Remember when everyone complains about petrol cost?

It's legit a constant complaint that we see, especially here in America where everything is spread out, public transportation is ineffective, and everyone owns a car. On top of that there are people... I don't know how they do it... but there are people who commute an hour to work (or more)... every day. That's 10 hours of driving a week; 500 hours of driving a year. What a grind and heinous expense! Multiple thousands of dollars per year on fuel alone. No wonder people complain.

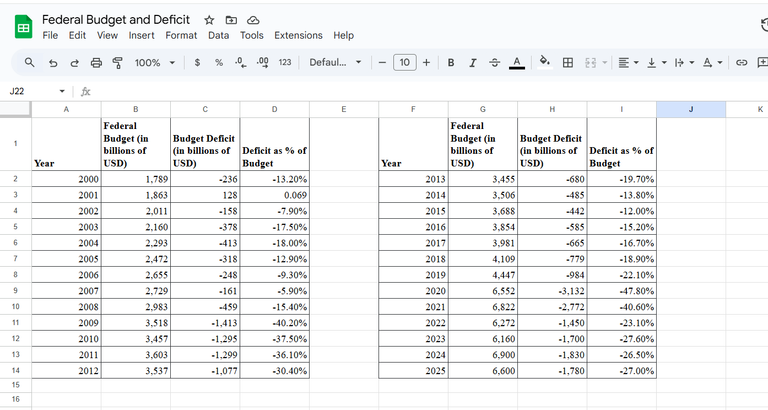

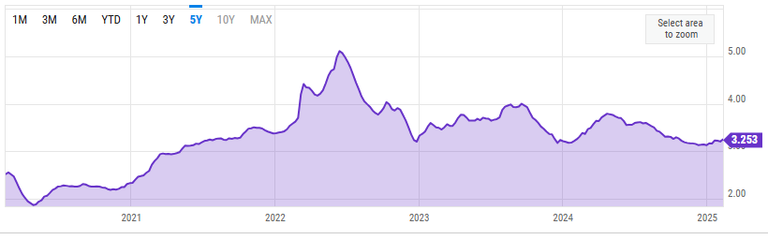

https://ycharts.com/indicators/us_gas_price

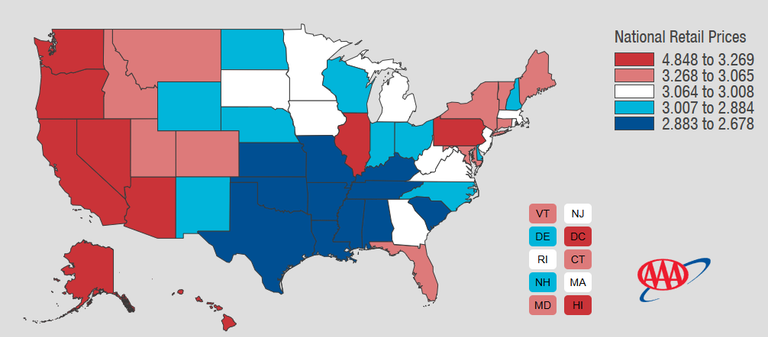

But as we can see here... the price of gas hasn't gone up...

In fact I moved to PA in September 2021, and the price of gas here very closely tracks the national average. The price of gas in September 2021 is almost identical to the price right now. Of course such statements cause a slew of knee-jerk reactions and Akctually responses.

What about summer 2022?

What about the 2020 bottom out?

Well first of all the crude oil cycle peaks in summer and troughs in winter.

This is just the basic supply and demand of the market.

Demand for crude oil skyrockets in summer and slows to a crawl after Christmas.

So what's the dip in April/May 2020? That was peak COVID lockdown/fear.

What happened in summer 2022? Cycle top on top of Russian sanctions.

dOn'T fORgeT WuT tHEy tOOk frOM uS

People love this shot from the movie Die Hard that show price of gas costing under 80 cents in 1988. Of course it should be obvious that this is a very disingenuous argument to make... as if to say someone could make today's wages in 1988 and buy whatever they wanted dirt cheap. Not how it works.

Point being that price of gas has way less to do with currency devaluation and way more to do with supply and demand. Currency devaluation has been a drop in the bucket compared to all the other drama surrounding this resource, up to and including infinite warfare to acquire more and power the military industrial complex itself.

Inflation is also cyclical.

People like to measure inflation in a straight line. Hell, even the FED itself does it! 2% per year target! Again, this is not how it works, especially now that the unsustainability of the debt network is catching up to itself in a big way. We are living in an era, or rather and end of an era, where the only way to keep this economy afloat is to print trillions of dollars in order to "stimulate the economy" when it's about to collapse. The last time we got one of these liquidity events was COVID when we seemed to think it was a good idea to shut down the entire world economy. Yeah that didn't work out so well.

So while it may look like crypto is struggling right now... we also haven't survived long enough to see the NEXT liquidity event. And trust me: they always get worse. The amount of money that needs to be injected balloons with the rest of the unsustainable volatility we see.

DXY

The strength of the dollar is quite high right now considering just how weak and on the brink of collapse everything is in the legacy economy. Trump has made it very clear that he wants a weak dollar and lower interest rates, but Powell has been fighting him on this. And now we see this tariff situation escalate as if to purposefully create an artificial emergency so he can get what he wants. Pretty devious if true, but I guess we'll see how it goes.

Point being that inflation can not be measured in a straight line. It happens in bursts and the full effects don't materialize for years until the money and properly circulated throughout the economy.

Even video game economies are cyclical

Buy items cheap on the weekdays and sell them high on the weekends when the people with actual jobs log in. Easy money.

Cost of food has skyrocketed!

And is that because we printed a bunch of money or is it because "bird flu" is killing all the chickens and food warehouses keep randomly blowing up? It should be obvious that a devaluation of a currency affects every product equally. The problem is that technology is constantly evolving and making it easier to produce certain items but not others. For example when is the last time you pain long distance phone bill?

Conclusion

Ultimately the economy is a total immeasurable clusterfuck. People don't like this, so they isolate one variable when trying to make a point. This is not how it works. The value of products and the value of money changes constantly on a daily basis, but we anchor the value to the currency because it is more stable than all the other assets we are measuring against.

The market cycle itself sends everything up and down over time.

Many have tried to combat the volatility.

None have succeeded.