Everyone okay out there? Are you sure? It's been a heck of a week hasn't it? I was commenting on a post from @tarazkp just the other day that I feel like we are all just NPCs (Non-Player Characters) in a video game right now. We have these fixed rules that we have to adhere to and can't move outside of that role. Meanwhile the rich folks in the world are the actual players of the game and they have free reign of the open world to earn, exploit, and hunt at will.

It's kind of a terrifying thought isn't it?

It is time again for another Finance Friday/Friday Finance. This is a series I started where I talk about random bits of financial stuff that I have seen, gathered, or experienced during the week. I hope as a reader you find it informational, entertaining, or both. I also hope it can generate some good discussion and edify the community.

—-----------------

I've been tempted to look at my traditional investments this week, but I know that probably isn't the best idea. I've said this before, but I am pretty lucky to have a decent paying full time job for the area of the country I live in. Move to one of the coasts and it would be considered a pittance, but here in middle America, it pays the bills. One of the cool things about having that steady paycheck is I can set up a regular pull from that paycheck to go into my investments before taxes.

So technically, I've been DCA'ing for decades now. It doesn't matter if the housing market crashes, COVID hits, or politicians play games with the markets, I just keep buying my regular allotment of mutual funds twenty six times a year.

Land Transformation

I'll be the first to admit, I don't read all the release notes that come out for @splinterlands anymore. I'm more of a wait and see and then figure it out sort of guy. I know there are a lot of people who had early strategies for land and everything planned out about how they were going to make money. That's not me. As I said, I decided to take a more hands on approach and learn as I go.

You can imagine it came as a shock to me the other day (a couple weeks after the wood/iron/stone rollout) when one of my grain producing lands was suddenly "transformed" to a wood producing land. My biggest grain producing land to be exact. I reached out to @slobberchops with a great big WTF, and he graciously explained that was all part of the system.

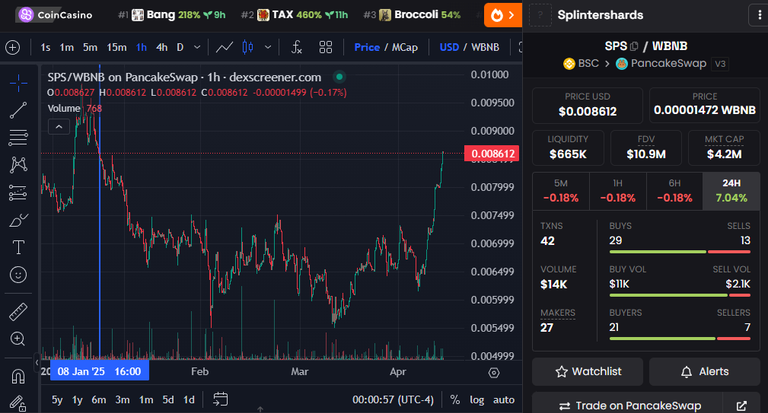

That's what I get for not RTFM I guess. It sucks though because now I am likely going to be at a grain deficit and with none of my other six lands producing anything but (just enough) grain, and wood (which the price sucks on), I am likely not going to be able to do anything with my lands in the future.

I was really excited about the possibility of enhancing some of my cards one day, but I feel like that is a pipe dream now. I don't want to say I am going to get out, but it's starting to look like I will have little choice.

Meanwhile it appears my validator node has dropped down to 66th place but I have still only missed 3 blocks this whole time. Thanks @monstermarket for hosting that!

HIVE

As you might have notice, there is a lot going on with HIVE lately. There have been some really good though heated discussions about delegations and voting and all sorts of other things. While I know some of you consider HIVE your primary source of income, it's important to remember not to take all of this too personally. In the grand scheme of things, there are other way more important things to be worried about than a relatively small social blockchain. Don't get me wrong, I love HIVE, but perspective is important.

That being said, I'm actually impressed about how well the price of HIVE has been holding steady despite the rollercoaster the other markets have been on and this recent division on the chain. I was hoping to pick some more HIVE up at .18, but now I am not sure it is going to fall that far.

I may need to readjust my buy points.

Precious Metals

I was looking at my precious metal stocks this morning because I was alert that Kinross Gold is up 7.4% in overnight trading. Meanwhile I have also been getting alerts about my Fortuna Silver Mines stock as well. It would seem precious metals may have taken a bit of a hit and are starting to recover. Still nothing close to the big swings we are seeing in the traditional and crypto markets. That seems to be about par for the course.

I haven't been involved in precious metals for very long, but based on what I am hearing from the seasoned experts, that definitely tracks and it's part of the reason so many people use precious metals as a safe haven for their investments. With the recent dip in the price of silver down around the $37 to $38 mark I have been considering visiting my local bullion store to see if I can snag any nice piece near spot price. We will see if that actually happens though. I might just buy online and pay the shipping cost...

I'll have to look at my budget!

Looking Forward

I remember around this time last cycle I had already taken some relatively large gains from my NFT dabbling and I was waiting for $100K BTC to come around so I could take some more. As we know, that second part never happened and I was left holding the bag. It's a bit unnerving to compare this cycle to last one. There are still a whole lot of unknowns, but still a lot of months left in 2025. I hope we still get to see that face melting bull run that everyone was hoping for, but if we don't, you better believe I will still be here blogging away about my generic life and other random ramblings!

Sports Talk Social - @bozz.sports