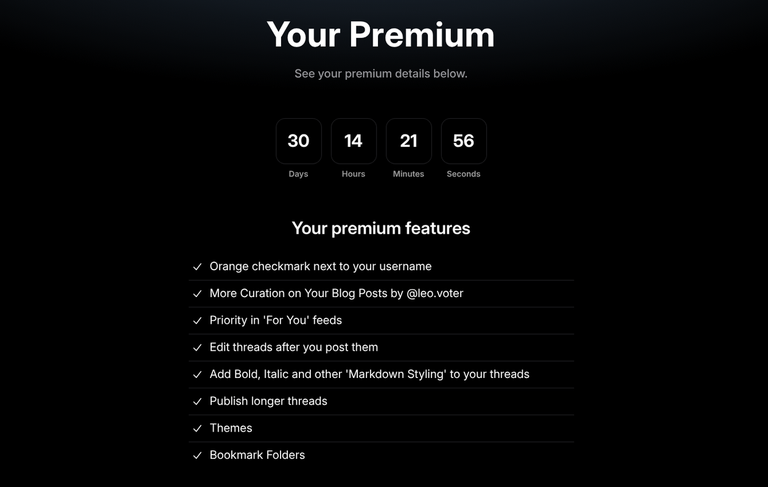

I bought another month of Premium today. The 10 HBD for it used to buy $LEO along with $HIVE or $CACAO to create Protocol Owned Liquidity for the project. We are past that and now we are buying 100% $LEO and sending it back to the community. Your LEO Rewards are payed off partly be Premium users like me who contribute to the SIRP (System Income Reward Pool). Inflation is over.

- Max Supply: 30,000,000 LEO

- Circulating Supply: 30,000,000 LEO

- Native Blockchain: Arbitrum

- Bridged Blockchains: heLEO (Hive), bLEO (BSC), pLEO (Polygon)

- Listed Exchanges: Maya (Native LEO on Arbitrum), Hive-Engine (heLEO), Pancakeswap (bLEO), Sushiswap (pLEO)

- Emissions Rate: 0 (no inflation, no new tokens)

Rewards Without Inflation

LEO inflation used to be 0.208 per block. There is a new block every 3 seconds. There are 86,400 seconds in a day. That is 5990.4 LEO created everyday to reward users for being a part of the project. This type of distribution is perfect for fair distribution of Tokens in a decentralized projects. There are great many advantages that made us on HIVE better than other blockchain social media projects that came (and mostly withered away). The disadvantage is that the inflation put downward pressure on the Token price.

When users see the value of their holdings go down, they tend to sell. Even big believers of the project can end up selling with the expectation of buying the dip later. Thus the selling compound and it becomes more difficult to onboard new users to HIVE. There are other blockchains and DAPPs that attempt to become a blockchain social media.

- No transaction fees.

- Users get paid for their contributions

Above are the main Unique Selling Proposition (USP) we have to offer. Traditional social media has massive userbases and algorithms designed to keep the users as long as possible on the website/app. UI/UX combined with earnings is how we onboard masses onto HIVE. I don't think we should change Layer 1 Tokenomics. The experimentation should be left mostly to the DAPPs and keep the base layer less prone to change. Permanant inflation of $HIVE does have its benefits.

Can We Generate $120 Daily Revenue

$LEO price used to be under 2 cents for a long time. During that time roughly 6K LEO were being distributed daily. That is less than $120 of value. Premium is 10 HBD per month with 2 free months when paying for an year. This means 12 Premium users per day should be more than enough to pay for loss of inflationary rewards! On top of this we have 5% beneficiary rewards going to @leofinance that get added to the SIRP. @khaleelkazi had the idea of combining the Reward Pool for delegators and authors/curators. The suggested distribution is as following.

