This week, I thought it would be a good idea to look at one division of LBI that I have high hopes for into the future. That is, our @lbi-pwr wallet. Currently, the wallet itself is worth just over 2000 HIVE, so not nothing but only around 2.5% of our fund. But that does not tell the full story. When you factor in a 16000 HP Delegation from our main wallet, the picture is different.

First, what is PWR.

The PWR token is the backbone of the Hive Power Ventures project run by @empoderat. The token is rewarded to delegators of Hive Power, along with rewards for PWR stakers and participants in the liquidity pool. The project bears some resemblance to EDS, and aims to build up as much Hive Power as possible, and reward token holders with dividends. The different angle is that dividends are exclusive to funds held in the LP.

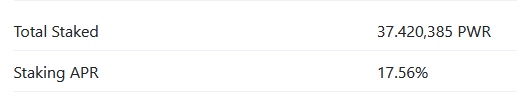

A recent update to the project has boosted the return on HP delegations to 12%. This brings it to a competitive position in the HP market. Like many token projects these days, PWR basically re-packages curation rewards into a tokenized version. It does so cleverly, and the project has built a good measure of sustainability in since its launch. The upgrade to 12% delegation APR was recently announced in this post and is guaranteed to run for at least 6 months.

PWR is intended to maintain a "soft peg" to HIVE, and it's track record has been good at maintaining a fairly close range around 0.95-1.05 Hive per PWR.

LBI's Position.

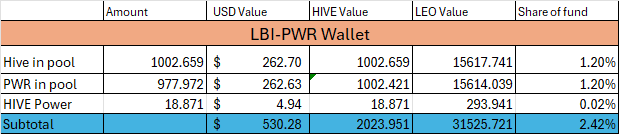

We have a dedicated wallet to hold our PWR assets. In it we have around 1000 PWR currently paired with HIVE in the liquidity pool. This earns both PWR and HIVE as the rewards for the LP each day. Presently that is around 0.77 HIVE and similar PWR. The daily swap.hive reward from the pool is sent each day to our income collecting wallet @lbi-income. This is our income we draw out of this position. Everything else we make is for compounding, one way or another.

Currently, we don't hold any staked PWR. It's a decent passive option, but There are a few moving parts and staked PWR isn't our best option. The biggest position we have is the delegation of 16,000 HP from the main wallet (@lbi-token) to @empo.voter. With the recent APR update, we are now earning 5.2 PWR each day from here. Add in the 0.75ish we get from the pool, and we are growing the wallet by 6 PWR (6 HIVE value) each day. This means that over the next 12 months, without changing anything else this wallet should double in size. Doubling is nice, but I'd like to get more funds in here to grow it bigger.

I have begun the slow task of building the @lbi-pwr wallet with it's own Hive Power. Here is my morning routine:

- Transfer PWR earned from HP delegation from main wallet to PWR wallet.

- Transfer swap.hive earned from the pool to the income wallet.

- Swap 1 PWR to HIVE.

- Add HIVE and PWR to the pool position.

- Swap remaining PWR (around 4 per day) into swap.hive.

- Withdraw to native HIVE.

- Power up and increase empo.voter delegation.

Why build up another HP wallet?

I'm quite keen to build each of our major wallets into stand alone divisions. The @lbi-eds wallet is in good shape, it holds 20% of the funds total assets and has a solid, clear growth path for many years to come. Recent work I have done to boost the @lbi-dab wallet has set it up for the future, and put it on a similar path. This PWR wallet is still reliant on the HP delegation from the main wallet for it's growth. That is fine, but building each division as stand alone gives more options in time.

So the plan is to build up the HP in our PWR wallet, without powering down the main wallet to do so. At our current rate, we will power up around 1500 over the next year. I'd definitely like to do better than that, and will be on the look out to add more in to the wallet to build it faster. Since I started a few days ago, we have a massive 18.871 HP built up. But, this fund is building with a 5 - 10 year outlook, and small growth today will make a big difference over time.

Here is our current wallet position:

As this wallets owned HP grows, I'll slowly decrease the delegation from the main wallet, likely at a slower rate than this new HP balance grows, so our net delegation continues to increase. For example, if we power up 30 HIVE per week in the pwr wallet, then I may decrease the main delegation by 15 HP. The ultimate goal, likely years away, is a big chunk of HP in the PWR wallet, and our HP in the main wallet freed up to use for other purposes.

So there you have it, that's the plan as it stands now. Build the PWR wallet up with its own HP, slowly decrease the delegation from the main wallet, and steadily build the pool position.

However, if things change, well...

Here are some links to learn more about the Hive Power Ventures project, and our involvement:

Thanks for checking out this post and keeping up to date with all things LBI.

Cheers,

JK

Posted Using INLEO