Hello and welcome to this weeks LBI Holdings and Income report. LBI is a pooled investment token based on HIVE with a range of assets backing its token. Each LBI token represents a share of the assets, and the value of that share is published daily on inleo.io as a thread. All you have to do is check our profile page to find the most recent "Asset backed Value" for the token.

LBI came under new management last year, and we are working on raising its profile, converting it into a token that shares a portion of its income each week with token holders, while also selecting investments to maximize growth. LBI's roots are firmly planted in the @spinvest ethos of "get rich slowly". We don't chase amazing returns and massive gains, we look for solid investments, long term growth and the magic of compounding.

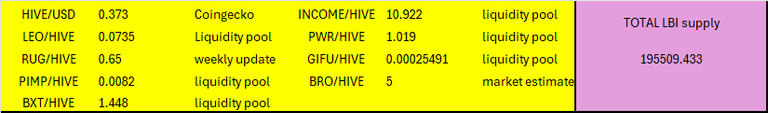

Here are the asset prices at the cutoff time for this report:

And here is the link to last weeks update for those that wish to compare:

https://inleo.io/@lbi-token/lbi-weekly-holdings-and-income-report-week-26-week-ending-26-january-2025-94i

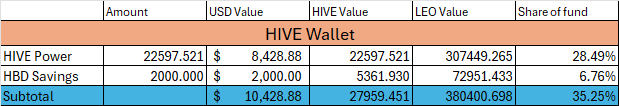

HIVE Wallet

Grew our HP by 67 this week, which is a decent week for us. No change for the HBD. I completed the small reshuffle of our delegations this week, to bring our new delegation to @gifufaithful up to 2000. Our @leo.voter delegation missed its payment for several days this week, so we missed out on some income as you will see in the income report below. HIVE has dropped over the week, and has declined a bit more since this report cutoff, so our values have taken a dip.

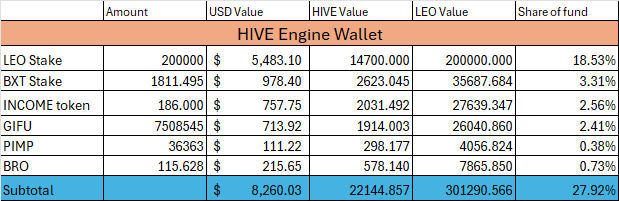

HIVE Engine

LEO has remained quite down in value and roughly around 18% of our total fund - which is way off where it was on it's last pump where it got up to 40% of our asset value. Our other asset here have been fairly stable in HIVE value overall. PIMP is down a bit, but it is a fairly small position for us. I've added more BXT this week, from some converted HBD from post payouts.

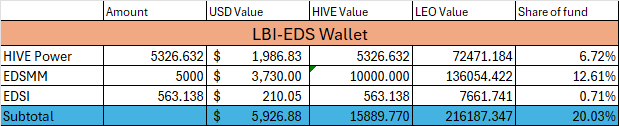

@lbi-eds

27 EDSI growth for the week. No surprises at all from this wallet, just slow and steady growth. Sitting bang on 20% of our fund.

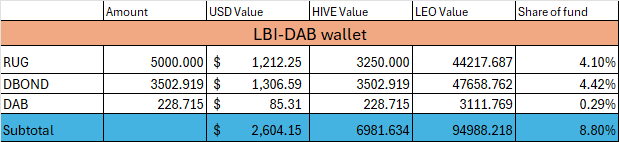

@lbi-dab

RUG minted less DBOND this week, with the yield from RUG fluctuating widely from week to week. That's ok, as in the long run it averages out to a nice yield. This week we added just under 25 DBONDS, and 9.5 DAB. No change here for now. I would low key like to find a few thousand HIVE to buy another 5000 RUG, and double our position while the RUG price is low.

