Today I'm back to my usual routine, posting my TA on Sunday, to be ready on Monday and know what to expect, although Monday is not really a trading day, except if you're scalping on very low time frames. It's better to wait for Monday low and high to be printed, then trade accordingly, but then again, each to their own.

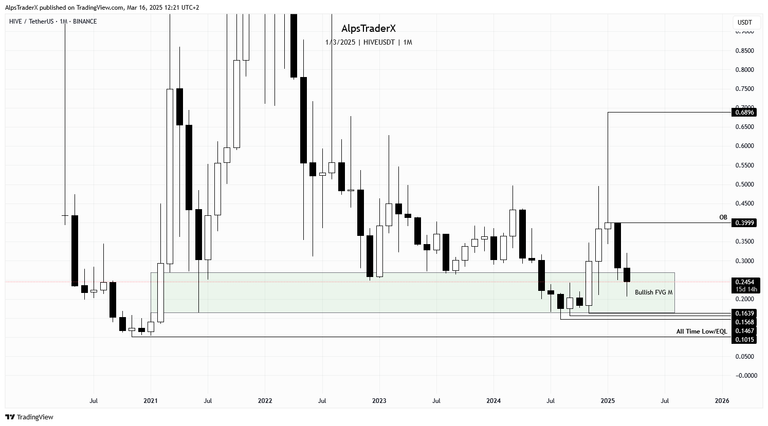

Comparing the monthly chart to last week's status, price went deeper into the bullish gap. We're halfway through the month, still two weeks to go, so it's too early to make a decision, till the candle is not closed.

I'm not a huge fan of using averages, but sometimes I check the 200 day SMA. $HIVE went below it this month, so it considered undervalued. Price needs to get above $0.2834, which is the 200 day simple moving average (SMA).

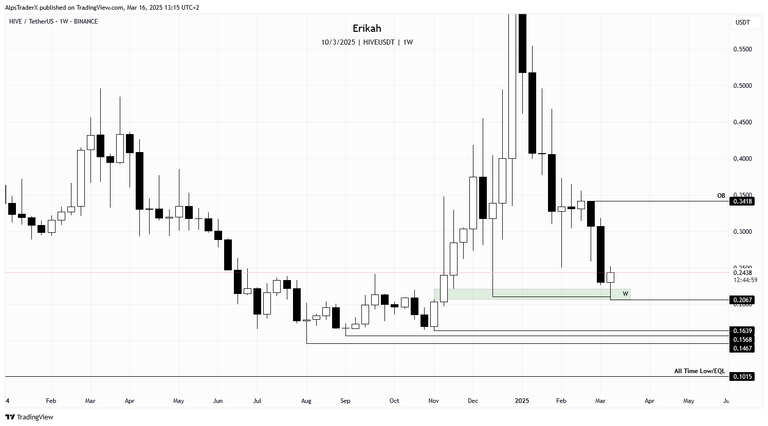

The weekly chart looks a bit better. Price swept liquidity under the nearest swing low, rebalanced the bullish gap defended price nicely. There are still 12 hours to go till the candle close, but so far we have a bullish candle.

For bullish continuation, price has to get back and close above the weekly OB at $0.3418. Otherwise revisiting the lower levels at $0.1639, $0.1568 and $0.1467 can happen. I hope not thought.

On a daily time frame, the bullish gap I mentioned last week could not defend price, last Sunday price closed below it and swept liquidity below the last swing low. On the way down there was a bearish gap created, which is capping the market now.

At the moment of writing, price looks a bit heavy, so sweeping the low at 0.2067 looks likely, if we don't get a bounce here. The leg down has a few gaps, which could reject price, so the way up is not going to be smooth.

I suppose the h4 is pretty explicit. Earlier today, the bearish gap (marked with yellow on my chart) rejected price. Looks like $HIVE is nose diving at the moment. There's no gap on the buy side, so the closest liquidity pool price could bounce is at $0.2281. In case this dip goes lower, I'm looking at $0.2228 and ultimately $0.2067.