- Authors / Curators = 70%

- Miners = 10%

- leo.voter delegators = 20%

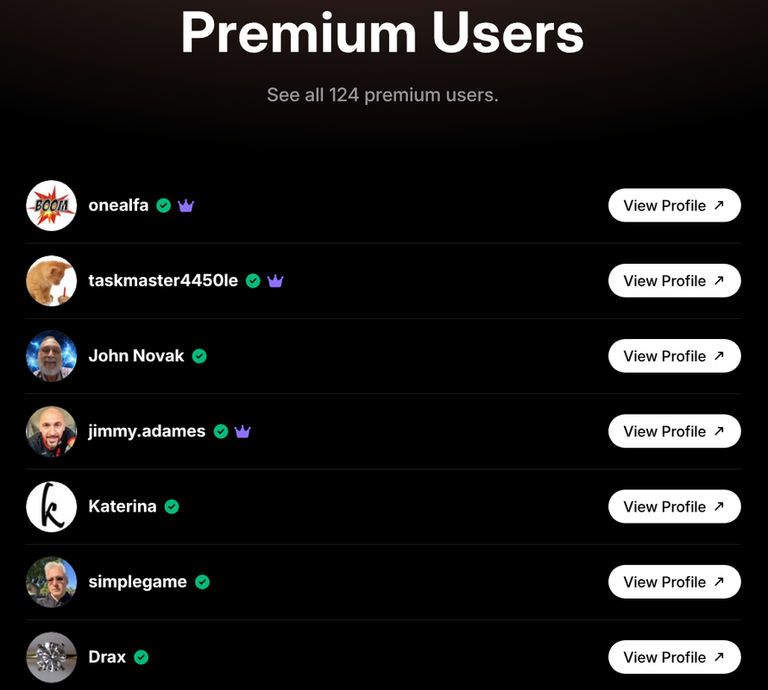

At the moment we have reached 34.4% of what our immediate goal should be for Premium. We have 124 Premium users at the moment. Once we have 12 X 30 users paying for Premium, that revenue alone is sufficient to cover all the (USD) value of what was distributed to the users. If you join right now, your name will be added to the bottom of Premium user list.

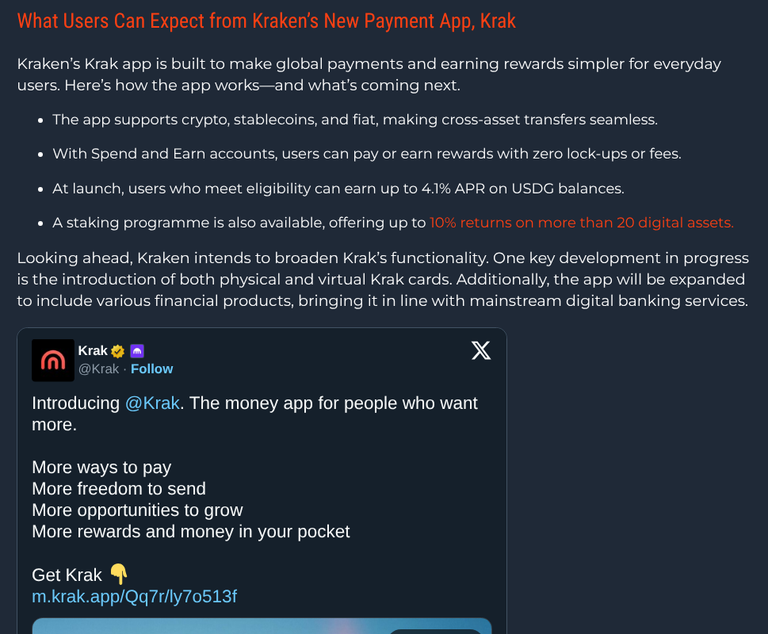

LeoMerchants and LeoKit as Long Term Plays

When you have large centralized players in cryptosphere that are dealing with billions of dollars trying out similar things the small LEO team was planning on, we can have the confidence that we are on the right path. Successful execution is not guaranteed. We are competing against companies with large treasure chests, highly paid blockchain engineers and massive marketing reach and brand recognition. I do think we have a good chance at carving ourselves a successful piece of the blockchain payments pie running on top of the DEX infrastructure we have built over the years.

