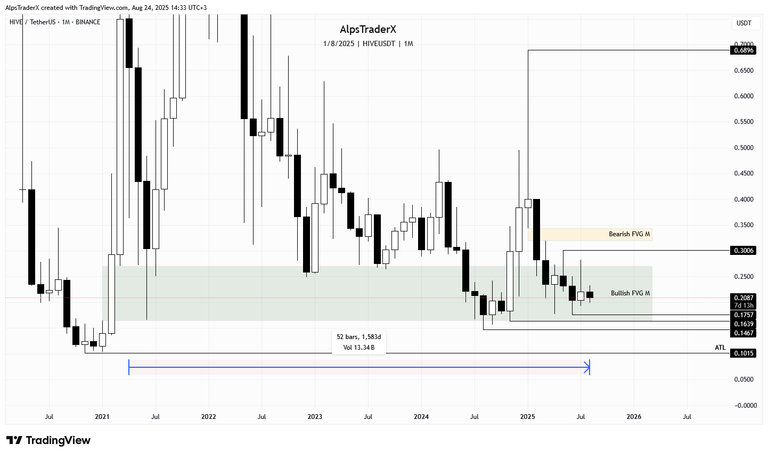

Things are changing in the crypto world, so being Sunday, here I am with another analysis, as usual. Let's see what our assets have been doing lately.

Compared to last week, the monthly chart shoes a bearish candle, which is not closed yet, so we need to wait another week to know what kind of candle we're closing the month with. Previous monthly analysis is still valid, so check my previous posts.

On the weekly chart, price swept liquidity from the $0.2049 level, which was the swing low last week and bounced off. There are still 12h to go till the candle close, but once closed, it confirms $0.2327 as a swing high, the nest to target if price decided to reverse here. If we don't get a reversal and the weakness continues, I'm looking at $0.1757 to be swept.

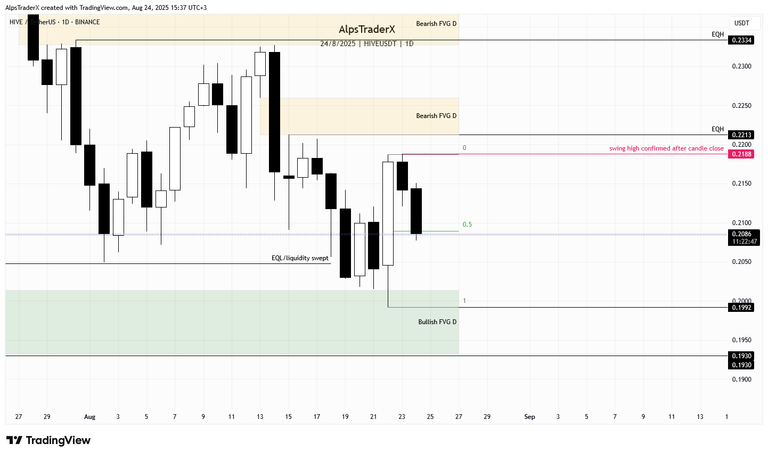

Since last week, price swept liquidity from the equal lows at $0.2048 on the daily time frame, dipped into the bullish fair value gap (FVG) marked with green on my chart, on Friday. After that, we had an expansion, caused by Fed Chair Jerome Powell announcing Federal Reserve will lower interest rates in September. This was on Friday, after which we had a bearish candle on Saturday and today's candle, although it's not closed yet, is bearish. Being Sunday, we can't expect much as there's no catalyst to move price and after such an expansion it's normal to see a small correction.

At the time of writing, price is slightly below mid-range, so we don't have a clear direction about where it wants to go yet. If the weakness continues, $0.1992 is the swing low I'd look to be swept, or even lower, $0.193 is the next one on the downside.

After the current candle close, which is going to happen in a little more than 11 hours, $0.2188 is going to be confirmed as swing high and will be my upside target level to be swept in case price reverses.

Zooming out (a bit), even though I don't trade trendlines, you can see $HIVE broke out on Friday and it is retesting it as we speak, on the h4 time frame.

Zooming in a little, you can see that the Friday move left two gaps on the way up, which means internal liquidity and are rebalanced at some point. The upper one has already been rebalanced and inverted too as could not defend price. The other one is half rebalanced, but we don't see a bullish reaction yet. Price also touched the trendline at this level and it is at mid-range.

This is a crucial level for price to hold. In case this gap can't defend price, $0.1992 is next on the downside.

In case we get a bounce, $0.2151 is next on the upside, but first comes the bearish gap, marked with yellow, which acts as resistance. So first invert the gap, which means close above it and hold, then $0.2151 and ultimately $0.2188 is next.

We're going to know more on Monday. Maybe wait for Monday high and low to be formed.

$BTC is at an important level as well, on the daily time frame. It is back inside the bullish gap that has been holding price for 43 days now. It has been rebalanced, then retested, and price is back again, on its way to retest the OB.

If we don't get a bounce off the OB, $111,618 could be next.

We have an inside bar pattern formed on the daily time frame, not that I trade patterns, but it shows where price is at the moment. It's about to retest the low of the inside bar low.

ETH/BTC Price has swept both highs, 0.039543 (EQH) and 0.041135, which I mentioned in my previous analysis.

The expansion we had on Friday, left a bullish gap, which has not been retested yet. I'm not saying it's going to be rebalanced these days, price could hoot up without looking back, but it's a possibility. On the upside the immediate level to be swept is 0.041782, after which comes 0.046121. In case the gap can't hold price, 0.036068 is the downside target.

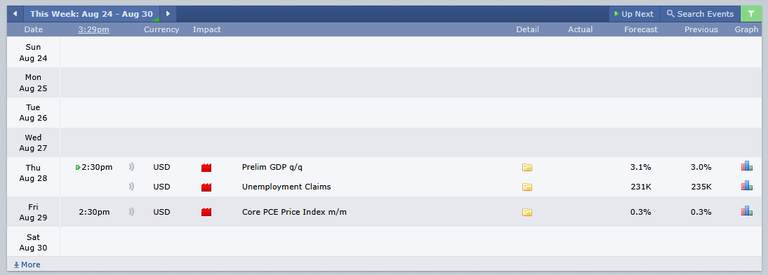

Next week we only have 2 red folder days, so volatility may not be as it is with a full week, but that doesn't mean red folder news are the only catalysts to move the market.

I started using Snaps, so if you're interested, you can check my Snaps as I'm dropping updates if there's anything significant to speak about.

Remember, technical analysis is not about forecasting price, but about reacting to what price does.

As always, this is a game of probabilities, not certainties. Also please note, this is not financial advice, it's my view and understanding of the market.

All charts posted here are screenshots from Tradinview.

Come trade with me on Bybit.

If you're a newbie, you may want to check out these guides:

- Communities Explained - Newbie Guide

- Cross Posting And Reposting Explained, Using PeakD

- Hive Is Not For Me

- How To Pump Your Reputation Fast - Newbie Guide

- Tips And Tricks & Useful Hive Tools For Newbies

- More Useful Tools On Hive - Newbie Guide

- Community List And Why It Is Important To Post In The Right Community

- Witnesses And Proposals Explained - Newbie Guide

- To Stake, Or Not To Stake - Newbie Guide

- Tags And Tagging - Newbie Guide

- Newbie Expectations And Reality

- About Dust Vote And Hive Reward Pool, by libertycrypto27