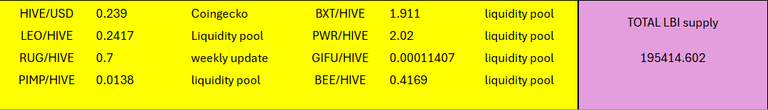

Hello and welcome to this weeks LBI Holdings and Income report. LBI is a pooled investment token based on HIVE with a range of assets backing its token. Each LBI token represents a share of the assets, and the value of that share is published daily on inleo.io as a thread. All you have to do is check our profile page to find the most recent "Asset backed Value" for the token.

LBI came under new management last year, and we are working on raising its profile, converting it into a token that shares a portion of its income each week with token holders, while also selecting investments to maximize growth. LBI's roots are firmly planted in the @spinvest ethos of "get rich slowly". We don't chase amazing returns and massive gains, we look for solid investments, long term growth and the magic of compounding.

Week 52 - that means obviously that it is 12 months since LBI was relaunched under new management with new focus and energy to build the token up. It's been a fun 12 months for me personally.

Let's dive in and take a look at this weeks number.

And here is last weeks report for comparisons:

And, just for fun, here is our very first weekly update post a year ago:

https://inleo.io/@lbi-token/lbi-weekly-holdings-and-income-report-week-1-5-aug-2024-bb1

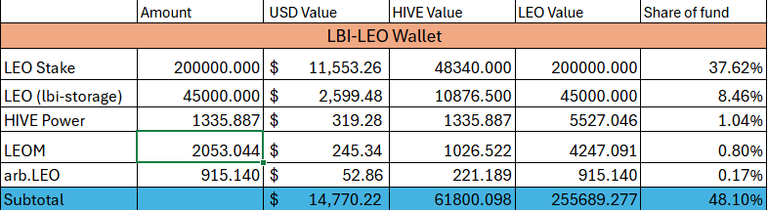

@lbi-leo wallet

For the second week, our LEO division is our most valuable. Getting very close to 50% of our total asset base now. Again this week, I did sell a small amount of LEO (2000) to put into other wallets. Re-started a @leo.voter delegation from this wallet, and so far it is working flawlessly. Looks like the LEO team have fixed things so there will be no more missed days. 🥳

In terms of value over the week, this wallet has accounted for all our gains, increasing by $3000 over the week. I personally think there is much more to come, and won't be surprised to see LEO climb a lot more from here. 1 LEO = 1 HIVE is in my opinion highly likely in the next few weeks, and then it will be interesting to see how much LEO gets unwrapped from HIVE back to it's native ARB version to get staked. We do have a little already on ARB, still liquid. I've got to figure out what I need for GAS to do transactions over on ARB as I've never used it. Does anyone know if there is an ARB faucet, or where we can get what we need to transact on Arbitrium while it is still paused on MAYA?

A great week overall for the LEO division, making it well over $7000 in value gain over the last two weeks.

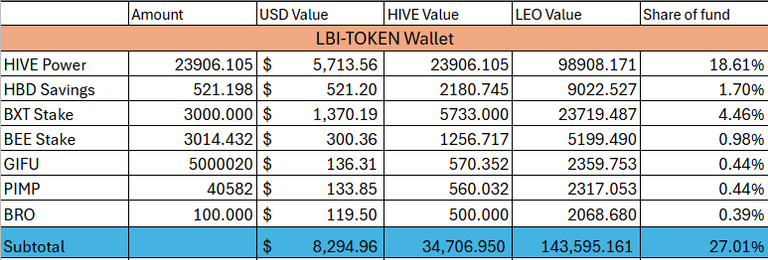

@lbi-token wallet.

Slightly down over the week, but not really anything significant to be honest. Added some more BEE as the delegation is still paying a massive APR, and the price is nice and stable. GIFU dropped over the week, but it is a tiny share of the fund so no big deal really. 60 HP gained for the week, and some BEE as mentioned above are the only real notable things for the week. Used some HBD earned from post payouts to top up income as you will see below.

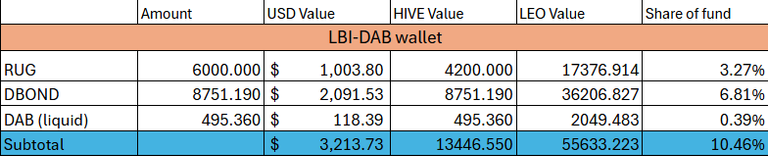

@lbi-dab wallet

Bought a few more DBONDS again this week, under their backed value of 1 HIVE. Minted close to 30 DAB again this week. The yield from DAB has increased a bit, I think because there is a large sell order on the market from the former biggest investor into the DAB project, @freecompliments. All those DAB are on the market, so they do not earn any yield, meaning more income for everyone else till they sell. I'd love to buy them all, but we don't have the funds to allocate. Well, we could sell off a chunk of our liquid LEO and buy them all, but I think selling significant amounts of LEO at current prices would be shortchanging ourselves.

