One of the projects that LBI has been working towards building a position in is the PWR token based project run by @empoderat. It is a well run, and professionally managed project aiming to build a base of HIVE Power and reward holders of the PWR token with distributions and dividends. We set up a new wallet to hold our investments in this project - @lbi-pwr - and started out with a little HP delegation to start earning PWR.

Just over a month ago, this wallet was set up and announced in this post:

https://inleo.io/@lbi-token/setting-up-our-next-investment-jf8

Since then, the delegation has been increased a little, and rewards have gone over to the wallet to slowly but steadily build the LP position. However, yesterday, I had some funds to invest as I had pulled some HBD savings out to give a few of our investments a top up. So some of these funds went to this wallet, to get added to the LP and fast track the position a bit. 1000 HIVE was sent over, swapped half into PWR and added to the pool.

From that original post, here was the plan for this investment:

Grow the delegation to @empo.voter over time.

Transfer all PWR earned to @lbi-pwr

Swap half to HIVE, and add to the PWR/HIVE liquidity pool.

This will generate more PWR, which will also be compounded into the pool.

From next month, funds in the pool will earn HIVE payouts, along with PWR.

The HIVE earnings will go to the income wallet, all PWR will be compounded.

The yield generated on the PWR delegation to @empo.voter is fixed at 8%. On our current delegation of 3000 HP, we are receiving 0.658 PWR tokens. From tomorrow, this delegation will increase to 7500, with the ultimate goal being to build it up over 10K. The first thing I'll note is that the 8% yield is less than other options. That's ok though, because it is very reliable (I haven't seen it miss a day) and the PWR is "pegged" to HIVE (its a soft peg, but feels pretty reliable currently).

So once I get the delegation increased tomorrow, we should be earning 1.65 (roughly) PWR per day. On top of that, the pool now will earn some PWR as well, bringing us up close to 2 PWR per day. Does not sound like much, but compounding over a few years can work magic.

The purchase we made, buying 500ish PWR out of the pool did move the price a bit. Prior to our buy, it was around 1 PWR = 0.98 HIVE. After, it is now tracking around 1.02. So we moved the market a bit, but that is to be expected and that is pretty much the normal range that PWR trades around. I couldn't really have put much more in in one hit, as it would have moved the price too much.

The numbers.

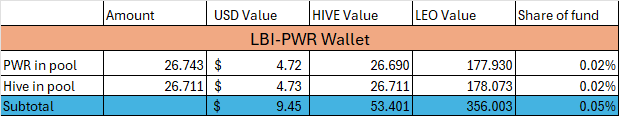

In last weeks report our position was still small.

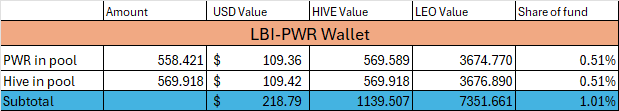

Now, after this change, here is what it looks like today:

So we now have 1% of the funds total assets deployed in the PWR pool. Still not a significant amount yet, but it will be interesting to see how that changes through organic growth. Overall, once the delegation gets updated in the coming hours, we will have a bit over 7.5% of the fund committed to the PWR project overall. 7500 HP delegation, plus 1139 HIVE value in the pool, compared to an overall fund size of 112000 HIVE value.

Admin

So, just for clarity, here is how this portion of the fund is administrated.

- 7500 HP (soon) delegated from the main @lbi-token wallet.

- PWR from that transferred to @lbi-pwr each day.

- Yield from the pool comes as half PWR, half Hive.

- Only the HIVE portion is sent to @lbi-income for the weekly distribution.

- All the PWR then gets split 50/50 and added to the pool.

In this way, we continue the theme for LBI now of layers of asset growth eventually feeding into a source of income. The LP will grow by close to 2 Hive in value per day, and the income generated will be around 0.25 Hive value currently. As the LP position grows, so to will that income.

Building multiple streams of passive income on the back of reliable asset growth is the name of the game for LBI these days. PWR fits this bill perfectly.

The main goal in the short term is to keep building the HP delegation up to 10,000 HP, and keep growing the LP position.

I had some funds to invest as I had pulled some HBD savings out to give a few of our investments a top up.

This was one of the things I did with the funds I pulled out of HBD savings. More posts on other moves will be out in the near future with some of the other positions I've added to.

Thanks for reading, hope you have a great day,

Cheers,

JK

To learn more about LBI, and what we have been up to recently, here are some posts with more info:

https://inleo.io/@lbi-token/major-change-for-our-eds-wallet-9ba

https://inleo.io/@lbi-token/lbi-august-2024-recap-9vv

https://inleo.io/@lbi-token/dividends-resume-for-lbi-holders-bci

Posted Using InLeo Alpha