Things keep happening, and we keep watching the same indicators. Maybe the alt squeeze is starting, I'm watching LTC over ETH, which seems to be performing outside the "alt" space and as such I am not particularly interested in gaining additional exposure to ETH.

But we can watch these same "ratios" in hive-engine - what are the tokens that you think have some sort of "fixed value" in HIVE terms?

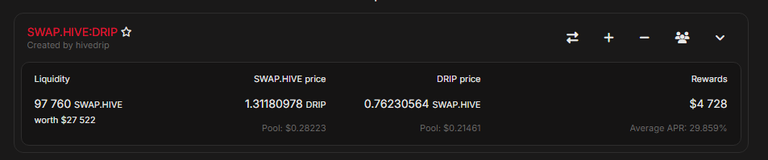

DRIP cheaper than ever

Of course their incredible first year staking rewards are over, so maybe it makes some sense that DRIP is effectively "half-price". They sold some NFTs, but generally it seems the market is questioning if DRIP really should be "pegged" to HIVE price, or if it was only a convenient fiction of the bear market.

I'll remind you all that DRIP was sold in "tranches" and the next tranche is priced at 2 HIVE.

So if it ever reaches that point again, its a +150% increase from here, plus any yield you can manage to earn along the way. And there are several options with DRIP, in the LP or staking.

But is this a good risk? We could also be seeing the project have its HIVE-based pricing scheme go haywire and completely get away from them. In this case, which we have seen before, we will get "USD cope", but that doesn't mean much for investors who track in HIVE terms.

Welcome back to the bull run!

Just the fact that we are now talking about "which token will go up more", means we are, officially, in the bull run. Welcome. Now don't get me wrong, this could still be early days; "the first wave". As I often say, I don't have a crystal ball, but I am maneuvering based on the information and indicators I have. And if you were to look over my blog over a long enough period of time, you would probably find nearly all my secrets revealed.

Its probably not that I am smarter than anyone else, but there are plenty of cool trades to think about in this "small pond" of HIVE.

Is it time to be fearful, or greedy, when it comes to DRIP? I'm not sure, let me know what you think below.

)

)