Hello and welcome to this weeks LBI Holdings and Income report. LBI is a pooled investment token based on HIVE with a range of assets backing its token. Each LBI token represents a share of the assets, and the value of that share is published daily on inleo.io as a thread. All you have to do is check our profile page to find the most recent "Asset backed Value" for the token.

LBI came under new management last year, and we are working on raising its profile, converting it into a token that shares a portion of its income each week with token holders, while also selecting investments to maximize growth. LBI's roots are firmly planted in the @spinvest ethos of "get rich slowly". We don't chase amazing returns and massive gains, we look for solid investments, long term growth and the magic of compounding.

Back in action after some time off-line and missing last weeks update. HIVE is well down, and LEO is up since last update, so our valuations are quite different than 2 weeks ago.

Last report:

https://inleo.io/@lbi-token/lbi-weekly-holdings-and-income-report-week-45-week-ending-8-june-2025-2xk

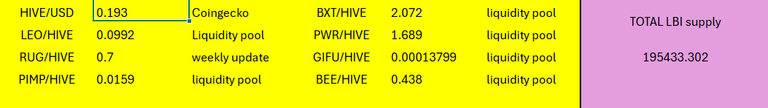

Token values at cutoff:

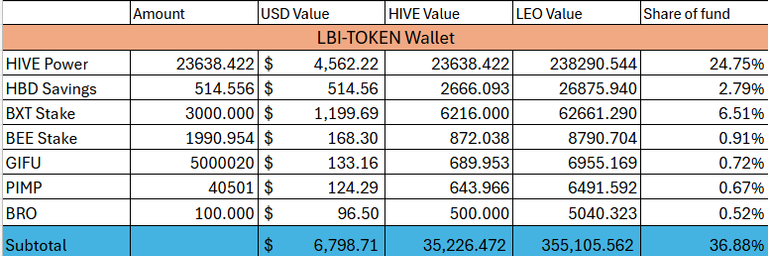

@lbi-token wallet

I've shifted the 50K LEO from being reported here to the "LEO wallet section. Not much news or significant changes other than that over the last 2 weeks. Growth is down due to my inactivity while attending to the real world.

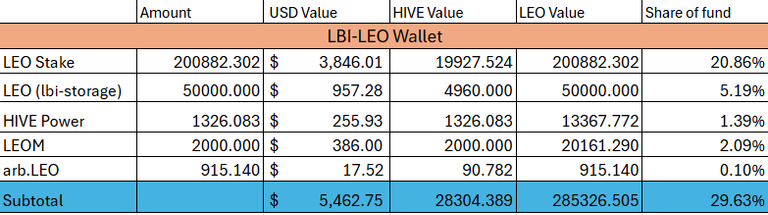

@lbi-leo wallet

LEO has performed strongly while I was away, and adding the 50K liquid to this wallet means it is now around 30% of our fund. LEO 2.0 news has dropped, and I will have more to say in a future post. Suffice to say I am more bullish on LEO than I have been for a long long time. LBI is very well positioned to build up to control 1% of LEO supply - which is a goal I will work towards.

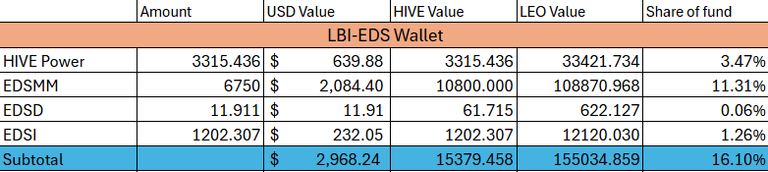

@lbi-eds wallet

Steady, and reliable as always. I've added more EDSMM, and we are over 1200 EDSI now. Not much to say here, it just keeps doing what it is meant to do.

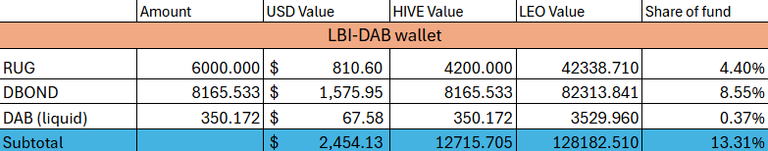

@lbi-dab wallet.

While I was away, I obviously wasn't selling DAB to buy more DBONDS. Might be time to let our DAB tally grow a bit. Everything stayed on track and we added 50 DAB over the two weeks I was off.

@lbi-pwr wallet

Hovering around 4% of the fund currently, this wallet spins out decent income each day for us, as well as nice growth. The project continues to be supported, with PWR still trading at a significant premium to it's asset backing.

Totals

USD value down due to the poor HIVE price. LEO value per LBI is down due to the strong LEO price. Long term prospects improved due to the improving LEO tokenomics.

INCOME

The income report is all out of whack thanks to my time off. Check back next week to get an accurate outcome. The higher LEO price means we get less LEO for our HIVE income, so the number of LEO tokens will be lower, but the value of those tokens is better.

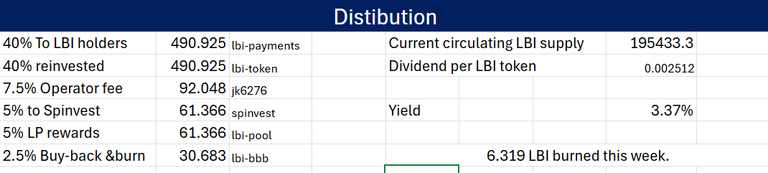

And the distribution report:

Like I said, the numbers are wonky, but 6.319 LBI burned and a decent dividend sent out.

Conclusion.

LEO 2.0 should be very good for LBI - we are very well positioned for the changes. I'll have more to say and outline our more detailed plans in coming posts, but for now it is happy days.

Good to be back on deck. As we head towards 12 months since we re-launched LBI I think we are in pretty good shape for the future.

Cheers,

JK.

Posted Using INLEO