Hello and welcome to this weeks LBI Holdings and Income report. LBI is a pooled investment token based on HIVE with a range of assets backing its token. Each LBI token represents a share of the assets, and the value of that share is published daily on inleo.io as a thread. All you have to do is check our profile page to find the most recent "Asset backed Value" for the token.

LBI came under new management last year, and we are working on raising its profile, converting it into a token that shares a portion of its income each week with token holders, while also selecting investments to maximize growth. LBI's roots are firmly planted in the @spinvest ethos of "get rich slowly". We don't chase amazing returns and massive gains, we look for solid investments, long term growth and the magic of compounding.

Can you believe it is already 33 weeks since we relaunched LBI under new management. Time flies.

Anyway, on with the report - it'll be a brief one today, am crunched for time.

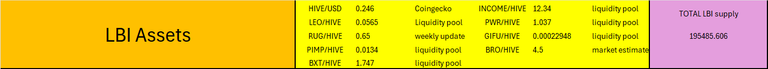

Asset prices at cutoff:

Last weeks report:

https://inleo.io/@lbi-token/lbi-weekly-holdings-and-income-report-week-32-week-ending-9-march-2025-lfm

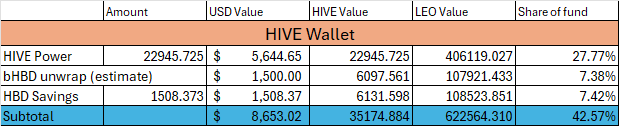

HIVE Wallet.

62 HIVE added this week. Trying to let the HBD balance grow, and use post payouts instead of unstake from savings for the daily income shift. Will see how it goes as I also pay for LEO Premium and our dividend bot from liquid HBD. Worth a try to allow our HBD balance to grow back after dipping into it a fair bit.

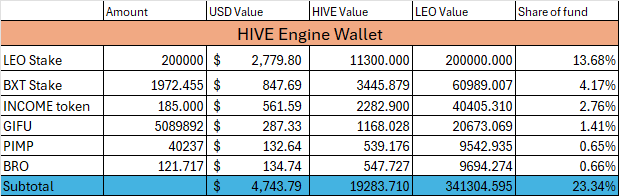

HIVE Engine wallet.

As mentioned in this post we have started an unstake for our LEO. This will be moved over to a new wallet - @lbi-leo - to build a single purpose wallet for LEO. Some may get sold for HIVE to either power up or buy miners, but the long term goal is to return to growth over time for our LEO and build up a new stand-alone wallet for all things LEO. Facts are that LEO stake yields around 4% APR from curation, while leo.voter delegation yields 12%. To boost income and growth, it is clear which path is better. I do think this is a major problem for the LEO economy, it disincentivizes holding staked LEO, while making it beneficial to sell LEO for HIVE. Pretty simply, I see a need for an overhaul to improve the financial incentives to hold LEO staked.

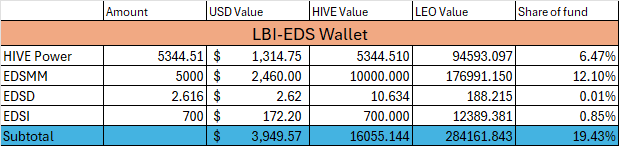

@lbi-eds wallet.

We added 20 EDSI, and a little EDSD again this week. Super reliable as always. We also add 3 HIVE Power each week just through inflation. Simple growth.

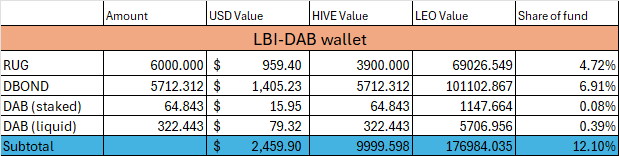

@lbi-dab wallet.

387.286 Total DAB this week, up 16.761 from last week. Nearly 28 DBOND added also, so our growth in HIVE value this week is 44.717.

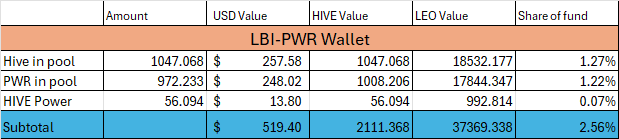

@lbi-pwr wallet.

This wallet also grows in total by 42 Hive value per week. Some gets added to the pool, and some gets powered up to build its HP. Another reliable steady performer.

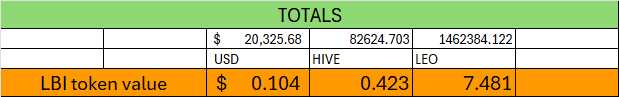

Totals.

USD value is down a little, around $500. HIVE Value drops also slightly, while LEO value is well up, around 1 LBI = 7.5 LEO now. LEO's price decline is the main factor in play here. If it turns around and tarts to increase, the our USD and HIVE values will increase, and the LEO ratio will drop.

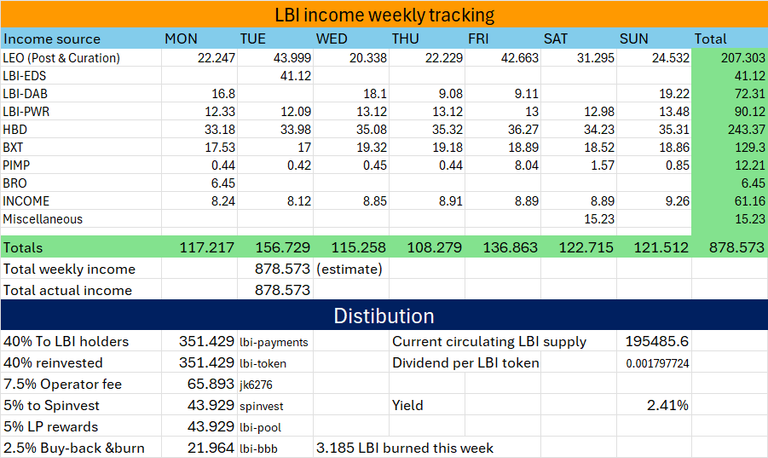

INCOME statement.

Income is up this week, with basically everything bringing in a little more. This is ok, but mainly a function of the LEO price dropping. Most of our income is HIVE, so when LEO is down that HIVE income converts into more LEO.

The dividend run has been delayed. @balaz is working on the bot, and it's not ready to go yet. I have the dividend money on hold for now in the @lbi-bbb wallet, and will send it out when I get the go ahead from Bala.

Conclusion.

A steady week this week. Everything basically doing what it is intended to do. Dividends will be paid when I can. Over the next month we will have some changes and our LEO position will be moved, and changed as mentioned above and in the post I linked earlier.

Have a great week everyone,

Cheers,

JK.

Posted Using INLEO