It's been a while since I checked my CIBIL report. For those who don't know what this CIBIL report is, I would like to mention that it contains everyone's credit history, which is tracked through the PAN number in India. It shows how many credit cards and loan accounts you have and a score is issued to every individual. This score varies between 300 to 900 whereas the score above seven hundred is considered very good. When anyone applies for a credit product including a loan or credit card, the bank or financial institution checks the civil report to determine eligibility. This applies only to India and I am not sure what mechanism other countries follow but in India, it is one of the important reports and if the score is not good in the sport then it is hard for anyone to get such credit products from the banks.

I am very particular about it and there was a time when I used to check it frequently to see how things were going. Now it's meanwhile when I checked my report last time and now onwards I will try to keep a tab on this. Many portals are providing this report for free however there is also an option to get a detailed report that is chargeable but even a free one is good enough to see how is it going. I prefer using https://www.paisabazaar.com/ which is easy to use and provides adequate details and as they mentioned its available for free. I use it because they don't call to sell their products but many others do because they get the mobile number.

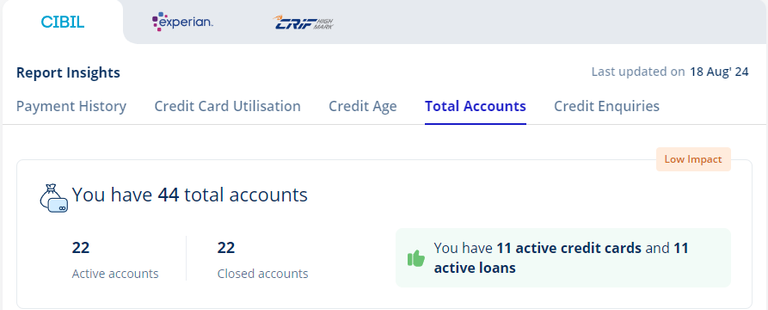

I have many credit cards from different banks and to be honest I don't even remember the count. This report shows it all that I have 22 active accounts and this includes 11 credit cards and 11 loans. Cards count is correct 11 loans are not there and there is a catch. In India there is a product called BNPL (Buy now pay later) and since its a credit product with some limit hence this is considered it a loan account and there is no EMI for that in place. In that case, I don't have 11 loans but yeah, there are a few.

Today I am more focused on credit cards and it says that I have 11 active credit cards so I went through into details to see what cards I have not used in the last 6 months. I use different cards for different purposes and it's helpful. I'm very particular about repaying the outstanding credit card and I make sure that it is paid before the due date. I have never paid any late payment penalty or interest on the outstanding and for that purpose, I use an application called CRED that helps me to track all my cards in one place.

I think that this is the area where I need to pay more attention and now I am going to do it to see what are credit cards that I have not used in the last six months and if its better to close them. After going through in details I figured out that there are two cards that I haven't used in the last six months and I don't feel the need to use these cards anymore because they do not offer any extraordinary benefit. I have already emailed the bank for the cards closer and I hope that they should be done in the next couple of days. Now because I have already placed the request for two cards closer hence in the next quarter I will have 9 active credit cards instead of 11. This data is updated every month so most probably I am going to have 9 active cards in the next month's report.

A credit card is a useful product provided we use it properly and it's not free money hence we need to understand that if we use it for unnecessary expenses then it might be a problem when paying back. I never use credit cards for unnecessary expenses and even I prefer to have credit cards that come with no annual or renewal fees however I have a couple of cards with annual charges. But since they offer some option through which I can get the fee waiver and I achieve it every year. I prefer using credit cards for all the online payments because it is easy and helpful and when I have the option to pay the money through the bank then why should I use my bank account for this? On top of this, I also earn some reward points which is an added benefit.

Now onwards I will be trying to track this report closely and see how things are going because now I am trying to manage my finances better by reducing the number of cards. Even I am making prepayment for some of my loan accounts so I hope that in the next few years, there will be a reduction on my loans as well. I know that liability is never good but sometimes it is needed to do something big because we don't have that much money with us and that is when loans are helpful to get things done and for that, we need to pay the EMI. I never take loans for expenses instead I take them when I am investing in something which can be real estate in most cases.

Thank you

Posted Using InLeo Alpha