Welcome to the weekly SPI Report

Each Sunday, @spinvest uploads an earnings and holdings report to keep investors up to date with fund performance and news. You can subscribe to these weekly reports in the comments.

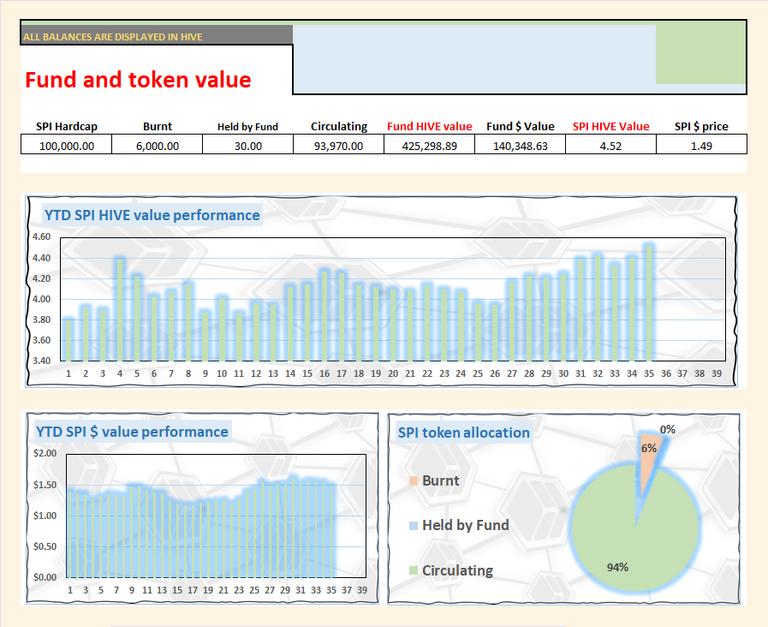

SPI is the flagship growth token for the SPinvest fund. Launched in June 2019. SPI tokens act as both a token of ownership and a governance token. Since launch, we've been able to 7x the HIVE value (including revaluations and token split) and 12x the dollar value of the fund.

We are now in our 5th year of operation and still going strong as we stick to our plan of investing the bulk of our holdings into time-served investments and HODL.

Our motto is = Getting Rich Slow

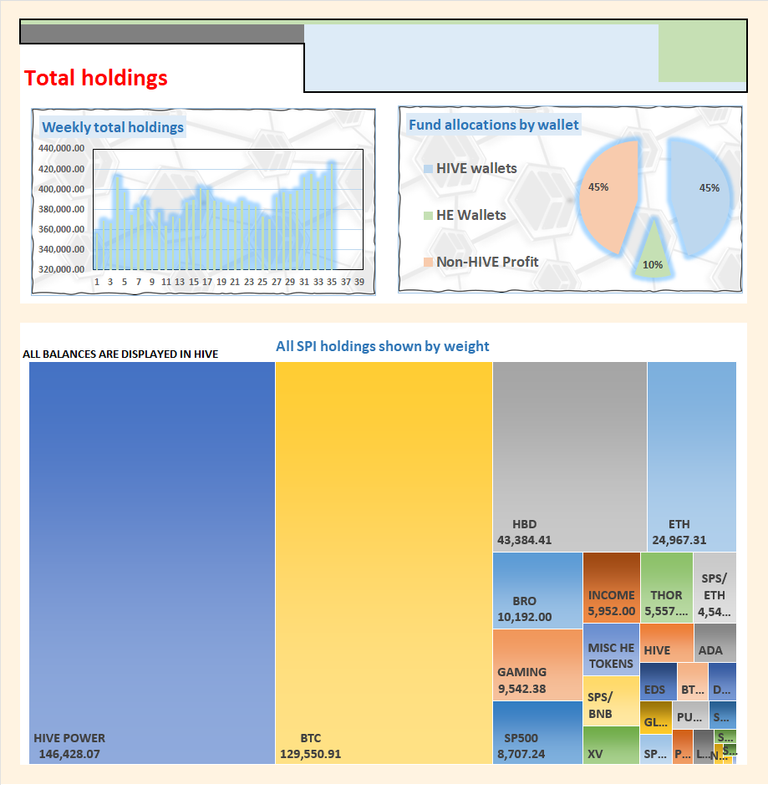

In our expansive portfolio, we are involved in over 30 investments, with a significant portion dedicated to HIVE, BTC, and ETH. We firmly believe in avoiding impulsive actions driven by the fear of missing out or chasing unattainable aspirations. Instead, we rely on tried and tested strategies that have proven to be the most effective and secure.