$BTC is not looking any better to be honest. On the daily chart, price was rejected by the bearish gap (yellow on my chart) once again and chances are price is going for $76,565. The bullish gap (marked with green) has already been rebalanced and I hope it can hold price, but retesting the previous high is also possible.

What I'm going to show you now has nothing do do with $HIVE or $BTC directly, but it's part of the global picture and worth mentioning it.

This is the Dow Jones Industrial Average (DJIA) chart. For those of you who don't know what it is, it's a stock market index of 30 prominent companies listed on stock exchanges in the United States. Turned bearish this week as we have a change in state of delivery.

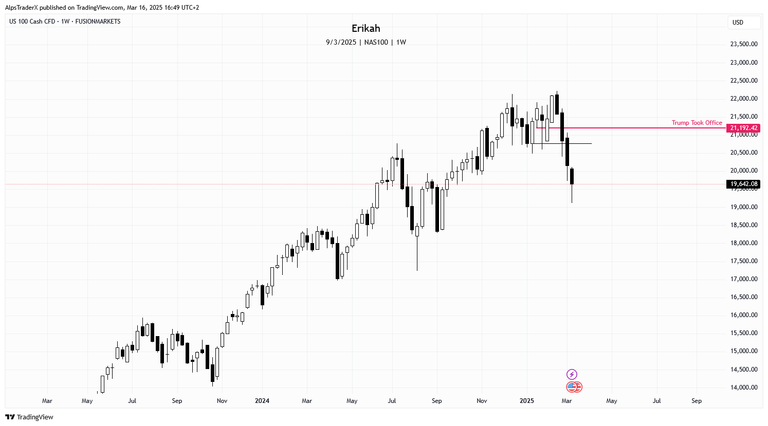

This is the NASDAQ chart.

The Nasdaq Stock Market (/ˈnæzdæk/ ⓘ; National Association of Securities Dealers Automated Quotations) is an American stock exchange based in New York City. It is the most active stock trading venue in the U.S. by volume, and ranked second on the list of stock exchanges by market capitalization of shares traded, behind the New York Stock Exchange. source

Turned bearish last week and confirmed the change in state of delivery.

This is the S&P 500 chart.

The Standard and Poor's 500, or simply the S&P 500, is a stock market index tracking the stock performance of 500 of the largest companies listed on stock exchanges in the United States. It is one of the most commonly followed equity indices and includes approximately 80% of the total market capitalization of U.S. public companies, with an aggregate market cap of more than $43 trillion as of January 2024. source

Turned bearish last week and confirmed the change in state of delivery.

I marked when Trump took office on the chart.

DJIA and S&P 500 also have some big volume imbalances currently, which is due to liquid market. If you look at the historic data, this is not something that has been happening often.

There are so many things going on on geopolitical level that can influence the markets that I can't even begin to tell you. Things are not looking good and chances for the situation to improve asap are slim to none. I'm not going to get into specifics in this post, that's another story for another time, but I'd warn you, to be cautious and better start accumulating as this is the time.

Remember, technical analysis is not about forecasting the price, but about reacting to what price does.

As always, this is a game of probabilities, not certainties. Also please note, this is not financial advice, it's my view and understanding of the market.

All charts posted here are screenshots from Tradinview.

If you're a newbie, you may want to check out these guides:

- Communities Explained - Newbie Guide

- Cross Posting And Reposting Explained, Using PeakD

- Hive Is Not For Me

- How To Pump Your Reputation Fast - Newbie Guide

- Tips And Tricks & Useful Hive Tools For Newbies

- More Useful Tools On Hive - Newbie Guide

- Community List And Why It Is Important To Post In The Right Community

- Witnesses And Proposals Explained - Newbie Guide

- To Stake, Or Not To Stake - Newbie Guide

- Tags And Tagging - Newbie Guide

- Newbie Expectations And Reality

- About Dust Vote And Hive Reward Pool, by libertycrypto27