One of my main goals for my second year running LBI is to boost it's liquidity. One of the ongoing issues for Hive Engine based investment tokens is the "exit strategy". The asset you bought and patiently held for a while is having a good run, and you want to take profits. The order book however is very thin, and the price you could sell for is way below the "true value" of the token, that is its asset backed value. How do you exit your investment without crashing the market and loosing your gains through slippage?

Liquidity pools.

LBI/LEO

Up until recently, LBI had one liquidity pool, with our token paired with LEO. The pool itself has carried incentives in the form of LEO tokens provided from a modest portion of our income. It has served a decent job of providing some liquidity for the LBI token, but it doesn't solve the problem on its own. The pool has consistently had around 20,000 to 30,000 LEO in it paired with the equivalent value of LBI tokens. As far as trading volume goes, it has its moments but over the long run there has not been significant, fee generating volumes going through it.

Since it's inception (just under a year ago), it has seen $23,000 worth of trades go through, generating just $30 in fee income for liquidity providers. This works out at less than a percent return from fees. We incentivize the pool and that is currently paying out around 22 LEO per day, returning nearly 20% apr based on the current level of funds in the pool. In addition, LBI tokens held by Liquidity Providers (LP's) in the pool are included in our weekly dividend payout, so you don't miss that weekly dividend by providing liquidity.

If we look at the last seven days however, the pool is a bit more interesting:

You can see it has generated $3 in fee income in the last week. This works out at a bit over 3% return for LP's and makes the pool a little more interesting. I'd put the increase in volume going through the pool down to a few factors:

- LEO price surge. Leo's recent gains have made this pool more active. Arbitragers have bought LBI on the order book, sold it through the pool, and profited from the big price moves going on lately. Also, some have been selling their LBI to hold more LEO directly, or to buy LSTR instead.

- New pools, new arbitrage options. We have added new pools for LBI, firstly paired with fellow investment token BRO, then more recently with the new darling of Leo - LSTR. These pools have opened up more arbitrage opportunities and traders (particularly the arb bot runners) are enjoying the volatility.

- Maybe a little increased attention for LBI recently. Hopefully LBI is slowly getting on more people's radar as a viable investment option.

Continuing to fund this pool with 20-25 LEO per day in rewards once the current reward period ends will be a tough ask, LEO is much harder to come by now compared to when we set this reward contract up. I think an APR target of 10-15 % is more realistic.

LBI/BRO

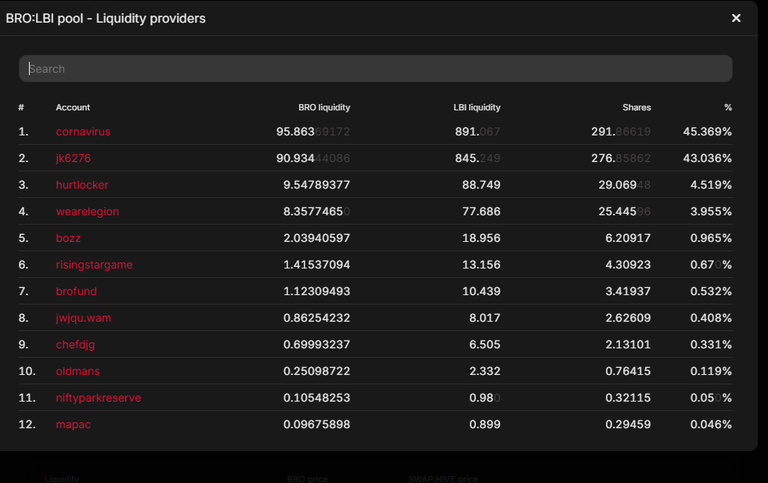

Around a week ago, in collaboration with @raymondspeaks from the BRO project, with @stickupboys doing all the actual work, a second pool was added for LBI, paired with BRO. Over the week, a bit over 200 BRO have been put in paired with around 2000 LBI. Liquidity is still low, at these levels, around $800 worth. Trading has been decent, with the fee income so far equating to 4.5% return for LP's.

The appeal of BRO for LBI is that there is some crossover in holders between the two, but also some significant divergence in styles. If you are looking for some variety in your investments, this could be an interesting pool to add liquidity to. You get BRO, which has done a good job of being highly liquid compared to many investment style tokens, and LBI with its structured, asset backed approach and significant LEO holdings.

The pool is incentivized, with some LEO rewards for LP's. Also, LBI in the pool will still count for your dividends for LBI, and I think the same is the case for BRO, although I'm not certain on that yet. So, by adding to this pool you could earn:

- LEO from LP rewards (daily)

- LEO from LBI dividends (weekly)

- HIVE from BRO dividends (weekly)

- Trading fees within the pool

Makes it a little interesting I think.