Our guiding principle is to accumulate wealth steadily, adhering to the philosophy of "Get rich slowly." We employ the power of compounding by consistently reinvesting in sound opportunities to amplify our returns over time.

When considering SPI tokens, it is essential to adopt a long-term perspective, aiming to hold them for a minimum of 3-5 years. Our rationale behind this recommendation lies in the belief that substantial returns require patience and allowing investments to mature organically. By committing to an extended investment horizon, you significantly increase the probability of maximizing your potential gains. This aligns perfectly with our overall investment philosophy and strategy, ensuring sustainable growth and profitability in the long run.

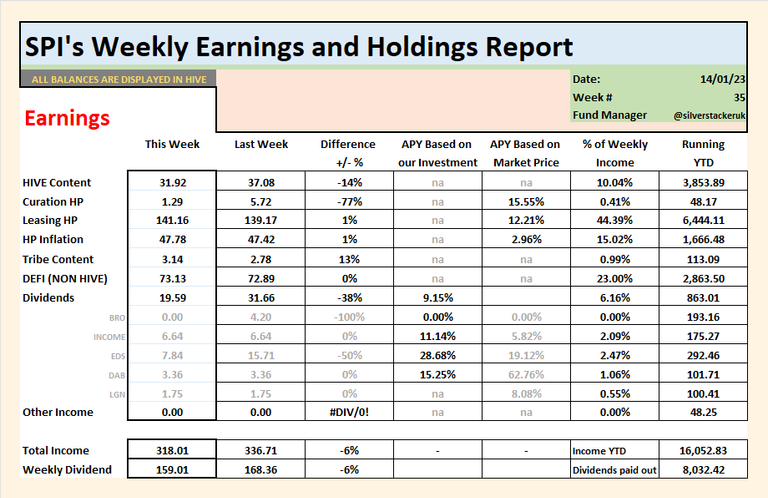

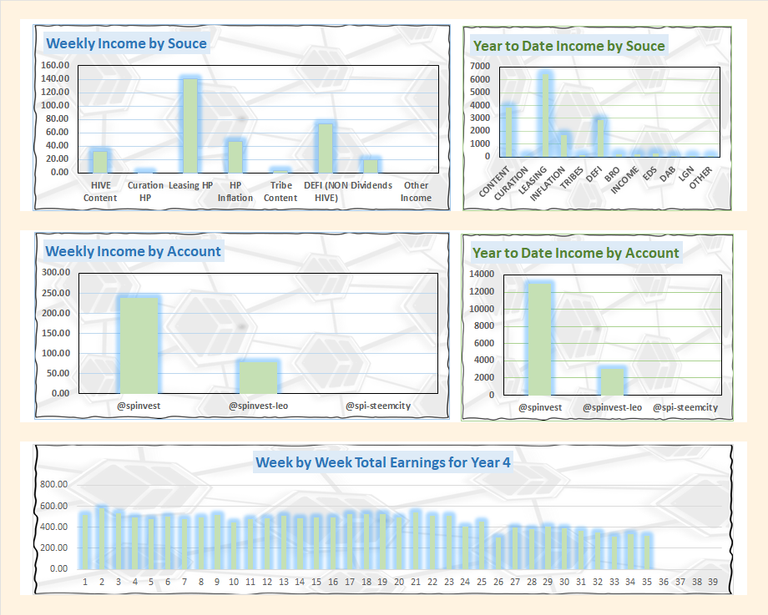

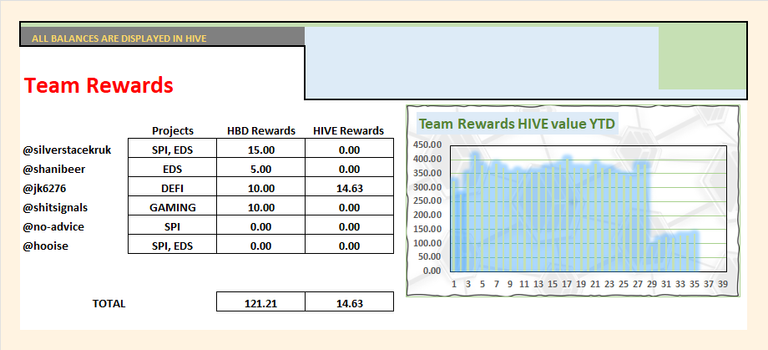

