I had an interesting conversation today with a long time 'internet friend', someone who I have chatted with cordially many times and for now will not be named. For their own reasons, they are getting out of some tokens, and this includes some of the tokens that I run, so as we have been quite conversational in the past, they reached out to me, which I do recommend, especially to 'members' (holders) of my tokens.

I consider my token holders as members, and deem it as somewhat of a (fun) responsibility to help them, and this is even somewhat of a mission statement when it comes to INCOME, as the fund motto is 'synergy'.

And so I found myself explaining a few things, and I thought this could be of interest to all the people who follow me, so here we go with this post.

INCOME token

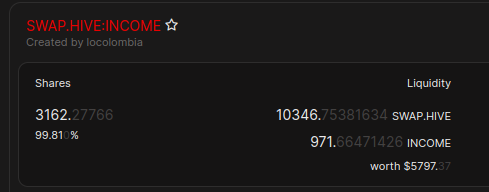

INCOME token, as the longer standing of our two 'main' projects, has a pool with a nice amount of "corporate" liquidity in it. It was designed to help investors get both in and out. Likely, it will 'always' have the best price both ways, especially for small quantities.

So use the pool!

Although I 'make money' when you dump to me on the market below NAV, it doesn't make me happy. It makes me want to send you the link to the pool (above).

ECOBANK

Now we come to ECOBANK, the project is much newer, and instead of being backed up by digital assets, its backed up by physical assets. Here is a bit of ramble inspired by this person's desire to know the best way to unload ECOBANK tokens:

ECOBANK is the trickier of the two.... The spread is awful, there is no pool. The main reason, as far as I can tell, is that ECOBANK is properly priced in dollars (not HIVE), and HIVE is very cheap. New mints for ECOBANK are set to $1.65, let's call it 5 HIVE for this example.

We might hope to raise this year the NAV of ECOBANK to $2 or more (there are some good 'real estate' things possibly coming up this year for the fund) - and this would be pretty darn good, and make us feel good. But if we anticipate HIVE to go to $1 or more, the price of ECOBANK in HIVE is anticipated to fall below 2 HIVE; when priced in HIVE we can hope to lose 60% or more due to 'opportunity cost'.

The largest local partner is frequently asking me to sell some tokens for money. I have managed it before, but mostly its me buying from him. One time, I listed at $1.10, the original pre-sale price, and due to a HIVE dip in price, they fell to about 85-90 cents, and @jelly13 bought them all, a few thousand. I assume he took fiat and just used HIVE as a passthrough. For an investor calculating in fiat, this might make a lot of sense (to get the aforementioned 'opportunity cost/loss' out of our minds)

But this is the largest current problem with ECOBANK, you need to use (read: believe in) HIVE to even know how to participate in ECOBANK and, Who among that select group will elect such a steep (perceived) opportunity cost/loss?

I honestly have been quite perplexed by this.

Our hope is to sell one of our current properties and buy another. If/when this happens, we will have some surplus which we can dedicate to buying HIVE. Buying HIVE can be a marketing expense that we can write against profits made on flipping the property.

To keep this as short as possible, it is on my short list of ideas to enact some sort of buyback 'fund' with this money, or interest earned on this money. Because [as I mentioned previously in the conversation] I really believe that it is important for people to move in and out of a project. And not just for people, for me too! I am the largest investor in ECOBANK and have a ridiculous amount of my own money tied up in this token - I couldn't even cash out enough for a hamburger if I wanted to the way things stand 🙈

Now, we pre-sold these ECOBANK when HIVE was much more expensive. So far so good, in terms of investors on paper 'results'. The perceived opportunity costs have not come about yet, they may never come about. The whole perplexing case is based on some guess about the uncertain future, that (everyone?) seems to believe that HIVE will be more expensive sometime in the future.

/rant

So, there are three things you can do, and I guess they are in some sort of order of operations:

- Use the market order books to list the tokens. Pre-sale was $1.10 - current book value of assets at last calculation was $1.65/token. Use this as your measuring stick. Don't hold your breath.

- Hope HIVE goes up in value (🤣)

- Know that "soon" (this is real estate soon, not crypto soon) it is our intention to establish a buyback fund because we recognize this problem.

- (Bonus) Keep in touch with me along the way.

Parallel to that, we have been producing spanish content to get Colombians who are interested in ECOBANK (there are seemingly many) the information they need to actually buy some. So if you have orders up, if this ever happens (ie if we manage to get through the 'onboarding' challenges) they may get scooped up. Remember that orders expire after 30 days, and HIVE price changes affect the realized USD price of your token sales/listings.

This is a problem, in fact it was a problem for INCOME before we made the pool, and its a common problem for many tokens, even (especially?) for tokens not backed by anything. In some far flung future, I would like to get an ECOBANK pool. We will see how it all plays out, no use talking about plans further out than 'the next steps', and no use making a pool while there is no liquidity to put in it.

Another thought I have is about that 'soon' phrase. When I assume that 'real estate' soon is not as fast as 'crypto' soon, I am probably ignoring the fact that the meme around "soon" in crypto means not soon at all. I wish some things would move faster as well, I'm not super sure what to do about that other than keep trying.

I hope you found this content interesting, perhaps learned something, let me know all about it in the comments.