Want to give a shout out to those that have added to the pool so far. @cornavirus is one of LBI's biggest holders and has been for years, and it's nice to see @hurtlocker with a foot in the LBI door. We have seen Hurt go in heavy on BRO and become by far it's biggest holder currently - welcome to LBI. Other LBI regulars are there, along with some BRO accounts also. Thank you all.

LBI/LSTR

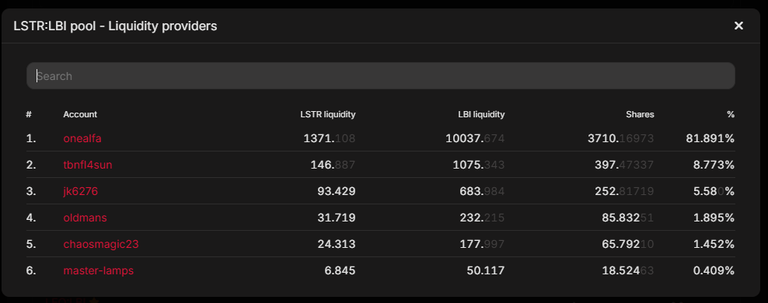

The most recent addition, an LBI/LSTR was a pretty obvious move. @leostrategy has all the attention of the LEO community at the moment, and partially this pool is a transparent move to have LBI ride on their coat-tails. But the substance behind the move is also there.

Arbitrage. This pool opens up a 3 pool arb triangle. LBI/LEO, LBI/LSTR, LSTR/LEO. I know that the bots of HIVE engine will be watching closely the price variations between these three pool, and trading volumes for our LBI pools should reflect that interest. More trading means more return for LP's.

Synergy. LBI and Leostrategy have a shared benefit of a growing LEO ecosystem. LSTR has amassed a significant capital base, and both projects have a vested interest in LEO succeeding. LBI holds a decent amount of LSTR, and it's success will benefit all LBI holders.

Alignment. LSTR has captivated the LEO community. LEO is the home base of LBI, and it is in our best interests to ensure we remain relevant to the LEO faithful. Pairing our token with the new darling of LEO makes sense from a PR and visibility standpoint for LBI, beyond the monetary benefits.

The pool has gained some solid liquidity pretty quickly, with LBI OG and LEO powerhouse @onealfa has put his entire LBI stack in there, along with a portion of his LSTR. Thank you sir. 🤝 Shoutout also to @tbnfl4sun, @oldmans, @chaosmagic23 and @master-lamps for joining in. I'll work on boosting the LEO rewards for this pool shortly.

What's next?

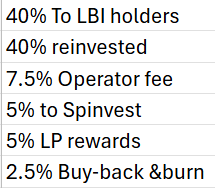

Next is to work on making these pools nice and useful. I have a little more LEO in reserve to tweak the incentives, sitting in the @lbi-pool wallet. However, we are not generating anywhere near enough income under our present distribution structure to maintain pool rewards long term. I don't personally see the pools being particularly attractive without an LP reward. I know others hold differing views, but I think liquidity needs a reward otherwise it will leave. We have no inflation to throw at pool rewards, so we have to earn the funds from revenue.

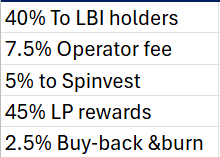

Here is our current distribution schedule:

Here is what I want to change it too:

The 40% of income being compounded into more investments was important early on in LBI's restructure. However we have significant growth baked into the project now, through EDSI, DAB, PWR and even our HP. The extra compounding funds should now be redirected into improving LBI's liquidity in my opinion. I'll wait to hear from LBI holders in the comments section how they feel about that suggestion.

Even with that we will struggle to adequately incentivize these pools long term, but it will help a lot.

I'd personally love to see a point in the future where we have these pools, nice and deep, along with others, and the majority of LBI tokens are in one pool or another. If most LBI is in pools, that makes on-boarding new investors easier and it offers a safe exit path if people want to sell their LBI one day (hopefully at a massive profit 😉 )

So...

If you hold or have an interest in some of these tokens take a look and consider if building a position in one of these pools fits your investment criteria.

If you run a HE based token and would like to pair it with LBI in a new pool, hit me up in the comments and we'll talk.

If you hold LBI and have an opinion on changing the income split, let me know.

If you have any other thoughts, or just want to drop in and say "nice post dear", feel free.

Thanks for reading, have a great weekend.

Cheers,

JK.

@jk6276 for LBI.

Posted Using INLEO