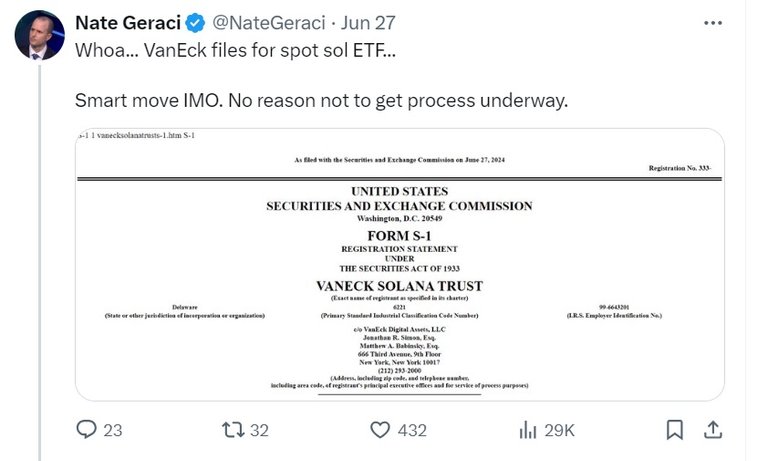

The name VanEck is not new to the world of ETF's

Thus it is no surprise that it has filed for Solana ETF in USA.

As per Mathew Sigel the head of Digital assets research at VanEck this makes them the first company to file for Solana ETF in USA

VanEck is an established American investment management firm that has its headquarters in New York city. They specialize in the issuance of exchange traded funds or etf's.

Additionally they also deal with mutual funds and handle accounts of institutional investors.

VanEck had also become one of the first issuers of Bitcoin ETF. Thus its foray into the realm of Solana ETF should not come as a surprise to anyone.

Their application in the field of SOL ETF is being made under the VanEck Solana Trust.

This application aim to be made as VanEck believes in the Sol's decentralized structure, utility and economic feasibility.

This was claimed by Mathew Sigel via a statement made on X.com

Once approved the SOL ETF is expected to be listed on the Cboe BZX Exchange.

What so many ETF's mean

First it was the BTC ETF that got approved next it was the ETH ETF that got the stamp of approval.

BTC and ETH are not the only decentralized blockchain. Solana ecosystem has been evolving at a great pace.

Therefore it is a ripe candidate where an ETF can be launched.

News based price action

Even though the current price of Solana is hovering in the range of $141 the ETF news did bring a positive spike making the price jump in the $150 range.

The solana blockchain supports a number of projects that are being developed on this low fee and ultra fast blockchain.

A large number of these projects are meme coins that see a lot of price movements.

It is anticipated that the price of SOL can reach $200 in the coming times.

Now that the news and anticipation of the SOL ETF getting approved is there thus the price targets are getting an upward revision With some crypto pundits claiming the price of SOL can go up 9x based on the ETF news development.

The slew of ETF approval for different blockchains can surely see a lot of money flowing into this space.

We can see a lot of positive sentiment being built for these blockchains.

The added inflow of funds can see money trickling down to a lot many layer 2 projects that are being built on these base layer blockchains.

Moreover the general positive attitude should help the worthy projects getting funding and investor support.

This also marks the era where crypto has started going mainstream.

The Flip side

On the flip side of things when the flood gates of institutional money and ETF money flows into Solana it would be hard to predict where the price settles.

Therefore those trading this crypto should be vary of leveraged trading.

Care should be taken before putting money in the layer 2 solutions that are being built on these blockchains.

When the bull run happens the investor exuberance brings in a lot of funds into the crypto verse and the fund flow is not restricted to the good projects.

A lot of weak projects too manage to get attention and easy fund allocations.

Therefore due diligence and research needs to be done before making any investments.

cover image source

Posted Using InLeo Alpha