A significant number of European investment portfolios marketed as environmentally responsible have been found to hold sizable stakes in the fossil fuel industry, casting doubt on the credibility of sustainable finance in the EU.

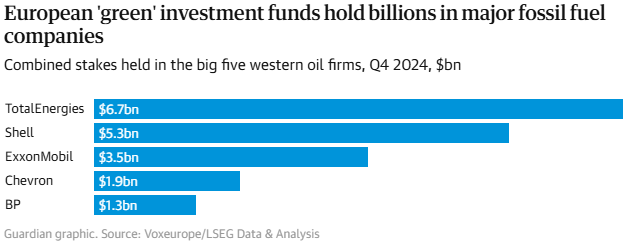

According to new research, funds that are labeled or promoted as climate-conscious or environmentally sustainable are collectively invested in more than $33 billion worth of shares in oil and gas corporations. These include some of the world’s most polluting firms, such as Shell, BP, ExxonMobil, Chevron, and TotalEnergies. These five oil majors alone make up more than half of the total fossil fuel exposure in the funds analyzed.

In some cases, the funds carry names that evoke strong green credentials—terms like “sustainable,” “climate,” or “low carbon” are common in branding. Yet behind these labels lie investments in companies that remain heavily reliant on oil and gas extraction. Beyond the big five, these funds also include holdings in firms such as Devon Energy, a major player in U.S. shale oil production, and Suncor Energy, which is known for its involvement in the environmentally destructive Canadian tar sands industry.

These investments are not technically illegal or even necessarily in violation of current European regulations. The portfolios in question have been disclosed under the EU’s Sustainable Finance Disclosure Regulation (SFDR), which was introduced to improve transparency around sustainability claims in the financial sector. However, critics argue that the rules are too lenient and leave ample room for greenwashing—a marketing tactic where products or services are made to appear more environmentally friendly than they really are.

Major global financial players, including JP Morgan, BlackRock, and Germany's DWS Group, are among those whose funds contain significant fossil fuel exposure despite being classified under SFDR Article 8 or Article 9. These articles are supposed to indicate that a fund promotes environmental or social objectives, or in some cases, pursues them as core goals. But under current rules, there are no hard restrictions on investing in high-carbon sectors—even for funds that carry these sustainability labels.

In response to increasing pressure from climate advocates and transparency watchdogs, the European Securities and Markets Authority (ESMA) issued new guidelines in 2024 aimed at tightening fund labeling standards. These guidelines discourage the use of ESG-related terms—like “green,” “climate,” or “sustainable”—unless at least 80% of a fund’s assets are aligned with specific sustainability objectives. However, these rules are non-binding and won’t take effect until late May 2025, leaving significant uncertainty about their impact.

Anticipating these changes, some asset managers have already begun quietly rebranding funds or stripping “green” language from their marketing materials. For instance, BlackRock and Robeco have reportedly adjusted fund names to better align with the upcoming criteria. Still, environmental groups argue that more decisive action is needed.

Organizations such as Reclaim Finance and Transport & Environment are calling for much stronger safeguards. They propose banning fossil fuel investments entirely from funds that are sold under ESG labels. Without such measures, they warn, investors—many of whom are trying to align their money with their values—will continue to be misled by misleading marketing.

The revelations also raise broader questions about the effectiveness of Europe’s regulatory framework on sustainable finance. If funds can include major fossil fuel players and still be marketed as climate-friendly, critics say, then the entire premise of ethical investing is at risk of becoming a façade.

As the EU prepares to enforce stricter standards, all eyes are now on regulators to determine whether they will follow through with meaningful reforms—or allow the status quo to continue under a greener guise.

Is the current EU regulation (SFDR) doing more harm than good by allowing greenwashing under official sustainability labels?