But - that would be a very nice position to put us in with that much DAB... Opinions welcomed.

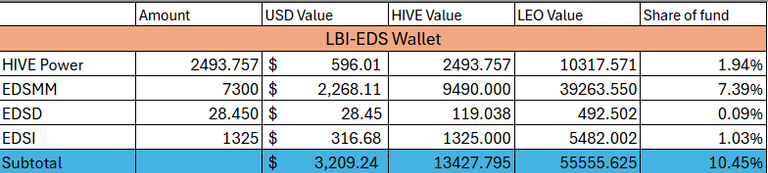

@lbi-eds wallet

A quiet week here. We minted our 25 EDSI, and sold a few above that (around 6 to be exact) to add a little EDSD. No news for the week, everything working as intended.

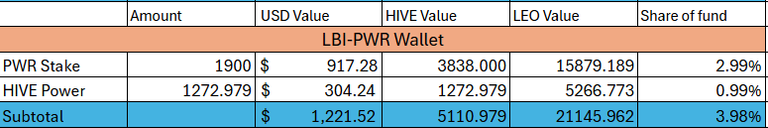

@lbi-pwr wallet

Bought a few more PWR this week, and rounded us up to 1900. Also added a bit of HP. The other change I have made this week is to stop swapping some of the earned PWR to LEO for income. The only income we will pull from here will be the Hive earned as staking reward. Everything else will compound. The wallet will grow by 8 HIVE value per day at our current earning rates. As I say every week, I'd love to have more in here.

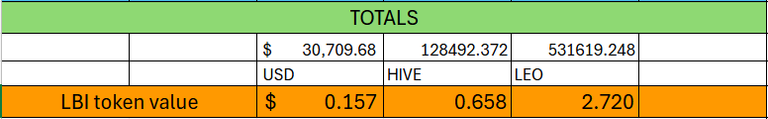

Totals

We cracked the $30,000 mark this week, and push over $0.15 per LBI which is lovely to see. All the value gain came from LEO, everything else was flat over the week.

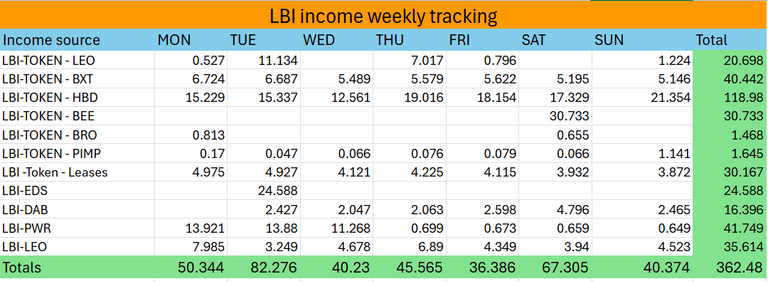

Income

In terms of LEO tokens, income is well down again this week. The days of being able to earn 1200 LEO per week are long gone. But in terms of value, well we are doing ok.

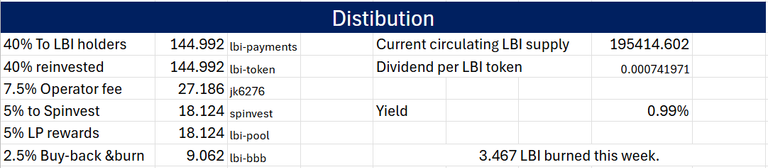

Last week we sent 180 LEO out as dividends, and they were worth $8.04 total. This week, we are sending our 145 LEO, which is worth $8.37. So, as you can see the number of tokens has dropped, but the value of the dividend in $$ terms has actually increased. 3.567 LBI burned this week.

Conclusion.

Another solid week in the books. The hardest part about running LBI at the moment is resisting the urge to sell LEO and take some profits, and rebalance the wallet values a bit. I have sold small amounts over the last 2 weeks, but with LEO likely to move much higher I'm going to try and hold off as long as possible.

Thanks for checking out this weeks update, see you all next week.

Cheers,

JK.

Posted Using INLEO