Hello and welcome to this weeks LBI Holdings and Income report. LBI is a pooled investment token based on HIVE with a range of assets backing its token. Each LBI token represents a share of the assets, and the value of that share is published daily on inleo.io as a thread. All you have to do is check our profile page to find the most recent "Asset backed Value" for the token.

LBI has just recently come under new management, and we are working on raising its profile, converting it into a token that shares a portion of its income each week with token holders, while also selecting investments to maximize growth. LBI's roots are firmly planted in the @spinvest ethos of "get rich slowly". We don't chase amazing returns and massive gains, we look for solid investments, long term growth and the magic of compounding.

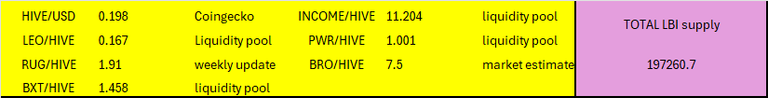

Welcome to report number four of the new era for the LBI fund. Here are the prices used at the time of this report.

To compare these results to last week, you can see last weeks outcome in this post:

https://inleo.io/@lbi-token/lbi-weekly-holdings-and-income-report-week-3-19-aug-2024-7vv

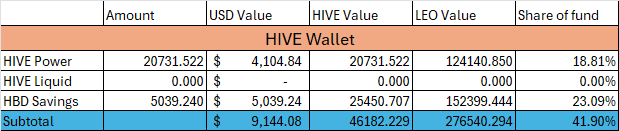

HIVE Wallet

A good week for Hive Power this week, with a bit over 200 added. Mainly this has come from content rewards, with our posts gaining some nice support for which I am very grateful. Our HBD savings will go up soon, with our monthly interest due to be claimed very soon. I am holding some liquid HBD, which is not counted here as it is to be used for some payments. Due to renew our Inleo Premium membership, and holding some to pay for the coding for the dividends which should be starting very soon. As we move forward, I'll carry 20 HBD liquid, and as we spend these, I'll let the post payout HBD rebuild back up to 20 before using any extra to keep buying EDSD.

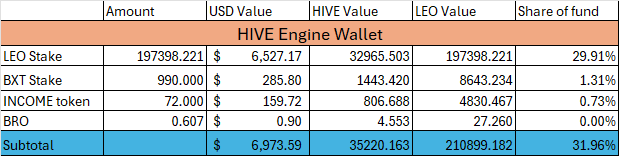

Hive Engine Wallet

Gained 270 LEO this week from our @leo.voter delegation. Bro gets added in to this wallet this week. We actually have 20.607 in our wallet, but we owe 20 of these to @trumpman who lent them to us to get started. When I sent back the LEO from the income wallet (the 40% to be re-invested), I used it to buy a little more of some of these. Added 2 INCOME, a little BXT, a little BRO, and some PWR which went over to the @lbi-pwr wallet, as well as 1 DAB which went to the dab wallet.

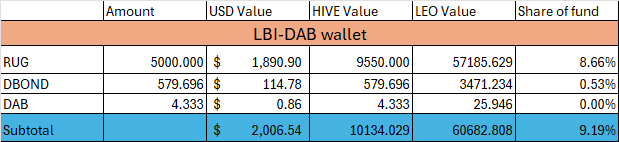

@lbi-dab wallet

Just under 100 DBOND added this week, from our RUG investment. We minted some more DAB, and I added 1 from the re-investment funds, because I'm wanting DAB to mint faster. This wallet will produce more income from today onwards, as I caved to temptation and am going to be selling 2 DBOND each day to add to the income. This wallet will steadily grow each week, despite selling a very small portion of our income.

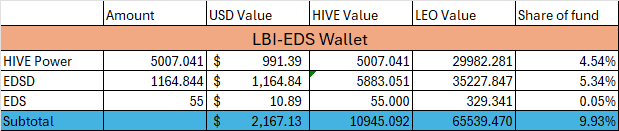

@lbi-eds wallet

A good week for post payouts on the main account means a good week for grows of EDSD. We added 32 EDSD this week, which is 32 USD value added to the wallets bottom line. Minted a bit over 13 EDS this week, which is also slow and steady growth.

