Hello!

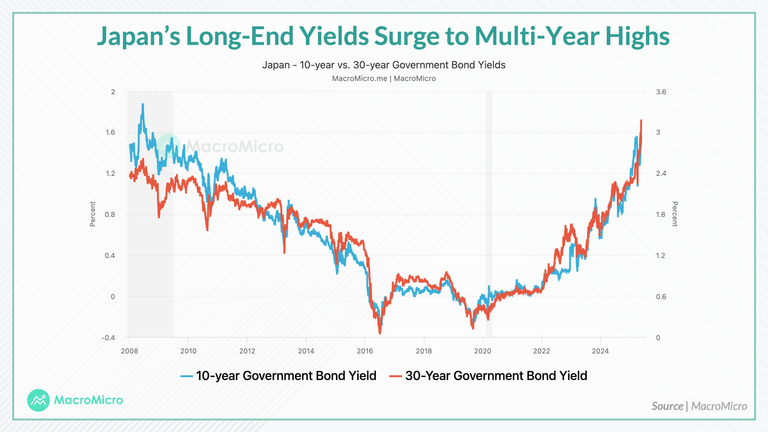

The markets are uncertain! Japan’s 30-year bond yield reached 3.16%, the highest since the global financial crisis. This is huge for an economy with more than 250% of debt to GDP ratio.

Japan is the nation with highest debt to gdp ratio, and it is at the border of a collapse.

Japan is known for low interest rates. Now, long-term borrowing costs are going up. This happened after a weak 20-year bond auction. Investors didn’t want to buy, so yields increased. Why is this important? Because this higher yields mean it costs more for the government to borrow money. This can lead to problems. Some people are comparing Japan’s situation to Greece during its debt crisis.

This will ultimately lead to higher inflation for the Japanese people. Unfortunately the poor will pay the price.

But there is another important part of the story:

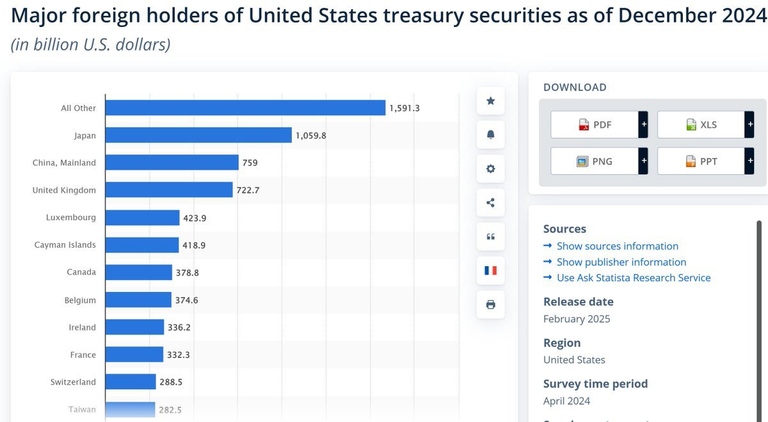

Japan holds A LOT of US Treasury bonds. If Japanese investors sell US bonds to focus on their own market, it could affect US interest rates. This is a global issue that can escalate very quickly. Translation: not good for the markets.

As you can see in the chart Japan as of December 2024 holds a lot of US Treasuries. It's the first country in the list, followed by China. If Japan starts selling this US Treasury securities things will get worse.

I'm not an expert in macroeconomics, but it always end the same way. They will print money to get out of the debt spiral, and it will inevitably end well for Bitcoin. Of course we will have a lot of turbulence and volatility during the journey but it will end well.

I hope you have a great weekend. I will spend some time with friends and family, I need some time to reset. Remember that we are in the crucial moment of the bull market, stay safe out there!

Posted Using INLEO