Hello and welcome to this weeks LBI Holdings and Income report. LBI is a pooled investment token based on HIVE with a range of assets backing its token. Each LBI token represents a share of the assets, and the value of that share is published daily on inleo.io as a thread. All you have to do is check our profile page to find the most recent "Asset backed Value" for the token.

LBI came under new management last year, and we are working on raising its profile, converting it into a token that shares a portion of its income each week with token holders, while also selecting investments to maximize growth. LBI's roots are firmly planted in the @spinvest ethos of "get rich slowly". We don't chase amazing returns and massive gains, we look for solid investments, long term growth and the magic of compounding.

Settling back in and getting everything back up to speed after my break. Lets take a look at how the last week has been for us.

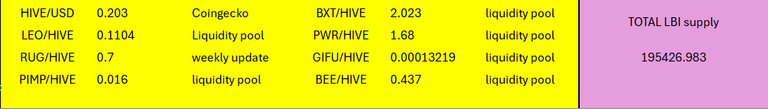

Here are the asset prices at cutoff time this week:

And here is the link to last weeks report for comparisons:

https://inleo.io/@lbi-token/lbi-weekly-holdings-and-income-report-week-47-week-ending-22-june-2025-lsp

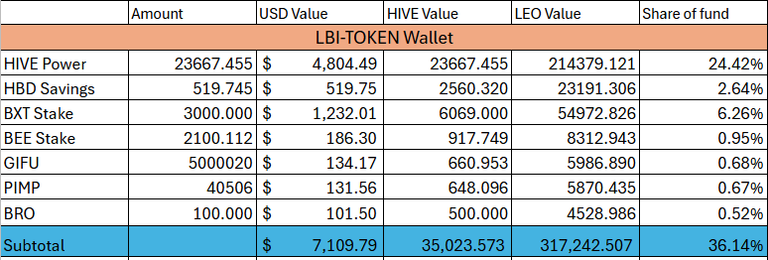

@lbi-token wallet.

Hive price is up slightly from last weeks report. The only other news is that I picked up a few more BEE to boost that delegation. Pretty flat overall with not much content put out the week before so little growth for this week. I am looking at the GIFU, PIMP and BRO in here and wondering if those funds would be better off allocated to other things with better yields. Because the price of LEO has gone up so much against HIVE, our HIVE incomes are producing a lot less LEO which you will see in the Income report below.

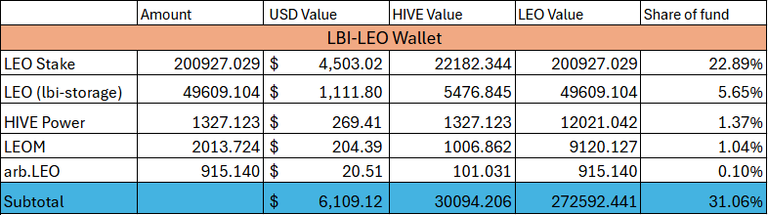

@lbi-leo wallet.

Definitely the most interesting of our wallets at the moment, with LEO values up, and a lot more potential upside to come - if things work. It won't surprise if this wallet quickly moves to become our biggest wallet by value. I'll hold the 200,000 staked LEO as is for now, and work on building up liquid in the @lbi-storage wallet with the intention of using them staked on arb when that option opens up. From our income I've been buying some LEOM each day, as there is a bunch on the market cheap. No idea what ROI they earn, would have to put them in a wallet by themselves to figure it out. But they are an investment in LEO's future, and passive income is the best kind.

LEO 2.0 should be a big success, if things work!

- Premium needs to work properly (it currently isn't, we paid LEO for premium 4 days ago and still haven't got it) Others are in the same boat.

- @leo.voter needs to work - faultlessly

- The bridge needs to work

- LEODEX needs to work

- ARB trading needs to work on LEODEX (been off line for ages - it's a MAYA problem not LEO, but still impacts LEO heavily).

If this stuff doesn't work LEO won't reach it's full potential.

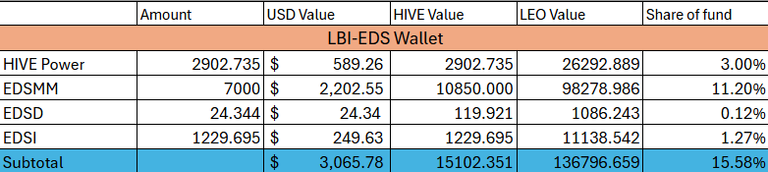

@lbi-eds wallet

Added another 250 EDSMM tokens this week. Maybe only 1 more week of buying ahead of us before the supply on the market runs out. We are up to 7000 now, which should mint us 1400 EDSI each year. I'd like to start building up our EDSD again. Once I stop the power-down and return to delegating HP to @eds-vote we should be generating 30 ish EDS per week. We shall see what happens then, but for now it is one more week of EDSMM and then re-asses.