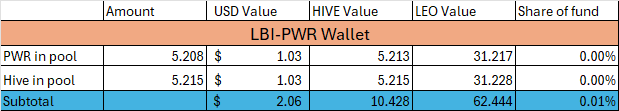

@lbi-pwr wallet

Ticking up here. Still very slow growth, and still not a blip in the overall wallet. But it is a process that is underway, and will slowly and steadily increase.

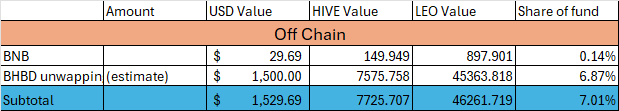

Off Chain.

No change this week.

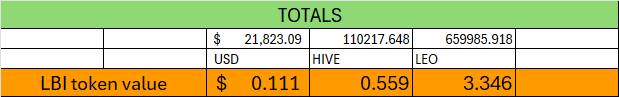

Totals.

We can compare to last weeks results

The reason I publish our value in 3 different currencies is so people can pick which one they want to measure their holding by. We can see that the USD value of the fund has gone up by $1000. Valued against HIVE the fund has dropped a bit, and against LEO it is little changed. The main difference is that the HIVE price last week was $0.184 and this week is $0.198. Because of the composition of assets, it can have interesting effects on valuations depending on price moves.

Personally, I tend to look at the USD value - but I know many will use the LEO value, particularly now that the liquidity pool is paired with LEO. Anyway, all three prices are published daily on threads.

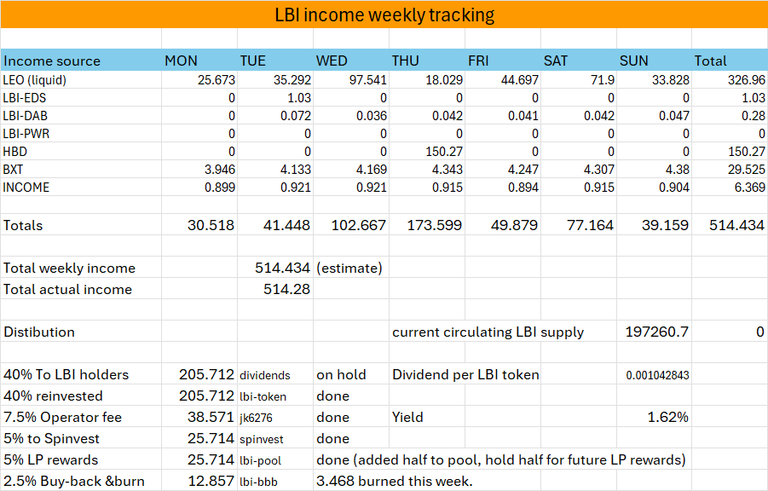

Income

Income is up a bit this week. A little more from post payouts of LEO, which is still our dominant source of income. BXT has been doing nicely, with its yield running at almost 20%. Next weeks report will have more of a contribution from the DAB wallet in particular. BRO will also make an appearance on next weeks income report.

I am holding the dividend funds at the moment. A test transaction should happen in the next day or two. Once we see that everything is working as intended, the remaining funds will be sent. Bear with us until we can get this all operating smoothly, should be all in place this week.

With the 5% LP rewards, I am adding half of that now to the pool contract each week. The reason for that is the initial contract was for 90 days. After that period, I'll have to renew it with a new contract. In order to have funds to add then, so the APR can still be acceptable, I am holding back some now. I am aware that the APR is still very low, but on the plus side it is sustainably sourced APR - not coming from wild inflation.

Lastly, the Buy Back and burn has been done, with 3.468 LBI permanently removed from circulation and sent to @null. The ultimate goal of LBI now is asset growth every week, and some sustainable dividends and LP rewards, with a slightly deflationary tokenomics.

Thanks for checking out this weeks income and asset report.

Have a great week everyone,

JK.

@jk6276

If you would like to learn more about LBI, here are some more posts for your research:

https://inleo.io/@lbi-token/lets-check-in-on-our-dab-wallet-4wg

https://inleo.io/@lbi-token/the-lp-is-growing-cx2

https://inleo.io/@lbi-token/dare-i-say-the-word-flywheel-lhw

Posted Using InLeo Alpha