Earnings this week are still around the 300 HIVE amount which is kind of low for us. The days of pulling in 500-700 HIVE worth of LEO each week from leo.voter and content are long gone and seeing these rewards drop in HIVE value over the past 24 months has been our biggest hit to our earnings.

Leasing income has also declined because we are delegating less to HIVE-producing incomes. 10k to @eds-vote and 2.5k to @clubvote. We have been delegating to @empo.voter but have been reducing our amount with plans to be out within he next month. I will move the HP over to leo.voter, its APY is lower but its consistent and LEO has good liquidity.

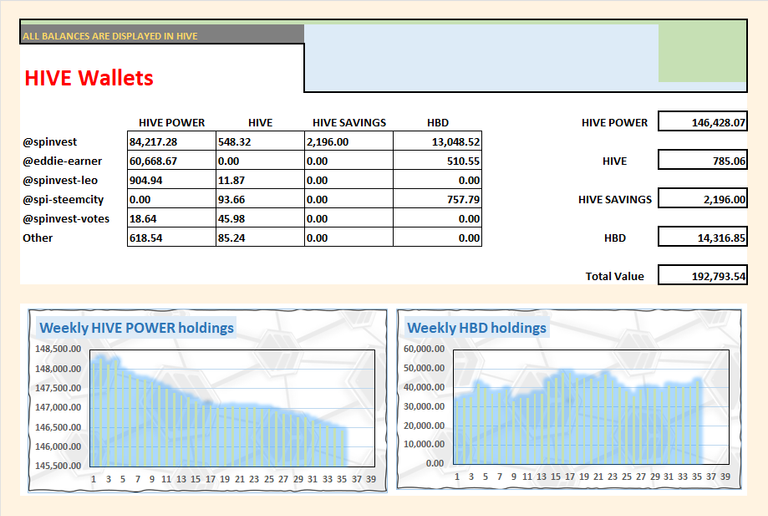

Pretty standard week all around. The HP balance for spinvest went up, eddie-earner went down, spinvest-leo went up and the rest grew by 0.0295%. HIVE dropped a cent or so from last week so this week our HBD balance gets more HIVE. If we can ever get 60k HIVE for our HBD, worth be worth considering, maybe even 30k and keep half our HBD cause 20% is awesome and it's nice to have liquid.