LeoDEX is Loved By Few Niches

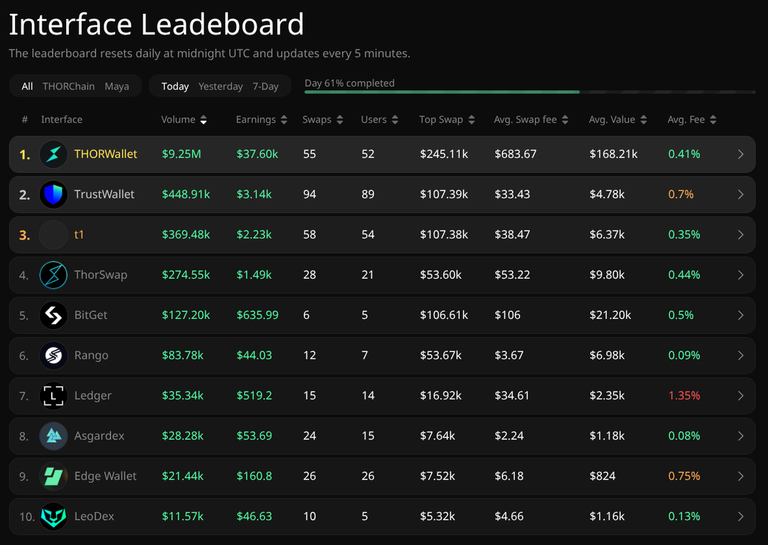

We are already one of the Top 5 interfaces on @mayaprotocol. Quick TCY integration and the first mover advantage with Zcash trading played a significant role in gaining marketshare within these two niches. Rujira Network seems like it will be another addition to the list. Being the first with a good enough product is one of the best things a business can do to grow. We must keep in mind that we are a business that generate revenue and distribute $LEO to the investors through buybacks.

Today we have LeoDEX make it to the Top 10 interfaces for THORChain + @mayaprotocol. This is not a position we can permanently defend yet. We need higher consistent volumes for that to happen. LeoDEX was around the bottom when we started. We have come a long way. We can grow the rest and reach 7 figure daily volumes.

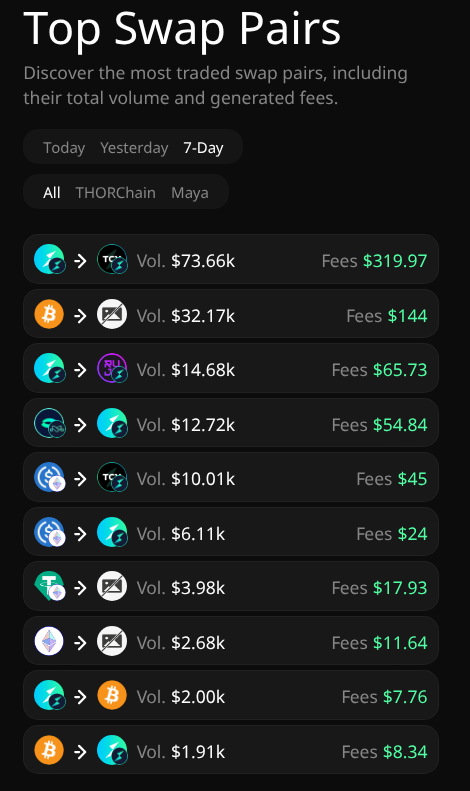

Notice The Niches

Visit xScanner to get similar statistics on other interfaces THORChain + @mayaprotocol and compare and contrast against the type of volume we have been having. I will highlight few important facts based on the 7 Day trading volumes.

- All 10 are linked directly to THORChain, @mayaprotocol or ZEC.

- 7 of them has $RUNE $CACAO or $TCY in the pair.

- Other 3 was swapped into ZEC.

- Only $BTC $ETH and stablecoins are the popular "outsider" assets.

We have excellent user retention on top of the growing volumes. Returning "customers" are extremely important as they tend to be the biggest fans of the DAPP and they bring in regular volume with no added acquisition cost. Returning users are also a proof that LeoDEX is doing many things right and offering a great cross chain DEX.

| Exchange | Swaps/User |

|---|---|

| Asgardex | 3.96 |

| ShapeShift | 3.42 |

| Vultisig | 3.11 |

| LeoDex | 2.3 |

| Rujira | 2.03 |

| ThorSwap | 1.73 |

| THORWallet | 1.36 |

| BitGet | 1.31 |

| TokenProcket | 1.29 |

| Rango | 1.28 |

I have only scratched the surface of where we could be. The indicators are positive. That does not mean everything is going to land on our laps. The weather is good. The soil is good. The seeds are good. It is time we work on this DeFi + social media farm as the conditions look good.

Best of Luck to Everyone!

Posted Using INLEO