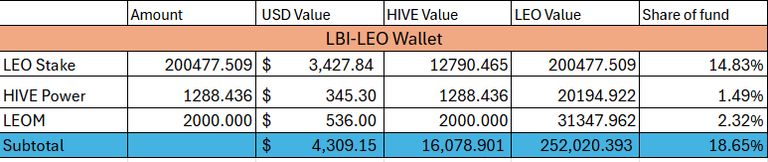

@lbi-leo wallet.

Value for this wallet is down slightly in USD, and HIVE terms, and up a bit in LEO value. Income was reliable for the week, and we staked 90 LEO over the week.

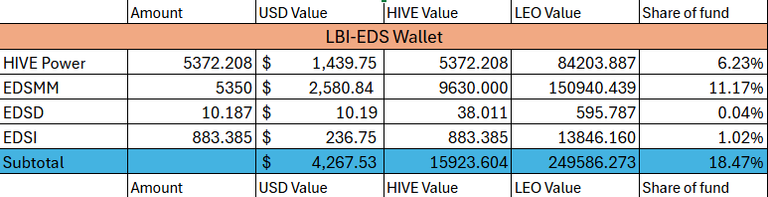

@lbi-eds wallet.

I have set a power-down for the HIVE in this wallet. A big holder of EDSI and EDSMM is selling their position to cash out for financial reasons, so I was hoping for the opportunity to pick up some EDSI and EDSMM over the coming weeks. However, the EDSI have all been bought off the market already, and a bunch of the EDSMM also. Anyway, I'll keep the power-down in place for now, and maybe get some more of these, or maybe use those funds for other wallets. Most of the HP will stay powered up for Eds-vote delegation.

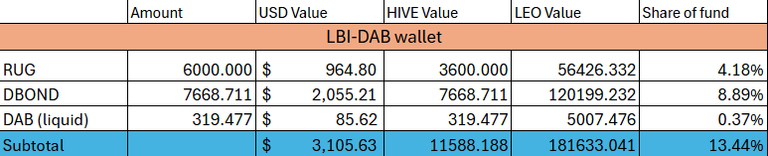

@lbi-dab wallet.

A stable week this week, we added 22 DBOND from the RUG income, and minted 22 DAB over the week. No changes to our holdings this week, and I think we will just let our DAB grow back a bit rather than sell some for more DBONDS, as the prices are not as favorable at the moment. With a large amount of DAB likely to hit the market soon, I'd like to free up some funds to boost our DAB position, depending on the price. No point overpaying when we can mint new DAB regularly, and the APR for DAB drops every week.

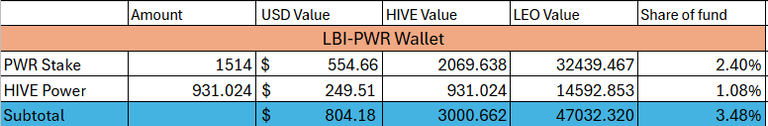

@lbi-pwr wallet.

Our smallest wallet has been our best performer this week. PWR has gained in value, and we grow this wallet each week. Slowly adding to staked PWR every day, and also adding a little HP daily. On top of that, the income that gets pulled out each day for the income wallet also adds up nicely, and helps us grow our dividends. If you are on Inleo, and would like to stay up to date with how PWR's token is performing on a daily basis, check out our daily update post with the current metrics on our Inleo profile.

Our PWR wallet grew over the week from 3% to 3.5% of the total LBI fund value - pretty impressive for one week without adding any extra funds into it.

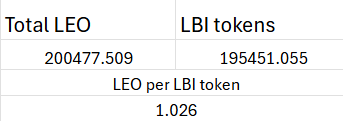

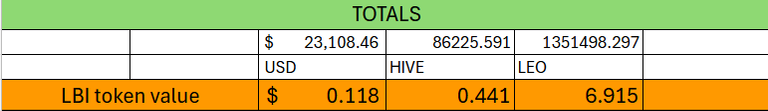

Totals

Overall, a very flat week. We finish basically where we started in terms of USD value. Down fractionally in HIVE terms, and up a bit in measured in LEO. I think we are in a decent position to push higher if the crypto gods bless us with a nice market over the rest of the year, but who knows really?

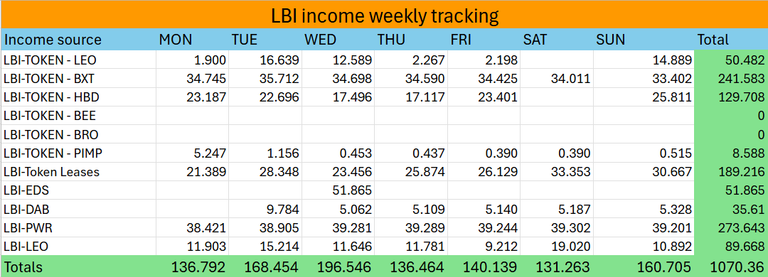

Income statement

Income is up this week, and would have been better if we had received the @bee.voter delegation payout. HP leasing has contributed well this week, with it's first full week on the books since starting it up. PWR has also been excellent, as I use 2 PWR per day for income and the value of those tokens has been strong. Thanks to these new sources of income I have been able to reduce how much HBD I use for income, so that is why it is much lower than previous weeks. I'd like to phase it out altogether for a while, to re-build the HBD balance. BRO is missing here as it come in early last week, so last weeks report had 2 BRO payments on it, and this week misses out.

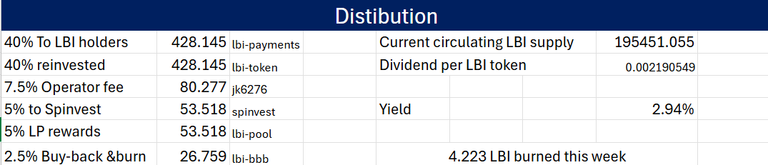

Overall, it was very nice to be able to comfortably exceed 1000 for the week, while using less HBD than previously. Next goal is 1200, but it will depend on the LEO price. If LEO goes up, it gets harder to keep income up as our mostly HIVE income converts to less LEO. We shall see what happens, but currently we are inching closer to the 3% dividend yield level, which is nice.

A nice record week for income, our highest amount of LEO paid out to LBI holders since we moved to our current format. 2.94% APR for the week, which may not seem great, but it is heading in the right direction. 4.223 LBI burned this week, and the dividend per LBI token is over 0.002 LEO. This is pleasing as it means that even the smallest holders with only 1 LBI do receive a dividend.

Conclusion.

A very pleasing week overall. Values have not moved much, but our income is growing and it feels like we have better days ahead. PWR has been strong, and all wallets are contributing as expected.

Onwards and upwards.

Thanks for checking out this weeks update post, see you all soon.

Cheers,

JK.