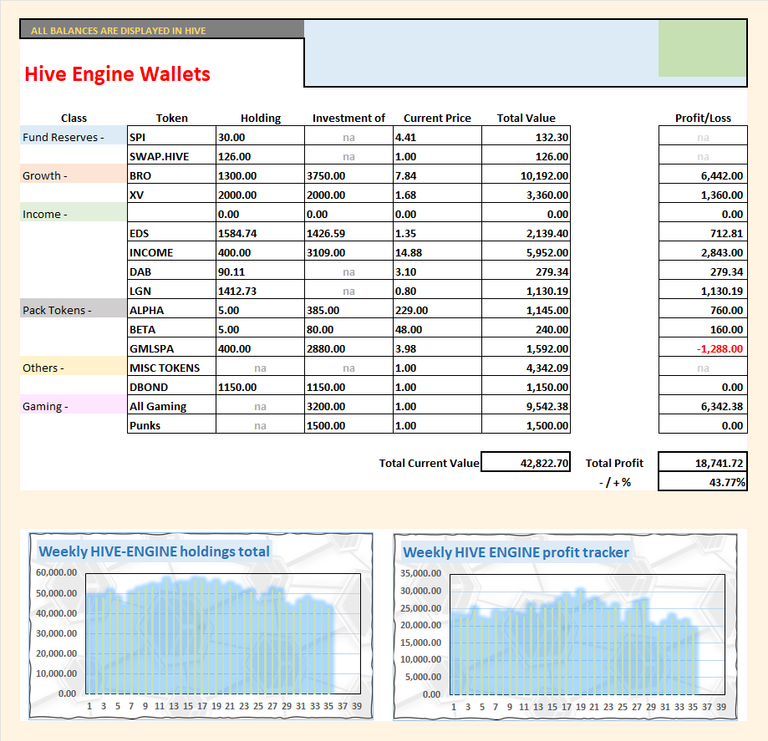

Our HE wallet this week took a hit pretty badly and for what reason, I have no idea. Normally when the price of HIVE drops, HE tokens are worth more HIVE. Our biggest hit came from gaming and we lost a few thousand HIVE of value over 3 WOO tokens alone. This will bounce back and we're still hopeful that WOO will become a popular game.

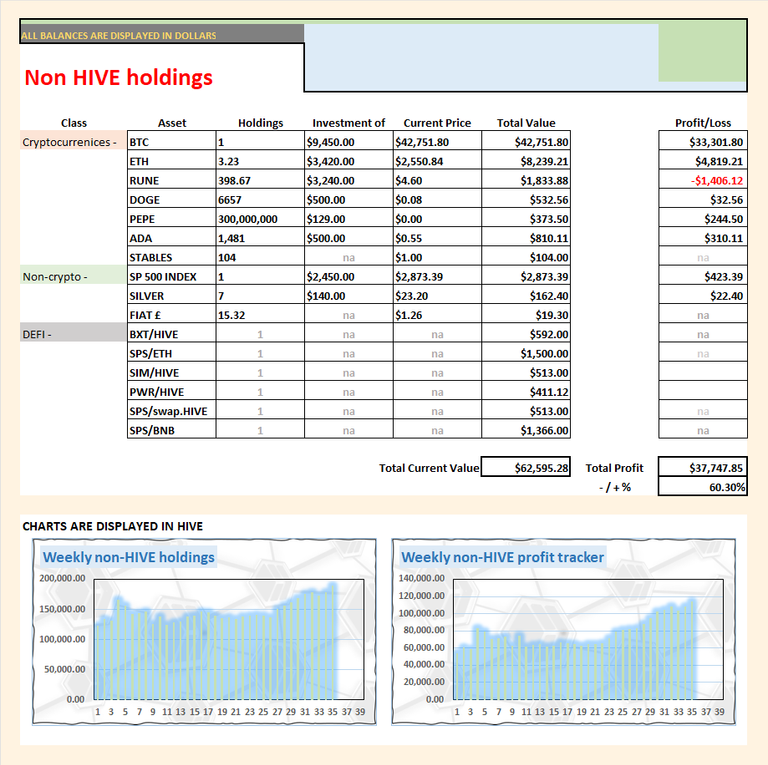

The past few days in crypto have looked brutal but the fact is most tokens are still up from last week so this recent dip has not really been that bad. Each week i talk about the BTC to HIVE ratio and this week we see the spread widen as 1 BTC can converted into 129.550 HIVE today. Remember, we're aiming for 200k.

We saw our ETH bags pump this week. My guess is now the Blackrock BTC ETF has been approved, people are now thinking ETH is next. HIVE is down 6.5% for the week and our non-HIVE wallets have broken even do the HIVE value has increased.

DEFI is performing well and we can expect this the explode over the next 12-18 months, this will be fun to see what JK can do.

A solid week with 2.37% growth on the fund. This brings us YTD to almost 14% and with 17 weeks left in the year, we dont have much to go to hit our 20% yearly target.

