LBI has been a supporter of the PWR project run by @empoderat for a while now. We have a big delegation in place (well big for LBI's size) and have built our liquidity pool position over recent months. However, with recent changes to the PWR project, it is time to review our position, and plans for the future.

All the details about the changes that have occurred for PWR are contained in the following two posts. I won't talk in detail about the changes themselves, aside to say that they all make sense to me and I'm happy to continue LBI's involvement in the project into the future. If you would like to check out what is happening, these posts cover it off:

https://inleo.io/@empoderat/important-pwr-token-revamp

https://inleo.io/@empoderat/a-look-at-the-backed-value-of-pwr

The goal of this post is not really to review the changes themselves, it is simply update LBI's position and plans ahead.

No more 1:1 peg.

Initially PWR was a "loosely pegged token" with a target of (and asset backing to match) 1 HIVE per PWR. This makes things all nice and easy for valuations and managing liquidity in the pool. However, those days are gone, as PWR has branched out from just being "HIVE Powered" and moved its assets into off-chain holdings. This means that the peg is no longer valid, and most of PWR's assets are held off HIVE in various holdings, most notably ETH. There is also leverage involved, so the "asset backed value" of PWR may become quite volatile. We can see this in just the last week.

In the second linked post above, we can see that PWR held assets worth around $0.20 per token, and was trading on HIVE at a small premium to that. If you use the link to view the wallet holdings and calculate using the current circulating supply for PWR we get a per token value of around $0.30, where it is trading in the LP slightly below asset backed value. At least it was prior to me reorganizing our position. The big gains are mainly down to the better performance ETH has had this week.

So, the big implication to begin with is the token value (at least the asset backed value) has become volatile (potentially very volatile given that leverage is part of the new plan). This means a new risk for LBI comes in to play - Impermanent Loss (IL). This makes providing liquidity a more risky proposition, if PWR does really well and booms in value, we may end up disadvantaged by holding many fewer tokens in the pool (but more HIVE). If you don't understand IL, then this post probably won't help much, but I would strongly recommend learning about it when considering a liquidity pool investment.

New risks, New opportunities.

The risk of IL comes into play for the first time in the liquidity pool, but the possibility of PWR increasing in value also kicks in. So, where do we position LBI to be well placed moving forward?

Out of the pool.

The liquidity pool has served us well, and been a good source of income. However I don't think it will be the best place for LBI to hold its PWR investment moving forward. PWR becomes (aside from RUG) our main source of off-chain exposure. @empoderat has been around crypto, HIVE and other chains for ages and has a strong reputation as an honest project manager. Having our PWR position diluted during a potential bull run is not in our interests.

What have I done?

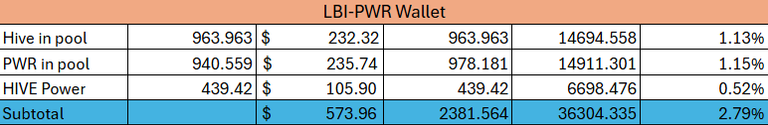

Last week, at the weekly update time, our PWR wallet looked like this:

PWR was trading at around 1.04 HIVE each at that time.

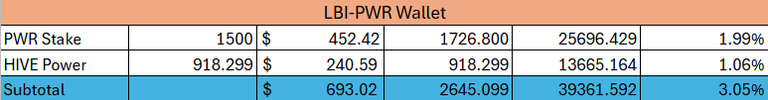

Once I made these change, our wallet now looks like this:

PWR was trading around 1.1 HIVE prior to our changes. I pulled all our liquidity, and swapped a portion of the HIVE into more PWR tokens (effectively increasing our PWR position). I did this up to a point where the pool price moved up to around the current "asset backed value" (around 1.15 HIVE). Remaining liquid HIVE was powered up and delegated to @empo.voter so we continue earning more PWR daily.

It will be interesting to see how staked PWR does in terms of staking rewards - it is based on the HE "lottery style" mining system. Our overall yield may drop a bit, as the pool carried around 22% APR (half Hive half PWR) and staking rewards are likely much lower.

I've also increased our HP position a bit (from the liquid HIVE removed from the pool, in line with our goal of building this wallet up to be more self-sufficient. We still maintain a 15000 HP delegation from the main @lbi-token wallet and intend to do so for a while to come.

Conclusion

We have removed our position in the PWR/SWAP.HIVE liquidity pool to avoid IL.

We have increased our direct exposure to PWR by swapping some HIVE into PWR.

We maintain our delegations to keep our growth and income on track.

We fully support the new direction for PWR and intend to become one of the projects biggest holders long term.

I'm delighted for LBI to have off chain exposure, particularly to ETH, without having to actively manage it ourselves.

We trust @empoderat as a reliable, knowledgeable and switched-on project manager.

Thanks for taking the time to check out this little update post.

Cheers for now,

JK.

Posted Using INLEO