Robinhood is deepening its commitment to the crypto sector by announcing a $179 million acquisition of WonderFi Technologies, a Canadian company that operates regulated digital asset platforms. The all-cash deal, equivalent to around 250 million Canadian dollars, is set to strengthen Robinhood’s presence in the Canadian market and enhance its international growth trajectory.

WonderFi owns Bitbuy and Coinsquare, two of the country’s most prominent cryptocurrency exchanges. Together, they recorded over CAD 3.5 billion in trading volume in 2024. The acquisition will allow Robinhood to tap into a broader base of crypto users and increase its exposure to regulated markets outside the U.S.

Under the agreement, Robinhood will absorb WonderFi’s team, expanding its Canadian workforce, which already includes more than 140 employees. The acquisition fits Robinhood's larger vision of evolving beyond stock trading and becoming a more comprehensive financial services provider.

WonderFi shareholders are expected to vote on the proposal in the coming months, and the deal still requires approval from Canadian regulators and courts. If cleared, the transaction is anticipated to close in the latter half of 2025.

The move follows a broader trend of consolidation in the digital asset industry, with other recent headline acquisitions including Coinbase’s $2.9 billion takeover of Deribit and Ripple’s purchase of Hidden Road for $1.25 billion.

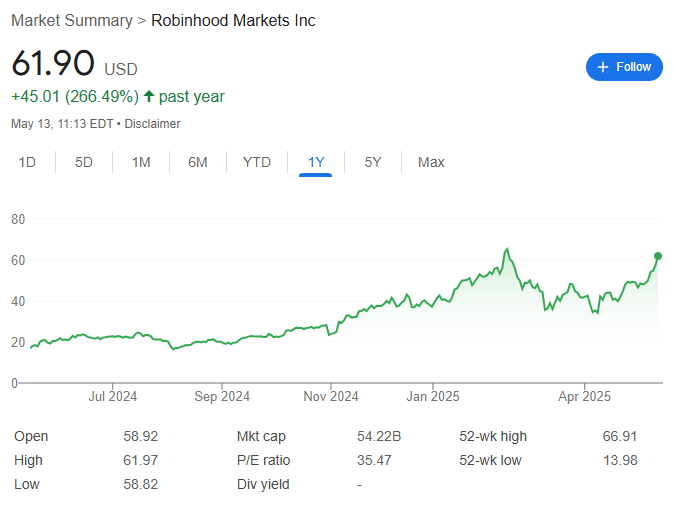

Robinhood shares have seen a strong performance in 2025, gaining more than 50% year-to-date as the company broadens its offerings and investor base.

What impact do you think Robinhood’s acquisition of WonderFi will have on Canada’s crypto landscape and regulatory environment?