The dividend APY sucks but this APY is based on the current market value of the token and not the amount you bought in for. If you bought into SPI on STEEM which many people did, you've likely paid around 0.70 HIVE per SPI after token splits are factored in so your dividend APY based on your investment amount would be closer to 14%. This is me bugging up the numbers but also true. If you bought into SPI at 2.25 HIVE, your APY would be 4% based on your investment.

This is something you should factor in and why both APY's are shown in our HIVE earning table. INCOME has a 5.82% APY based on the current price but our APY based on our investment is 11.14%. This is mostly because the price of the token has doubled over the past 2-3 years. In your personal investments. If you were earning 10% APY from something and its APY drops to 5% APY, is it because the project is earning less or has its token value increased? A dropping APY is not always a bad thing if your bags are increasing in value.

We saw this week the BTC ETF got approved, I guessing nothing will happen fast to the price of BTC but over the coming weeks and months, as things are set up, boomer money will start to flow into BTC. The BTC halving event will be the next big pump event whether it's priced in already are not and after that, it's a full-on bullrun for the next 12 months. Some are saying this cycle bullrun could be alot shorter and end faster than previous cycles. My plans for SPI remain as they are until something changes my mind. I don't think much could change my mind as I've been planning the past 24-30 months for 2025.

Anyways, thats this week's report. Dividends will go out this evening and i wish you all a wonderful Sunday.

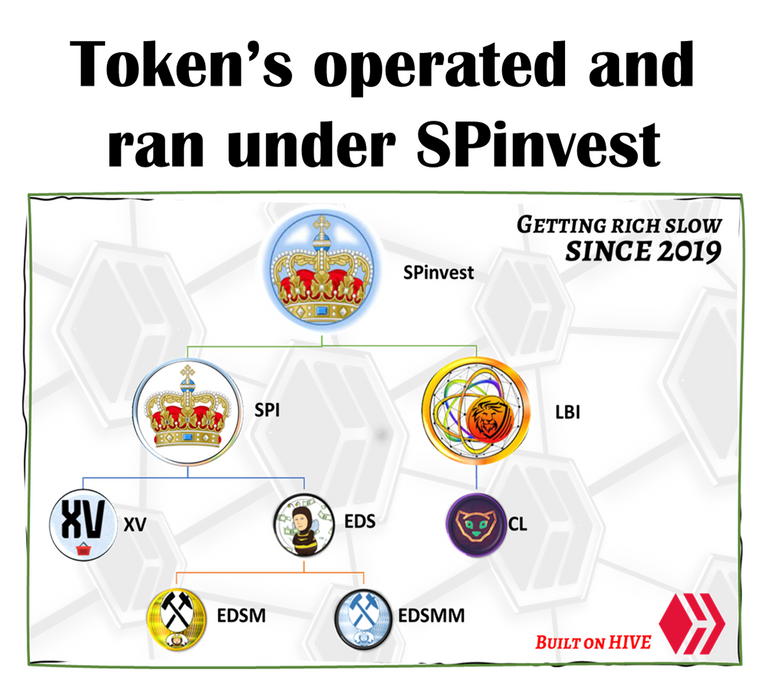

Links to all projects under SPinvest

| Token Name | Main Account | Link to hive-engine |

|---|---|---|

| SPI token | @spinvest | SPI |

| LBI token | @lbi-token | LBI |

| Top XV token | @spinvest | XV |

| Eddie Earners | @eddie-earner | EDS |

| EDS mini miners | @eddie-earner | EDSM |

| EDS micro miners | @eddie-earner | EDSMM |

| DAB | @dailydab | DAB |

| DBOND | @dailydab | DBOND |

Stay up to date with investments, fund stats and find out more about SPinvest in our discord server

Tag @spinvest to a comment below saying "I wanna Subscribe" and I will tag you in future SPI weekly reports.

Sub List:-

@ericburgoyne, @mikezillo, @shanibeer, @oldmans, @roger5120, @lilolns19, @riandeuk