How would people feel about me pulling our HBD to do so? I'm not married to the idea, it is nice to have an easy 0.8 HBD each day going straight to the income wallet, but even on a bad week RUG yields much higher so this would improve our growth rate at the short term expense of lowering income. Let me know what you think - it could be a good time to do this while HIVE is in a dip?

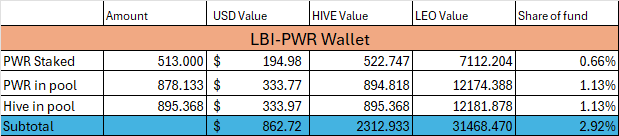

@lbi-pwr

The HIVE value is the main metric to watch here, and this week it actually fell. Last week, PWR was well over its peg, inflating the values a bit. It dropped back closer to 1 - 1 this week, so the values are more closely aligned. Anyway, the wallet is solid, it's income is reliable and the project is top-notch. Another wallet I'd love to get more HIVE into to build it bigger.

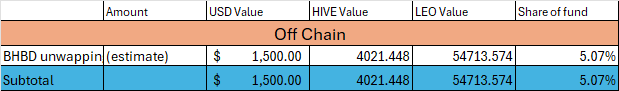

Off-chain.

Have not heard anything this week. No news sorry.

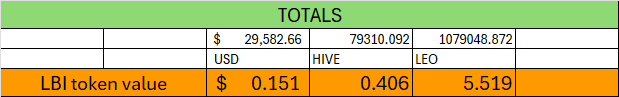

Totals

We see our USD value decline a couple thousand dollars over the week. Unsurprising with HIVE dropping from 0.417 to 0.373 USD over the week. Disappointed to dip below $30,000 in total fund value, but not much we can do about it. Hopefully things turn around for HIVE and it returns to higher levels.

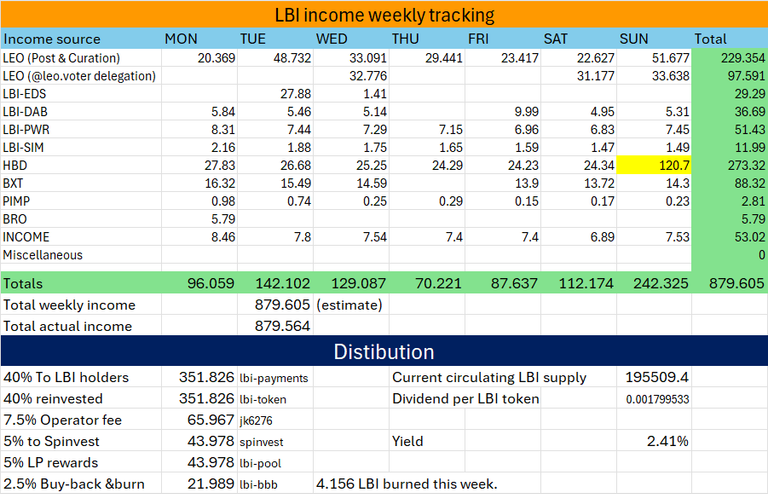

INCOME statement

4 missed payouts from @leo.voter for the week hurt our income total. I did sell a little HBD from post payouts to compensate for this, and get us to a solid total for the week. Ended up distributing 879 LEO for the week through the income split. This resulted in a yield for token holders of 2.41% - up a bit on last week and trending higher. This will fluctuate depending on the LEO/HIVE ratio, as alot of our income comes from non-LEO sources. This week, 37% of our income comes from LEO, and 63% is HIVE based (or HBD) income.

Overall yield is slowly trending higher, and the 1000 LEO per week income distribution is in sight.

4.156 LBI burned for the week, which is about average. This amount is also dependent on the price of LBI in the liquidity pool, and currently it is nicely around the LEO asset value of the token.

Conclusion.

Overall, a nice steady week. Income is trending upwards, which we like to see. All our growth assets are just doing their thing, and while price fluctuations alter values from week to week, we gain in assets every week.

Have a great week everyone.

Cheers,

JK.

Posted Using INLEO