Things in my part of the world have been pretty cold lately. I've been talking about it most of the week. We are finally on the back side of a polar vortex, but the effects are still lingering. For most of the week, my office at work has been without adequate heat. Usually that wouldn't be a big deal since I have network electronics in there that don't do well in the heat, but there are always limits and -20 F is definitely one of those limits.

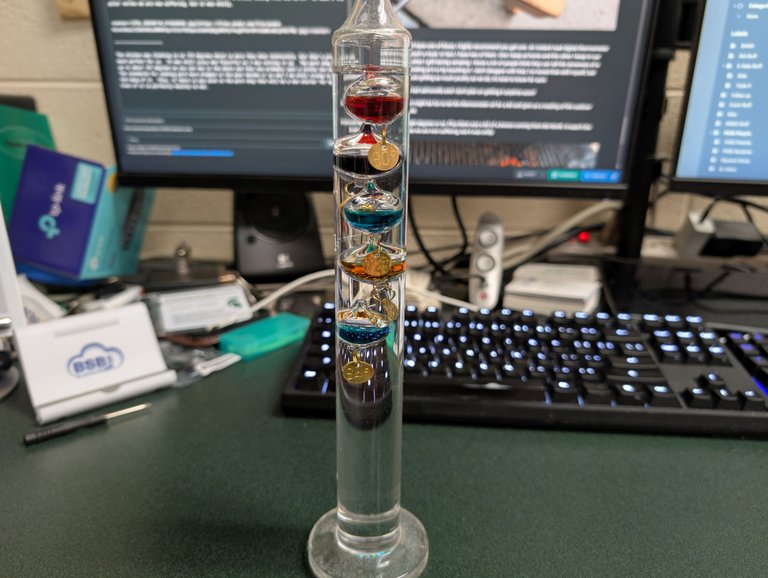

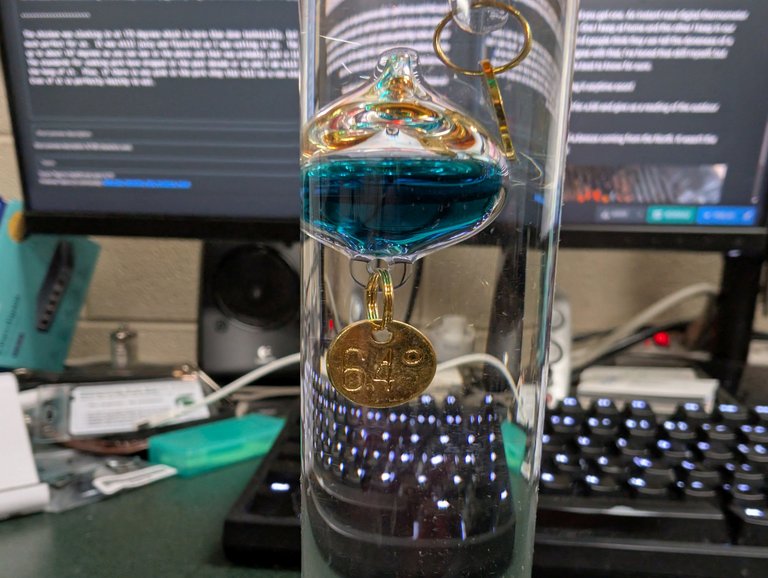

Of course it hasn't been -20 inside, the actual temperature in here is somewhere below 64 F. I got one of these cool Galileo thermometers a long time ago. I've kept it in my office for several years now and usually I don't pay it too much attention. This week has been different. Maintenance has been coming over and manually turning my heat on most days this week. Usually by the end of the day that bottom bubble floats down and we are sitting somewhere around 68 F, but by the next morning it shuts off and we are back below 64 F.

I think it's interesting how imprecise tools like this are. Back in the day, it was the best thing they had, but these days in a world of exact measurements, it's interesting to keep one of these handy. Perhaps if we looked at the markets in a more imprecise way versus exact measurements it wouldn't get to us as much as it does.

It is time again for another Finance Friday/Friday Finance. This is a series I started where I talk about random bits of financial stuff that I have seen, gathered, or experienced during the week. I hope as a reader you find it informational, entertaining, or both. I also hope it can generate some good discussion and edify the community.

Bitcoin is looking pretty good as we gear up for the Lunar New year. This might be a good time for people to take some BTC gains and move them into altcoins. Then again, people might just sit on their hands. It's hard to say at this moment.

I do know there hasn't been a time when I have seen so much positive crypto news hitting the airwaves. The mass media still seems to be trying to spin it in a negative light, but I think people are starting to see through the facade.

CHEX

As always, I think it is important to bring some news about some of my favorite projects. Trust me, it's much easier to do when they are doing well. I saw this post on Twitter the other day from one of the lead people at Chintai:

They have been promising several big announcements by the end of January and I think this is just the first of them. They already have the regulatory approval in Singapore (one of the only RWA projects to accomplish this). It also sounds like they are currently trying to get the necessary approvals in the UAE. If they can accomplish that and this feat in the US, it could give them a head start over many other projects.

With the token sitting at $.54 right now, I think there is still a lot of room to grow. Yes, it is down from the ATH over $.80, but honestly, with the stuff they have in the works, I don't think $10 or higher is unreasonable. Many of the faithful on Twitter seem to agree with me, but we all know they can be a bit delusional right?

Do your own research of course!

SMR

My favorite nuclear power stock has been having a banger of a week. My phone has been popping off all week with alerts that Nuscale Power stock has been climbing higher and higher. It's currently sitting at just shy of $29 per share. That's almost a 3x over the $10 per share that I bought it at. I'm not sad about that. The good news is, if things continue to go the way they have been, I think this stock could go much higher. I'd love to see an easy 10x from my initial investment.

I know that one is probably a long shot, but this is bull season, where dreams come true right?

All kidding aside, I do think nuclear power is going to be a big force in the markets moving forward. Especially with AI and quantum computing growing the way they have been. I'll keep beating this drum all year long.

FSM & KGC

Sadly, my Fortuna Silver Mines stock is not doing quite so well. It's been kicking around the five dollar mark for a while now. It's currently sitting at about $4.47. I only own about five shares, so it isn't a huge loss for me either way, but I still wish it were doing better.

My guess is, since the price of silver isn't moving too much lately, the price of this stock probably won't either.

On the other hand, my Kinross Gold stock is up 1.71% sitting at $10.69 per share. That's not too bad at all. I really don't pay too much attention to these stocks. They are mainly just something I hold and wait to see what is going to happen with them. If I get dividends, cool. If not, It's not a huge loss for me.

I hold all of these in my Robinhood account which is separate from my main investing account.

Wherever you are, I hope the weather and the markets stay warm for you!

Sports Talk Social - @bozz.sports