The DAB project, a collaboration between BRO and SPI, is a steadily growing collection of tokens designed to generate growth and income over time. LBI has been invested since we relaunched, and our wallet has hit a decent income level over that time.

But I've been keen to step it up a bit and get some more funds in there to accelerate our growth a bit.

Earlier in the week, I bought a few hundred DBOND's off the market. The funds for this came from selling some liquid LEO and GIFU I was holding in a separate wallet. This gives our DAB mintage rate a bit of a boost. Next, at that time I also bought some DAB off the market.

Staking DAB.

LBI has begun staking some of our DAB. For those that are not sure how DAB works, liquid DAB held in your wallet earns a daily HIVE income. Staked DAB earns the same APR but issued daily as DBOND instead of liquid HIVE. So to give our DBOND balance some extra growth, I've started staking some of our DAB. However, I still want our liquid DAB to increase over time, so that the HIVE income we pull out for dividends continues to grow steadily.

I settled on a method where I let our liquid DAB increase by 1 per day, and then stake any extra we mint. With our increased amount of DBOND tokens, we should comfortably mint over 1.5 DAB per day. That means liquid will grow by 1, and staked will grow by at least 0.5, with potential for more depending on how lucky we are with the mining lottery. Two days ago we minted 2.4, yesterday was 1.6 so it varies a bit.

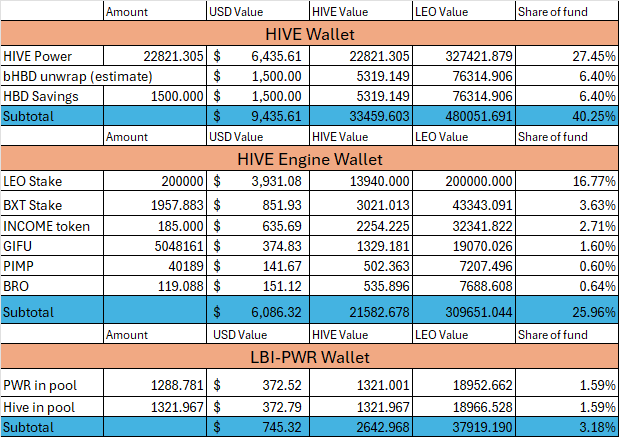

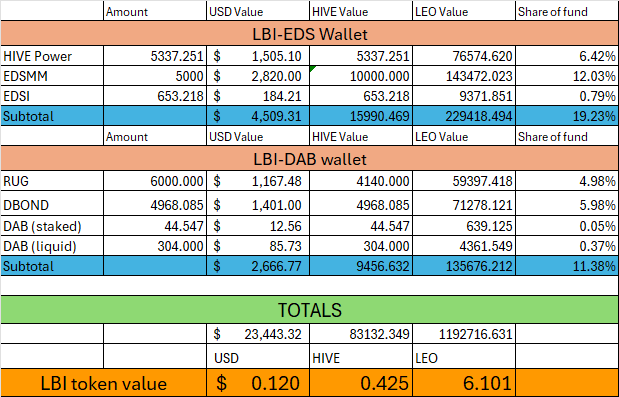

Anyway, as the wallet stands currently, we have 304 DAB liquid (which earns a bit over 0.5 HIVE per day income), and 44.5 DAB staked.

The next move.

Early in the week, I did another thing. I withdrew 500 HBD from our savings. The HIVE price is down a bit, around $0.28 currently. So I figured it would be a good time to swap from HBD to HIVE priced assets.

This morning that withdrawal finalized, and the funds were ready to go. I was low key expecting HIVE to pump just before the unlock, which would have ruined my plans, but it did not happen. Those 500 HBD traded to around 1700 HIVE. Here is what I did with those funds:

Bought 1000 RUG.

Bought 600ish DBOND.

Moved the remainder to a different part of our fund.

RUG is a high risk investment compared to most of our wallet. SSUK runs this token for DAB, and invests all funds off HIVE into defi liquidity pools. Rewards made from those investments are used to buy HIVE and distribute to RUG holders in the for of new DBOND. The yield is good, but the price has struggled since launch, particular in terms of HIVE. We bought our first RUG at 2 HIVE each, and they are now worth 0.69. So on paper we have lost significant HIVE value. However, it is not that bad when you look at the $$ values, and factor in the high yield.

Anyway, adding more RUG now will increase our weekly DBOND growth.

The other move I made was to buy up all the DBOND that was available up to 1 HIVE each. Between this purchase, and the one made earlier in the week we have added 1400 DBOND since last weeks report was released. This positions us for a much faster rate of DAB mintage, and accelerates our growth rate well above what it would have been if those funds were left in HBD savings.

What's next.

Now we sit back, and watch how things perform for a bit. I'm keen to see how our DAB mintage tracks after these moves, and watch our DAB balance grow faster than before. We will now be minting more DBOND from two sources, a weekly hit from our RUG position, and a small daily increase from our staked DAB. Prior to these moves, we were growing at around 30 DBOND per week (with big fluctuations depending on the weekly performance of RUG) and 10 DAB.

My expectation is that we will see our DAB mintage increase to 14-15 per week, and DBOND growth at maybe 40 per week.

Lets wait and see what happens.

LBI is all about growth, growing our assets to flow through to a growing income base. The DAB eco-system is a perfect match for our long term goals. Thanks for checking out this little update post.

Have a good one,

JK.

Posted Using INLEO