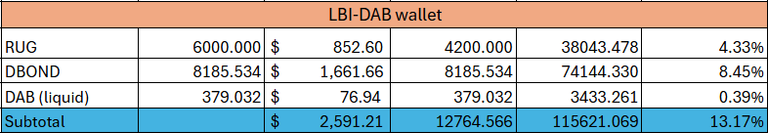

@lbi-dab wallet

Our DAB grows quickly now that we are one of the biggest DBOND holders. The markets are week at the moment, so selling DAB to buy more DBOND is not really an option for us at the moment. No news or updates lately from the project, and patchy income distributions (which usually get caught up). Haven't had a RUG update for ages either, so we are just plugging away and hoping that everything is on track.

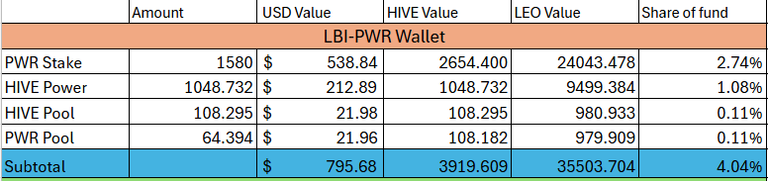

@lbi-pwr wallet

We are adding around 30 - 35 Hive and PWR to the liquidity pool each week, and focusing on building that position back up for now. PWR is still trading nicely above it's asset backing showing continued investor confidence. A wallet I'd love to have more funds in, but it is what it is. Steady around 4% of our fund here, but don't forget we have a big portion of our HP in the @leo-token wallet delegated to this project.

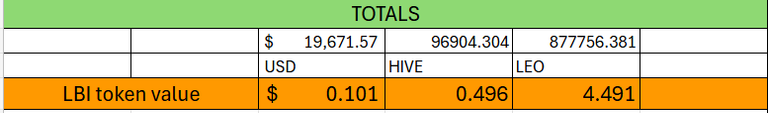

Totals

Dollar value is up a bit, HIVE value is up a bit, LEO value is down a bit. It's be nice to see HIVE price improve, but I guess our best bet at the moment is LEO.

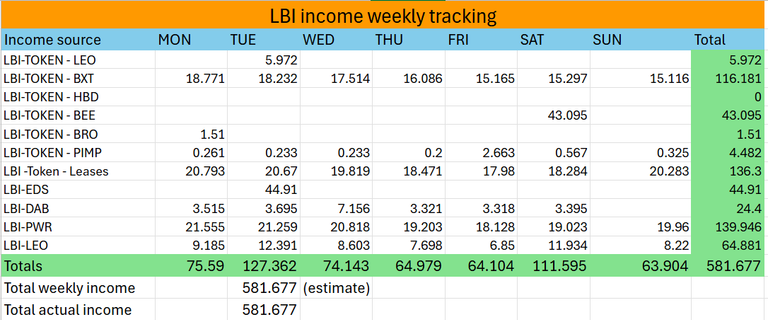

INCOME

So here is our reset week. The days of 1200 LEO per week are over, and this is the new normal I think. With LEO having pretty much doubled over recent weeks compared to HIVE, all our HIVE incomes swap into much less LEO than they used to. The only income not affected is the LEO wallet income, everything else is down in terms of LEO. On the plus side, the LEO is worth more in $$ terms, so it's not all bad.

This really is a baseline week, with no HBD to use from post rewards, and everything running at minimum while I was away. Lets see what next week brings.

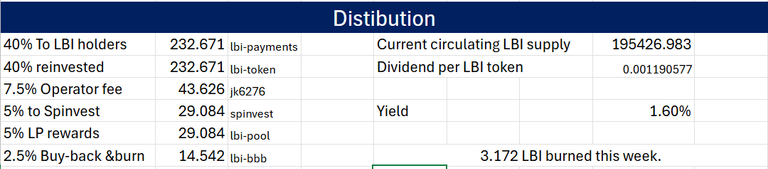

Dividends went out a few hours ago, and the income split is done for another week. Yield is down a lot from a few weeks ago, but that is expected for the reasons outlined above.

We burned 3.172 LBI this week.

Conclusion

It's been good to get back into the daily habits after my time off. LEO is the real driver for us in the weeks ahead, and overall I think we are in really good position. We have over 250000 LEO in total, and will benefit significantly if LEO 2.0 is successful.

An idea I just want to throw out there has come to mind lately. Amongst LBI token holders we have a mix of people. There are LEO maxi's that think we should be all in on LEO and not bothering with all the other HIVE stuff. There are the anti-LEO people that think we should have moved away from LEO completely and focused solely on HIVE. And there are many in the middle, ok with the mix of assets.

What if we split the project in two? Split the LEO wallets out separate - and created a new token with all the non-leo wallets rebranded as "HIVE Backed Investments" or something. @lbi-leo becomes the LBI token, and everything else becomes the "HBI?" token. Everyone gets a 1 for 1 drop of the HIVE token, and the fund effectively gets split into two separate funds. Just a thought - personally not excited as I'd prefer to keep it all as one unified and diversified fund, but I thought I'd put it out there for feedback. If there is much interest, I could make a dedicated post on it and gather opinions and run a vote, but let me know your initial thoughts here.

That's it for this weeks update, I'll be in touch soon.

Cheers,

JK.

Posted Using INLEO